Are Indexed Universal Life (IUL) Insurance Policies as Good as They Sound? – Part 1 – 08/01/20

Money Matters – Skloff Financial Group Question of the Month – August 1, 2020

By Aaron Skloff, AIF, CFA, MBA

Q: We are interested in permanent life. Are Indexed Universal Life (IUL) insurance policies as good as they sound?

The Problem – Indexed Universal Life (IUL) Insurance Policies Can be Confusing

Indexed Universal Life (IUL) insurance policies can be complex and contain a litany of rules and restrictions.

The Solution – Understanding Indexed Universal Life (IUL) Insurance

Let’s start with defining Indexed Universal Life (IUL) insurance. IULs are permanent life insurance policies that have a death benefit and a cash value. The death benefit is paid when you die and is typically tax free. The cash value is the accumulated cash inside the policy, as a result of payments into the policy, net of the cost of insurance, fees and charges. The cash value can earn interest based on price changes (excluding dividends) in an index, such as the S&P 500. Once interest is credited to your life insurance policy for an index term, those earnings are locked in and declines in the index do not reduce cash values (before the cost of insurance, fees and charges).

Click Here for Your Life Insurance Quotes

Understanding How You Earn Interest and How Your Interest Rate May Differ from Your Index Return

Insurance companies use different formulas to calculate the interest added to the cash value of your IUL insurance policy, as described below.

Indexed Interest Credit Formulas. The annual point-to-point formula credits interest based on the change in the index calculated using two dates, one year apart. The multi-year point-to-point formula credits interest based on the change in the index calculated using two dates, more than one year apart. The monthly point-to-point formula credits interest based on the change in the index calculated for each month during the index term. Monthly changes are limited to the “cap rate” for positive changes, but not negative changes. At the end of the index term, all monthly changes (positive and negative) are added. If the result is positive, interest is added to the cash value, if negative or zero, no interest is added. Many call the crediting strategy of IULs “zero is your hero” because the credit is 0.00% even if the underlying index decreases.

Some IUL insurance policies have bonuses. Bonuses fall into two primary categories: additional credit and multipliers. With an additional credit bonus, the policy receives a credit independent of any credit from the underlying index – even if the credit is 0.00%. They often begin in the 11th year of the policy and often range from 0.25% to 1.00%. With a multiplier credit bonus, the policy receives a credit dependent upon the credit of the underlying index. They often begin in the 11th year of the policy and often range from 5.00% to 15.00%. If a policy has a 15.00% multiplier credit bonus and the index credit is 6.00%, the bonus would be 0.90% (6.00% X 0.15). Some bonuses are guaranteed, and some are not. A policy with a high bonus may have high charges, particularly if the bonus is guaranteed.

Indexed Interest Rate. Your indexed interest rate (credit rate) is impacted by additional factors. The participation rate dictates how much of the increase in the index is used to calculate index-linked interest. A participation rate is usually for a set period. The period can be from one year to the entire term. The cap rate is the maximum rate of interest the cash value will earn during the index term. Some IULs guarantee that the cap rate will never be lower (higher) than a set minimum (maximum). The spread rate is a set percentage subtracted from any change in the index. Translation: the participation rate, cap rate and spread rate could be increased or decreased each year.

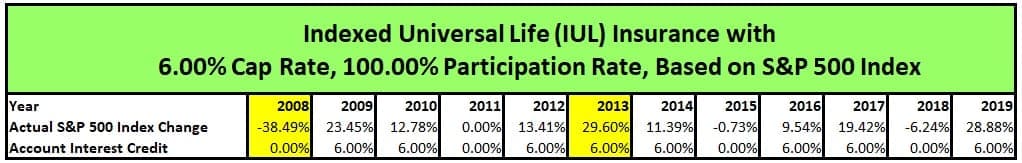

Indexed Interest Rate Example. Let’s look at an example of the credit rate on an IUL insurance policy based on a 100% participation rate, 6.00% cap rate, 0.00% spread rate and an annual point-to-point credit formula based on the S&P 500 index change. In this example, the first credit was applied at the end of 2008 and the last credit was at the end of 2019. Despite the S&P 500 price decrease of 38.49% in 2008 (“Actual S&P 500 Index Change”), the credit (“Account Interest Credit”) was 0.00%. Despite the S&P 500 price increase of 29.60% in 2013, the credit was 6.00%. This highlights the downside protection and upside limits of an IUL credit strategy. See the table below.

Click to Enlarge

Action Steps – Understand the Capabilities and Limitations of Indexed Universal Life (IUL) Insurance Policies

Before purchasing an IUL insurance policy evaluate its: death benefit, underlying index, cap rate, participation rate, spread rate, bonuses, cost of insurance, charges, and cash flow capabilities in the form of policy withdrawals and loans. Work closely with an experienced financial professional to understand all the capabilities and limitations of IULs.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.