Long Term Care Insurance Decline Rates – Long Term Care University – 03/15/15

Long Term Care University – Question of the Month – 03/15/15

Research

By Aaron Skloff, AIF, CFA, MBA

Q: Should I wait to purchase Long Term Care Insurance? What is the probability of my application being declined?

The Problem – Time is the Enemy When Applying for Long Term Care Insurance

You will never be younger than you are today. It is unlikely that you will ever be healthier than you are today. Younger applicants are more likely to qualify for good health discounts, which can reduce premiums by 10-20% per year. This discount remains in place for the life of your policy, even if your health deteriorates the day after you purchase your policy.

Underwriters are becoming stricter with their underwriting guidelines. Approximately two years ago, one of the largest insurance companies implemented mandatory blood and urine specimens as a key part of its underwriting process. While obtaining blood and urine specimens have been the industry standard for life insurance underwriting for decades, that fact that it is now spreading to Long Term Care Insurance proves the industry to tightening its underwriting criteria.

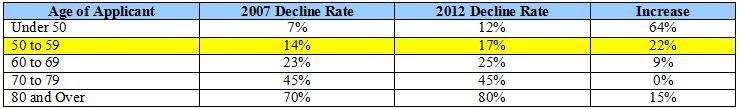

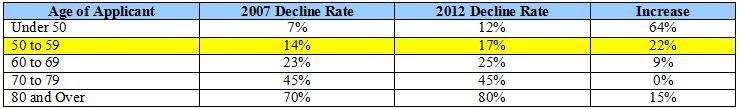

The older you are the more likely your application will be denied. The following chart provides the percentage of applicants declined based on five age groups.

Click to Enlarge

It is important to note that the 2012 decline rates preceded the blood and urine specimen requirements implemented by one of the largest companies. This requirement has surely resulted in larger decline rates after 2012. Applicant decline rates increased 64% for those under the age of 50. For applicants aged 50 to 59, the largest segment of applicants, decline rates increased 22%. As existing policy claims continue to run larger than expected, underwriters are expected to become stricter in the near future.

The Solution – There is No Time Like the Present When Applying for Long Term Care Insurance

Waiting to apply for Long Term Care Insurance generally works to your disadvantage. As you age you generally develop ailments. Applicants are generally not penalized for conditions like controlled high blood pressure and controlled high cholesterol. Applicants with arthritis, Type 2 diabetes, joint replacements and many other health conditions are regularly approved. Unfortunately, even the slightest sign of dementia is almost a guaranteed decline.

Although we cannot turn back the hands of time, we can freeze time when applying for Long Term Care Insurance. Once you submit an application your age is frozen for application purposes. This is important because insurance companies generally base their pricing on your application age and require stricter underwriting as your age increases. For example, underwriters require cognitive testing for higher age applicants. These cognitive tests include memory recall, reasoning and basic math. Since approximately 30% of claims are due to cognitive impairment, which increases with age, applicants should expect more rigorous underwriting at higher ages. With more rigorous underwriting come higher decline rates.

Action Step – Do Not Delay, Apply for Long Term Care Insurance While You Are Still Healthy

Obtain personalized quotes from at least three or four long term care insurance companies based on your health, age, marital status and customized benefits. Simply changing one of the previous variables or just the insurance company can double your premium. After reviewing the quotes along with the pros and cons, decide if Long Term Care Insurance is right for you

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.