Does Your State Tax Pre-Tax Contributions to Retirement Accounts? – Part 1

Money Matters – Skloff Financial Group Question of the Month – May 1, 2025

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘Pre-tax Versus Roth Employer Contributions to Retirement Accounts – Which Is Better?’ Part 1 and Part 2. Do pre-tax contributions to retirement accounts defer state income taxes?

The Problem – Assuming Federal Income Tax Rules and State Income Tax Rules Are the Same Can Be a Costly Mistake

Federal income tax rules can vary greatly from state income tax rules. Without proper planning, you may pay unnecessary income taxes today and in the future.

The Solution – Proper Planning Can Avoid Unnecessary State Income Taxes Today and in the Future

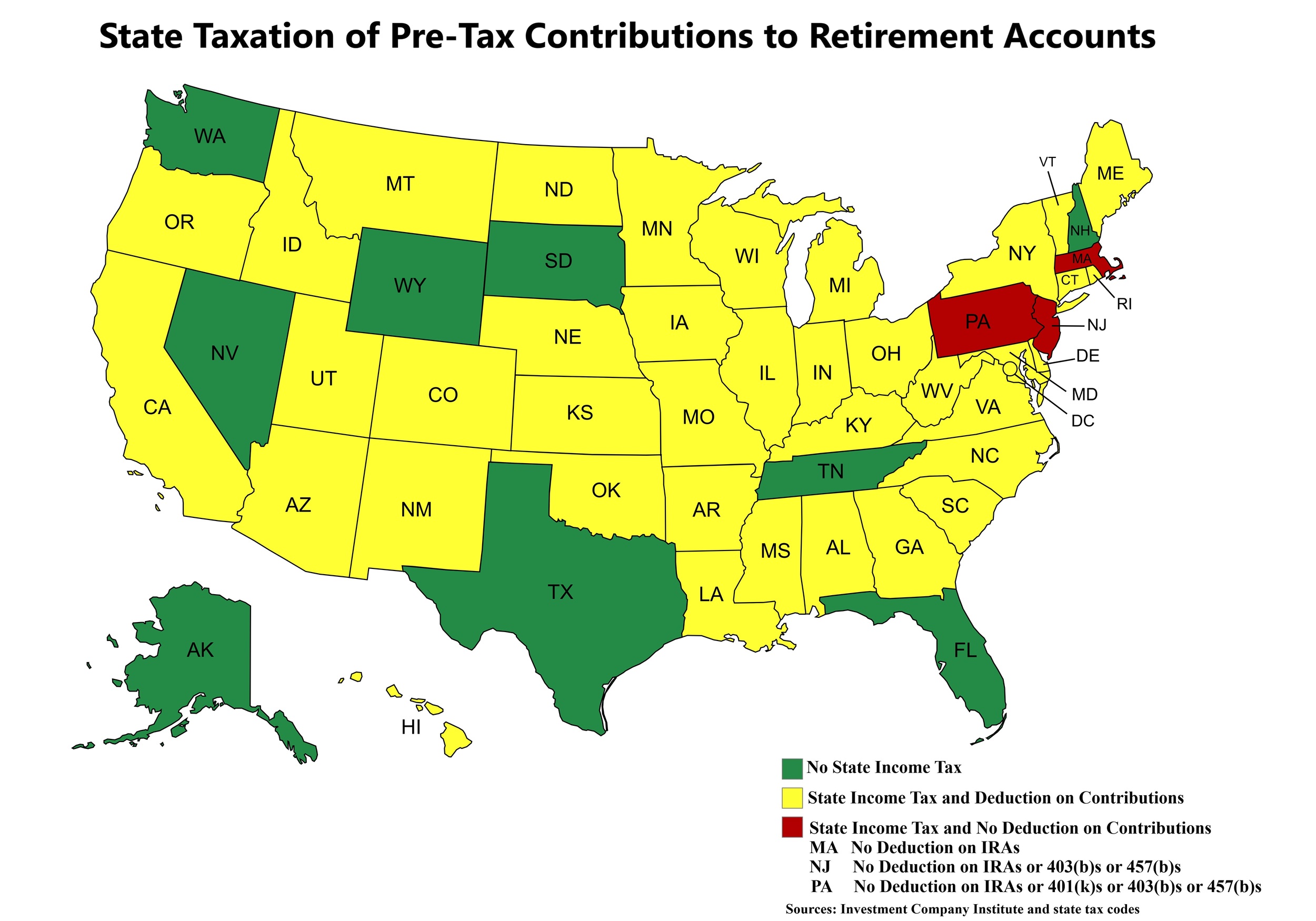

Pre-tax contributions to retirement accounts allow you to defer federal income taxes. With proper planning you can generate legal tax arbitrage of federal and state income taxes. Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have a state income tax. While New Hampshire does not tax wages, it taxes interest and dividend income. While Washinton does not tax wages, it taxes high earners’ long term capital gains. See the map below.

States that tax pre-tax contributions to retirement accounts require you to keep tax records of your contributions for what could be decades to avoid double taxation on your contributions upon withdrawal in those states. Without excellent tax records, you could face double taxation on your contributions. While most states allow you to defer state income taxes on pre-tax contributions, the states below do not.

Massachusetts. Massachusetts taxes pre-tax contributions to Individual Retirement Accounts (IRA).

New Jersey. New Jersey taxes tax pre-tax contributions to Individual Retirement Accounts (IRA), 403(b) and 457(b).

Pennsylvania. Pennsylvania taxes tax pre-tax contributions to Individual Retirement Accounts (IRA), 401(k), 403(b) and 457(b).

Proper Planning Can Avoid Unnecessary State Income Taxes Today and in the Future. With proper planning, you can make pre-tax contributions in states that defer income taxes and make withdrawals in states with low or no states income tax – a form of legal tax arbitrage.

Are You Interested in Learning More?

Click to Enlarge

Action Steps

Work closely with your Registered Investment Adviser (RIA) to optimize your taxes, and pay the lowest tax rates in the current tax year and future tax years.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.