Taking Your Lumps – or Not – Wall Street Journal – 06/09/12

The Wall Street Journal

Weekend Investor – Family Value – June 9, 2012

Taking Your Lumps – or Not

By Kelly Greene

So you have retired, adjusted to getting a monthly pension and think you have your finances in order. Then your former employer asks if you want to trade that check for a big chunk of money.

Deciding whether to take the lump sum when you already have retired depends on many factors. Here are some key points to consider.

Investment risk. Collecting a lump sum puts the responsibility for generating investment returns onto the retiree.

Inflation risk. On the other hand, the security of the monthly check might not seem as attractive 20 years from now, when inflation could erode its buying power.

Age and health. The younger you are, the longer you have to make your money last.

Family. If you are retired and your spouse is working, you could take the lump sum, invest it until you are both retired and then start taking distributions.

Comments June 9, 2012

Imagine you and your spouse are on a flight to visit your kids and grandkids. After discussing how excited your are to visit your family, the conversation turns to your finances and how happy you are with your decision to take the monthly pension your were offered upon retirement instead of the lump sum rollover into your IRA account. Thinking about the monthly pension of $5,000, or $3,000 if you spouse survives you, provides great psychological comfort.

Suddenly, the pilot makes an announcement, “We have an emergency!” Those are the last words you and your spouse hear before the plane crashes down, leaving no survivors.

Your children contact your financial advisor to ask what paperwork needs to be completed so they can inherit your IRA. Your financial advisor informs your children there is no paperwork to complete because there is no inheritance. Your children are at first in disbelief, and then become livid when your financial advisor explains the risk you took with the monthly pension instead of the lump sum rollover into your IRA.

When your financial advisor further explains that they will not receive even a portion of your monthly pension they literally break down in tears. They cannot reconcile how your worked for 40 years to earn that pension or lump sum rollover yet not a single penny was paid nor will a single penny ever be paid based on your decision to take a monthly pension.

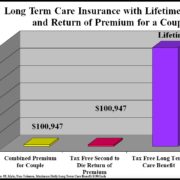

If you choose to take a lump sum rollover into IRA account you will definitively be paid a set amount versus the risk of not being paid with the monthly pension choice.

Aaron Skloff, AIF, CFA, MBA

CEO – Skloff Financial Group

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.