Retirement Account Rollovers

Money Matters – Skloff Financial Group Question of the Month – October 1, 2017

By Aaron Skloff, AIF, CFA, MBA

Q: We have numerous retirement account accounts that are difficult to track and even more difficult to optimize their risk and return. We are trying to consolidate the accounts. What retirement accounts can we rollover into what retirement accounts?

The Problem – Keeping Track of Numerous Retirement Accounts and Optimizing Risk and Return

The median employee tenure—the length of time a worker has been with his or her current employer— is approximately 4.2 years, according to The Bureau of Labor Statistics (BLS). Over the course of your career you could accumulate 10 retirement plans. Add in a handful of IRAs and it can be difficult to keep track of (RMDs or otherwise), manage and optimize the risk and return of these accounts.

The Solution – Rollover, Consolidate and Optimize Risk and Return of Retirement Accounts

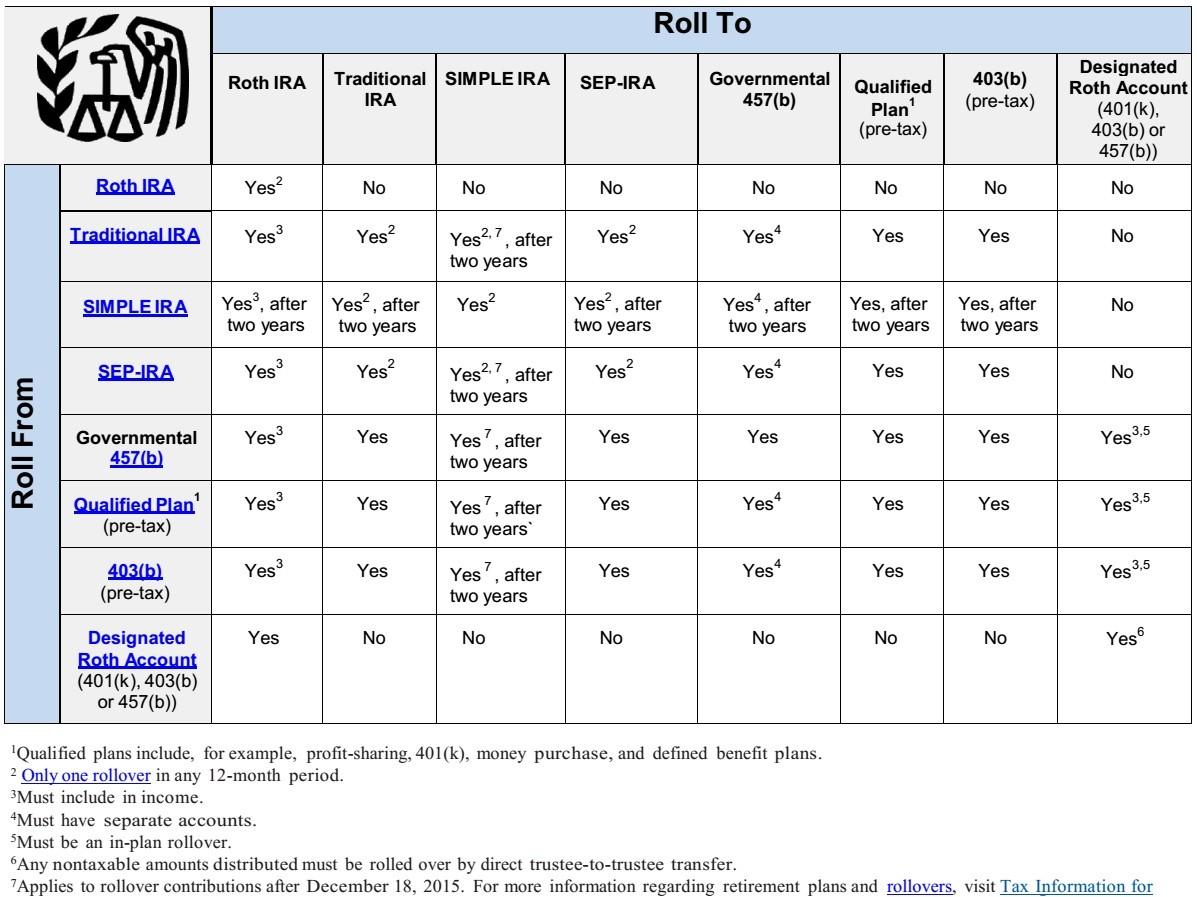

You can rollover and consolidate many retirement accounts into one or two retirement accounts. For example, you can consolidate 10 Roth IRAs into one Roth IRA. As another example, you can rollover a 401(k), 403(b), 457(b), SEP IRA and a SIMPLE IRA into one Traditional IRA. Once consolidated, it is easier to keep track of, manage and optimize the risk and return of these accounts. Please see the table below for an IRS list of the most common type of retirement accounts, their rollover compatibility and their tax implications.

Click to Enlarge

Action Steps

Work closely with your Register Investment Adviser (RIA) to consolidate your accounts and optimize their risk and return.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.