Long Term Care Insurance Elimination Period and Medicare – Long Term Care University – 09/15/14

Long Term Care University – Question of the Month – 09/15/14

Research

By Aaron Skloff, AIF, CFA, MBA

Q: What is an elimination period? What are the advantages and disadvantages of a short versus long elimination period?

The Problem – Determining What Elimination Period to Select on a Long Term Care Insurance Policy

Most long term care insurance policies offer you the option to add an elimination period to your policy when applying. An elimination period is the waiting period from the time your care begins until the time the policy begins paying for your care. Fortunately, many consumers purchase an adequate amount of care per day (daily benefit) and an adequate amount of care over the life of their policy (total pool of money). Unfortunately, many consumers who do not select the appropriate elimination period are not prepared for their out-of-pocket costs during the elimination period they select – which can easily cost tens of thousands of dollars.

Click Here for Your Long Term Care Insurance Quotes

Medicare Only Pays for Long Term Care under Limited Circumstances and for a Limited Number of Days

Many consumers incorrectly assume Medicare will always pay for the first 100 days of their long term care. According to the U.S. Department of Health and Human Services (U.S.D.H.H.S.), “Generally, Medicare doesn’t pay for long-term care.” Among the criteria Medicare requires that you meet to qualify for benefits, one clearly stands out. That one is a qualifying hospital stay. “This means an inpatient hospital stay of 3 consecutive days or more, starting with the day the hospital admits you as an inpatient, but not including the day you leave the hospital.” “Time you are being observed in a hospital before you are admitted doesn’t count toward the 3-day qualifying inpatient hospital stay.” – U.S.D.H.H.S.

If you meet all of Medicare’s requirements, they will pay 100% of your first 20 days of care. Starting on day 21, you will pay $152 per day (increased each year based on inflation) through day 100. Medicare will not pay for your care after day 100. For those lucky enough (or unlucky enough, for that matter) to qualify for Medicare payments, Medicare pays for an average of 28 days.

The Solution – Selecting the Appropriate Elimination Period

Like a deductible on an automobile or homeowners insurance policy, an elimination period on a long term care insurance policy shifts the initial cost of a claim to you and away from the insurance company. Specifically, an elimination period is the number of days you are responsible for paying for your long term care costs out of your own pocket. Like an automobile or homeowners insurance policy the more risk the policyholder is willing to assume the lower the price of the insurance. With a long elimination period, you gain one big advantage – lower premiums.

With a zero or short elimination period, you gain three advantages: 1) Zero or low out-of-pocket costs when you care begins, 2) Higher probability the insurance company will pay all of your long term care costs (money in your pocket today versus some future date, when you may not need it) and 3) Zero or low probability you will need to liquidate assets (and have to pay the commissions, taxes and penalties associated with those liquidations) to pay for your care during your elimination period.

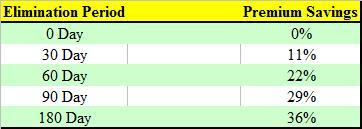

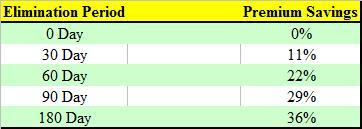

Based on the limited coverage Medicare provides to those that meet their strict requirements, you should clearly understand what your out-of-pocket costs may be. Let’s look at what your premium savings are as you increase the elimination period.

Click to Enlarge

Action Step – Establish Savings for Your Elimination Period

Based on Medicare’s myriad of requirements to gain benefits, assume you will pay for your own care during your elimination period. Select an elimination period you are comfortable with and establish a savings account equal to your anticipated out-of-pocket costs.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.