New Jersey and New York State Estate Tax Changes – 11/01/16

Money Matters – Skloff Financial Group Question of the Month – November 1, 2016

By Aaron Skloff, AIF, CFA, MBA

Q: Can you explain the changes to the New Jersey and New York state estate tax?

The Problem – Taxes When You Live and Taxes When You Die

It is common knowledge that with few exceptions, you pay taxes on: your income, your dividends, your investment gains and if you are lucky enough to win the lottery, your winnings. What may not be common knowledge is the federal estate tax of 40% and state estate taxes assessed on your estate when you die. Some states, like New Jersey (NJ) and New York (NY) also have their own state estate tax of up 16%.

The Solution – Federal, New Jersey New York State Estate Tax Exemptions

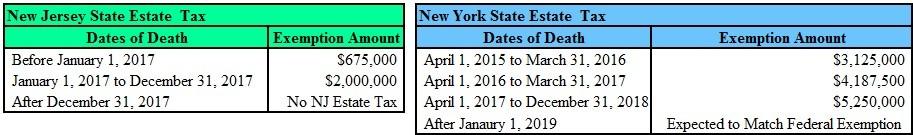

The federal government provides each person an exemption from its estate tax of $5.45 million for 2016 and $5.49 million in 2017. Amounts exceeding the exemption amount are subject to the 40% federal estate tax. The federal government allows portability, where a surviving spouse can use their deceased spouse’s unused exemption in addition to their own exemption. On October 14, 2016, NJ changed its estate tax laws to increase its $675,000 exemption in 2016 to $2 million in 2017 and eliminate its state estate tax entirely on January 1, 2018. In 2015, NY enacted several estate tax changes: increasing its $2.06 million exemption for those dying after March 31, 2015 and increasing its exemption in subsequent periods to what is likely to meet the federal estate tax exemption on January 1, 2019. The scheduled changes for the NJ and NY estate tax are outlined in the charts below.

Click to Enlarge

New Jersey Inheritance Tax. Changes to the NJ estate tax do not affect the NJ inheritance tax. The NJ inheritance tax is based on five beneficiary classes with different exemption amounts and taxes of up to 16%. Class “A” is subject to the estate tax, not the inheritance tax rules and includes: father, mother, grandparent, domestic partner and child of the decedent. Class “B” was eliminated by statute effective July 1, 1963. Class “C” includes brother and sister of the decedent. Class “D” includes every other transferee or beneficiary who is not included in Classes “A”, “C” or “E”. Class “E” includes the State of NJ or any of its political subdivisions for public or charitable purposes, an educational institution, church, hospital, orphan asylum and public libraries. These beneficiaries are exempt from the inheritance tax. The NJ inheritance tax exemptions and rates are outlined in the charts below.

Click to Enlarge

Estate Planning Goes Beyond the Estate Tax and Inheritance Tax. Estate planning includes building and protecting your estate. It includes optimizing income taxes and capital gains taxes and alternative minimum taxes throughout your lifetime. It also includes estate planning documentation, such as: wills, living wills, power of attorneys and trusts.

Action Steps

Work closely with your Registered Investment Adviser (RIA) and your estate attorney to develop an estate plan that protects and provides for you and your loved ones. Review your estate plan as estate tax laws change.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.

Click Here for Your Long Term Care Insurance Quotes