Continuing Care Retirement Community (CCRC) – Planning for Access to Care – 09/30/16

Long Term Care University – 09/30/16

Research

By Brad C. Breeding, CFP

Plan not only for cost, but also access to long-term care

When planning for long term care costs there are two important aspects to keep in mind. The first is the cost of care and the second is access to care. Considering that the average cost of a one year stay in a private room at a skilled nursing center is over $90,000- and even higher in certain regions- it’s easy to see why planning for the cost of such care is so important.

But it is equally important to plan for access to care; that is, how and where you will receive care when you need it. Unfortunately, this aspect of planning is all too often neglected until care is actually needed and this can lead to a difficult situation for many families.

For those who prefer to have a plan in place and reduce the potential burden on family members a continuing care retirement community– also referred to as a CCRC or “life plan community”- may be a viable solution. Yet, all CCRCs are not created equal and the contracts can be complex so choosing the right community, or even deciding if such a community is right for you, requires a fair amount of due diligence.

What is a Continuing Care Retirement Community?

There is no universal definition for a CCRC, and since they are regulated at the state level, each state may define a CCRC slightly differently. Generally speaking, however, a CCRC is a retirement housing choice that provides residents with contractual priority access to a continuum of care. Residents must be able to live independently upon moving into the community, but have easy access to assisted living, memory care, and/or skilled nursing care when needed.

What does it cost to live in a CCRC?

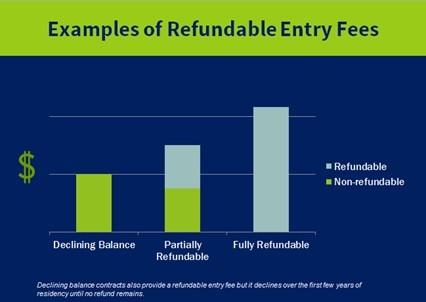

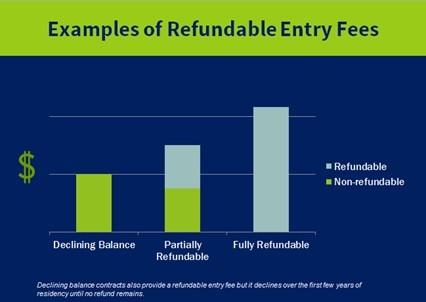

The cost of a CCRC can range drastically from one community to another based mainly on the location, size of the residence, and type of residency contract. In order to provide residents with priority access to care services and limit debt, many CCRCs require an entry fee. These fees range anywhere from under $50,000 up to several hundred thousand or more for single occupancy. The cost for a second resident is typically a fraction of what it is for the first resident. New residents often pay the entry fee using equity from the sale of their home. In many cases the entry fee will be partially or fully refundable in the event that you move out or at death. It is important to know, however, that the entry fee for a refundable contract will be higher than it would be otherwise. The following chart shows a conceptual example:

Click to Enlarge

In terms of month-to-month costs, the monthly service fee at a typical CCRC will likely exceed $1,000 and may be substantially higher, even several thousand dollars per month in many cases. Ideally a resident will be able to pay the monthly fee from a combination of fixed income sources and interest and dividends from retirement savings. Unfortunately, there are very few CCRC options for lower income retirees, although we will likely see more in the future.

Comparing CCRCs

Since no two CCRCs are alike it is wise to compare your choices. Aspects to consider include the lifestyle/culture of the community, services and amenities, financial viability of the organization, and quality of care services. As it pertains to pricing specifically, make sure you know exactly what services are covered by your monthly fee and which services might cost extra. You should also have an understanding of how various types of CCRC residency contracts will impact pricing not only today, but also in the future. For example, some CCRCs operate under all-inclusive model called lifecare; whereby residents basically pay the same monthly fee today and in the future- with the exception of annual inflationary increases- no matter how much care is ultimately required. Other CCRCs operate under a fee-for-service arrangement. Under this arrangement the entry fee and/or monthly fee may be lower today, but will increase when care services are needed. Comparing these two options purely on pricing would not be apples to apples. Instead, it is important to consider the potential lifetime costs based on a variety of possible scenarios. Keep in mind, too, that there are variations of both the lifecare model and the fee-for-service model so you should read the contract carefully.

About the Author

Prior to starting My LifeSite Brad spent thirteen years as a financial advisor. It was during that time that he recognized a need among older adults and their families for better information and guidance when researching retirement communities. Brad’s extensive knowledge of the senior living industry, combined with his financial planning background, allows him to provide valuable insights about lifestyle, healthcare, and financial planning considerations related to this significant life decision. Brad holds a Certified Financial Planner™ certification and has been quoted in national media such as Kiplinger’s Magazine, Wall Street Journal’s MarketWatch, USA Today and The New York Times. Brad is the author of What’s the Deal with Retirement Communities?, rated five stars overall on Amazon, and speaks regularly for retirement living providers, industry trade organizations, life-long learning classes, and other groups across the country. Learn more about Brad’s speaking engagements.