Guaranty Income Life AnnuiCare Hybrid Combination Annuity and Long Term Care Insurance Review – Long Term Care University – 12/15/18

Long Term Care University – Question of the Month – 12/15/18

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Long Term Care University article 1035 Tax-Free Exchange and are interested in Hybrid Combination Annuity and Long Term Care (LTC) Insurance policies. Can you please review the Guaranty Income Life AnnuiCare Hybrid Combination Annuity and LTC policy?

Overview. Guaranty Income Life Insurance Company (GILICO) is part of Kuvare US Holdings, and is an A.M. Best B++ rated, 92-year-old company. The Guaranty Income Life AnnuiCare policy is a Hybrid Combination Annuity and Long Term Care Insurance policy. With Traditional LTC policies, premiums can be increased and you may not receive any benefits if you do not need LTC. With Hybrid Combination LTC policies the benefits and premiums are guaranteed. The insurance company either: 1) pays you if you need LTC, 2) pays your heirs if you do not need LTC, 3) pays you and your heirs if you need a modest amount of LTC or 4) pays you a refund if you cancel the policy.

Click Here for Your Long Term Care Insurance Quotes

Hybrid Combination Annuity and Long Term Care Underwriting. Traditional LTC companies and Hybrid Combination Life and LTC companies conduct extensive underwriting. This often includes ordering and examining all of your medical records from your physicians, specialists, hospitals and outpatient facilities. It may include a paramedical exam to gather: your blood pressure, height and weight, an EKG, urine sample and blood sample. The more information underwriters have, the more likely they will find a reason to deny your application. While Traditional LTC companies approve the lowest percentage of applicants, Hybrid Combination Life and LTC companies approve a higher percentage. Hybrid Combination Annuity and LTC companies approve the highest percentage – approximately 80% to 95%.

Hybrid Combination Annuity and LTC companies do not require medical exams, do not require paramedical exams, and do not order medical records. They primarily rely on a telephone or face-to-face interview to test your cognitive skills. Thus, approvals are determined in 1-5 days.

Guaranty Income Life AnnuiCare is Unique Because It Can be Purchased at Higher Ages. Most Hybrid Annuity and LTC companies will not allow you to purchase a policy if you are over 80 years old. Guaranty Income Life AnnuiCare can be purchased through the age of 85.

Guaranty Income Life AnnuiCare Policy Options. The policy can be funded with after-tax or pre-tax funds.

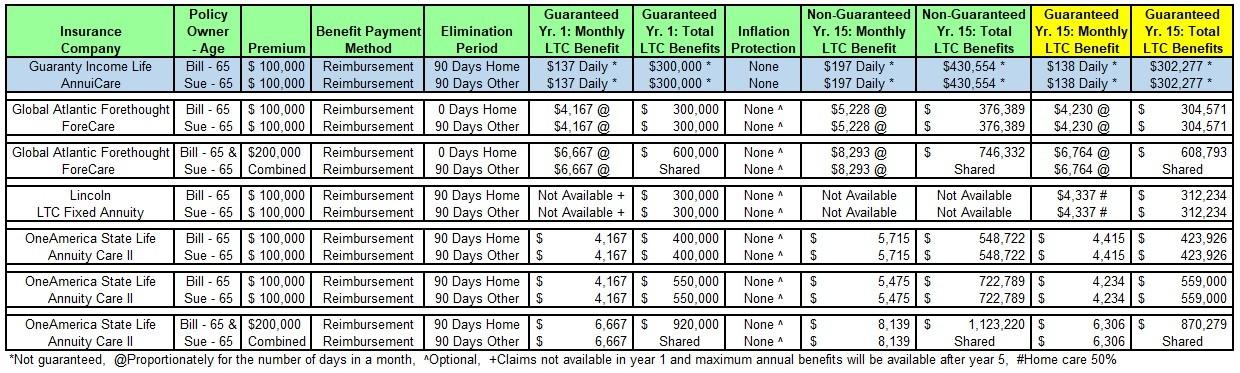

How Guaranty Income Life AnnuiCare Compares with Other Hybrid Combination Annuity and LTC Policies. Let’s look at a husband and wife, Bill and Sue, who are each 65 years old and reside in Georgia. They each pay a $100,000 one-time premium (or $200,000 combined with Global Atlantic or State Life) and are expected to need LTC in 15 years at the age of 80. They are comparing Hybrid Combination Annuity and LTC policies that offer the largest LTC benefits, with at least six years of LTC benefits.

Guaranty Income Life AnnuiCare Outperforms Competitors – with High Daily LTC Benefits on a Non-Guaranteed Basis for Individual Policies. Bill and Sue each will have $197 daily and $430,554 total LTC benefits on a non-guaranteed basis and $138 and $302,277 on a guaranteed basis (internal costs for LTC premiums are not guaranteed, but have never been increased for policyholders since 1999). Global Atlantic Forethought ForeCare is a strong alternative due to its 0 day elimination period for home care. Lincoln LTC Fixed Annuity is notable for its high monthly LTC benefit on a guaranteed basis. OneAmerica State Life Annuity Care II is a strong alternative due to its highest monthly and total LTC benefits on a non-guaranteed and guaranteed basis.

Click to Enlarge

Action Steps and Conclusions. Guaranty Income Life AnnuiCare provides high daily LTC benefits on a non-guaranteed basis. Since premiums vary greatly based on age, health and marital status, request individualized quotes.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.