Maximizing Contributions to Multiple Employer Retirement Plans 2019 – 08/01/19

Money Matters – Skloff Financial Group Question of the Month – August 1, 2019

By Aaron Skloff, AIF, CFA, MBA

Q: Because I work for multiple employers and have my own business, I earn $600,000. Can I contribute to multiple employer retirement plans? If so, how can I maximize my contributions?

The Problem – Higher Earners Disqualified from Contributing All of Their Earnings to Multiple Employer Retirement Plans

The days of pension plans are quickly fading. Social Security did not offer a cost of living adjustment to its benefits for 2010, 2011, or 2016 – an alarming trend. Furthermore, the IRS limits how much responsible savers can contribute towards their employer retirement plans.

The Solution – Maximizing Contributions to Multiple Employer Retirement Plans

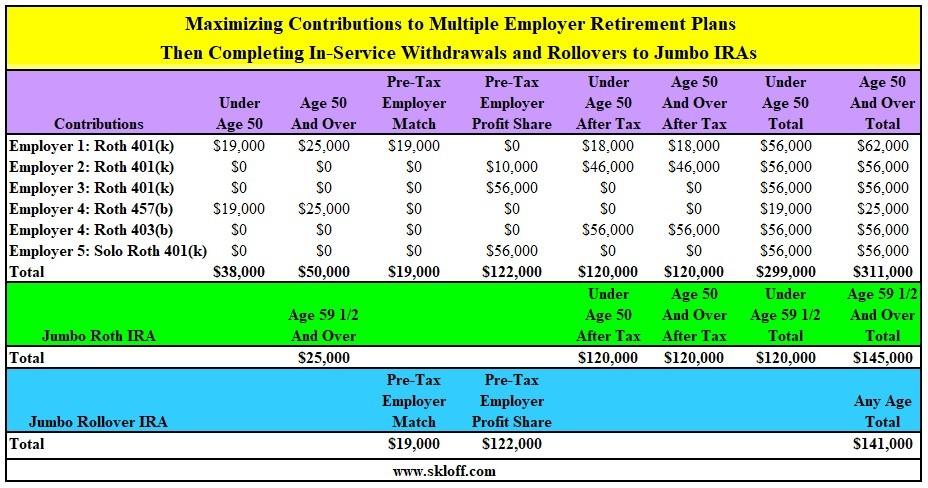

The IRS allows you to contribute to multiple employer retirement plans. The IRS places an $19,000 annual limit ($25,000 if age 50 or over) on employee contributions (elective deferrals) cumulatively across 401(k)s and 403(b)s and the same limits cumulatively across 457(b)s. It also places a $56,000 limit ($62,000 if age 50 or over) on the combination of employee elective deferrals, employer contributions and employee after tax contributions. As along as the employers are unrelated and not a controlled group (a parent-subsidiary employer that owns 80% of another employer or a brother-sister employer with five or fewer owners with a controlling interest in another employer), the limits are per employer. You can have multiple employer retirement plans with $56,000 cumulative contribution limits and one with $62,000.

Let’s take the example of maximizing cumulative Roth, employer and after tax contributions across multiple employers.

Employer 1: Contribute $19,000 (or $25,000 if age 50 or over) as an elective deferral to the Roth 401(k) to receive a $19,000 employer match and contribute $18,000 after tax to meet the $56,000 (or $62,000 if age 50 or over) limit.

Employer 2: Contribute as a $46,000 after tax contribution to the Roth 401(k), after a $10,000 employer contribution to meet the $56,000 limit.

Employer 3: Your contributions are prohibited to the Roth 401(k) because your employer’s $56,000 contribution meets the $56,000 limit.

Employer 4: Contribute $19,000 (or $25,000 if age 50 or over) as an elective deferral to the Roth 457(b).

Employer 4: Also contribute $56,000 as an after tax contribution to the Roth 403(b) to meet the $56,000 limit.

Employer 5: Your contributions are prohibited to the Solo Roth 401(k) because your employer’s $56,000 contribution, which is technically you for a Solo Roth 401(k), meets the $56,000 limit.

Create Jumbo IRAs with In-Service Withdrawals and Rollovers

After maximizing contributions, you can then complete a tax free in-service withdrawal and rollover of the after tax portion if under age 59 ½ to a Roth IRA , or Roth 401(k) and after tax contributions if age 59 ½ and over, if your employer offers this option. And you can complete a tax free in-service withdrawal and rollover of employer contributions to a Rollover IRA at any age, if the employer offers this option.

Fortunately, you can repeat this process every year. The following chart summarizes the process.

Click to Enlarge

Often Overlooked – Backdoor Roth IRA

In addition to the Jumbo IRAs described above, you can also contribute another another $6,000 (if you are under the age of 50) or $7,000 (if you are 50 or over) to a Backdoor Roth IRA.

Action Steps – Maximize Contributions to Multiple Employer Retirement Plans and Create Jumbo IRAs

Maximize contributions to multiple employer retirement plans and create Jumbo Roth and Jumbo Rollover IRAs by completing in-service withdrawals. Make the convoluted Internal Revenue Code work to your advantage and enjoy a successful retirement.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.

Click Here for Your Long Term Care Insurance Quotes