Tax Benefits of Long Term Care Insurance for Employers and Employees 2016 – Long Term Care University – 10/15/16

Long Term Care University – Question of the Month – 10/15/16

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Long Term Care University article titled “Combination and Life and Long Term Care Insurance Tax Benefits 2016”. What are the tax advantages of a business paying long term care insurance premiums for its owners and employees, including spouses?

The Problem – Long Term Care Insurance Premiums Tax Benefit Limitations

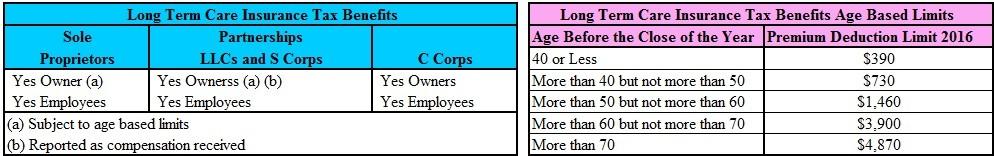

The IRS places limitations on the tax benefits permitted for long term care (LTC) insurance premiums.

The Solution – Maximize Your Tax Benefits

The IRS permits tax benefits for LTC insurance premiums based on your age, the payer and the recipient. We examine the optimal payer to maximize tax benefits below and in the accompanying tables.

Sole proprietors can deduct LTC insurance premiums for themselves, their spouse, and their dependents, subject to age based limits. The premiums are recognized as an adjustment on line 29 of IRS Form 1040 (self-employed health insurance deduction). Unfortunately, the age based limits may prohibit valuable tax benefits.

Sole proprietors can deduct LTC insurance premiums for employees, the employee’s spouse, and the employee’s dependents, without being subjected to age limits. The employees are not taxed on the premiums. Fortunately, sole proprietors can pay for an employee/spouse and the employee’s spouse (the sole proprietor) and avoid the age based limit.

Partnerships, Limited Liability Corporations (LLCs) and S Corporations (S Corps) Owners can deduct LTC insurance premiums for themselves, their spouse, and their dependents, without being subject to age based limits. The premiums are reported as compensation to the owners. The premiums are recognized as an adjustment on line 29 of IRS Form 1040 (self-employed health insurance deduction) and are subject to age based limits. Unfortunately, the age based limits may prohibit valuable tax benefits.

Partnerships, LLCs and S Corps Owners can deduct LTC insurance premiums for employees, the employee’s spouse, and the employee’s dependents, without being subjected to age based limits. The employees are not taxed on the premiums. Fortunately, partnerships and LLCs can pay for an employee/spouse and the employee’s spouse (the partners and owners) and the employee/spouse can avoid the age based limit. Family attribution rules (IRC section 318) treat an employee/spouse of an S Corp owner that owns 2% or more of the business as an owner, subjecting them to owner limitations.

C Corporation (C Corp) Owners can deduct LTC insurance premiums for themselves, their spouse, and their dependents, without being subject to age based limits. The owners are not taxed on the premiums.

C Corp Owners can deduct LTC insurance premiums for employees, their spouse, and their dependents, without being subjected to age limits. The employees are not taxed on the premiums.

Click to Enlarge

Additional Tax Benefits Example

An employer can complete a one-time LTC insurance premium payment of $50,000 or 10 annual payments of $5,000 that will insure their employee and the employee’s spouse. If paid in lieu of salary, it can reduce the employer’s and employee’s taxes (e.g.: FICA, federal income taxes and state income taxes). Finally, a lower salary can a have positive domino effect: a reduced income tax bracket, a reduced capital gains rate and greater itemized deductions). When businesses provide benefits, such as a LTC insurance, the combination of salary and benefits may not exceed what would normally be considered reasonable compensation for the services the employee (including spouses) provides.

Action Step – Maximize Your Tax Benefits When Paying for Long Term Care Insurance

Whether you are a sole proprietor, the benefits director of a midsized LLC or the CEO of a multi-national corporation, maximize the long term care insurance premiums tax benefits for all related parties.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.