Understanding Multi-Year Guaranteed Annuities – 11/01/19

Money Matters – Skloff Financial Group Question of the Month – November 1, 2019

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Understanding Annuities article and are interested in multi-year guarantee annuities (MYGAs). Can you please explain MYGAs?

The Problem – Finding Guaranteed High Interest Rate Vehicles in a Low Interest Rate Environment

There is a scarcity of guaranteed high interest rate vehicles. U.S. Treasury Bonds pay less than 2.00% for five-year or even 10-year terms. Even the highest interest rate bank CDs only pay 2.50% for a five-year term.

The Solution – Multi-Year Guaranteed Annuities (MYGAs)

Let’s start with defining multi-year guaranteed annuities (MYGAs), also known as fixed rate or CD-type annuities. They are often compared to bank CDs (certificate of deposit) because MYGAs are fixed annuities that provide a guaranteed interest rate for a certain term. MYGAs can be a strong alternative to bank CDs.

How MYGAs Differ from Bank CDs

While MYGAs have many of the same characteristics of bank CDs, there are some important differences.

Interest Rate. For the same term, MYGAs will generally have a higher interest rate.

Withdrawal Flexibility. While bank CDs generally have withdrawal penalties except for interest earned, MYGAs generally allow you to take up to 10% of the annuity value per year penalty free.

Early Withdrawal Penalty. While a bank CDs will generally have an early withdrawal penalty on the amount of interest (e.g.: six months of interest or one year of interest), MYGAs will generally have a surrender charge on the amount withdrawn (in excess of 10% – see above) that declines over the life of the annuity (e.g.: 5% in year one or 4% in year two).

Tax Deferral. Banks must issue a 1099 each year for all the interest you earn on your bank CDs. You are subject to income taxes each year, based on your income tax bracket. If your only sources of asset to pay your taxes on your interest is the interest itself, you will not be able to reinvest all your interest – resulting in lower compound interest. Insurance companies must issue a 1099 only when you take withdrawals from your MYGAs. You can defer withdrawals and the taxes on all interest until you choose to make a withdrawal. You are subject to income taxes only in the years you take withdrawals, based on your income tax bracket. By deferring withdrawals, you can earn interest on all your interest, resulting in higher compound interest.

Guarantees. In the event of a bank failure, your CD is protected by the Federal Deposit Insurance Corporation (FDIC). In the event of an insurance company failure, your MYGA is protected by your state’s Guaranty Association.

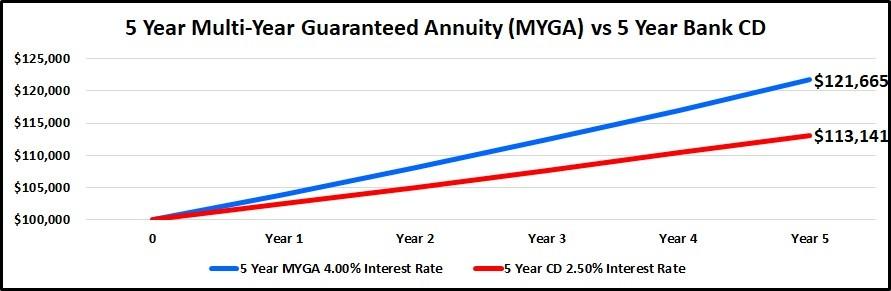

Numbers Speak Louder Than Words. Let’s look at an example of a five-year MYGA versus a five-year bank CD. Bill can pay $100,000 for a MYGA earning 4.00% or a bank CD earning 2.50%. We assume he would defer withdrawals from his MYGA and reinvest all his interest in his bank CD, paying the annual taxes on his CD interest from other assets. At the end of five years he would have $113,141 in his bank CD and $121,665 in his MYGA. His MYGA would have generated 64.9% more interest or $8,824. See the chart below.

Click to Enlarge

Action Steps – Compare Multi-Year Guaranteed Annuities (MYGAs) to Other Guaranteed Interest Rate Vehicles

Before purchasing a guaranteed interest rate vehicle like a bank CD, compare it to guaranteed higher interest rates offered by MYGAs. Work closely with an experienced financial professional to understand all the capabilities and limitations of MYGAs.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.