Investment Options

The Google 401(k) offers a traditional mutual fund lineup at Vanguard and Schwab Personal Choice Retirement Account. Schwab Personal Choice Retirement Account provides thousands of investment options, allowing you to have your Google 401(k) account professionally managed.

Professionally managed accounts can generate 3% to 4% higher returns per year.

Have Your Google 401(k) Account Professionally Managed

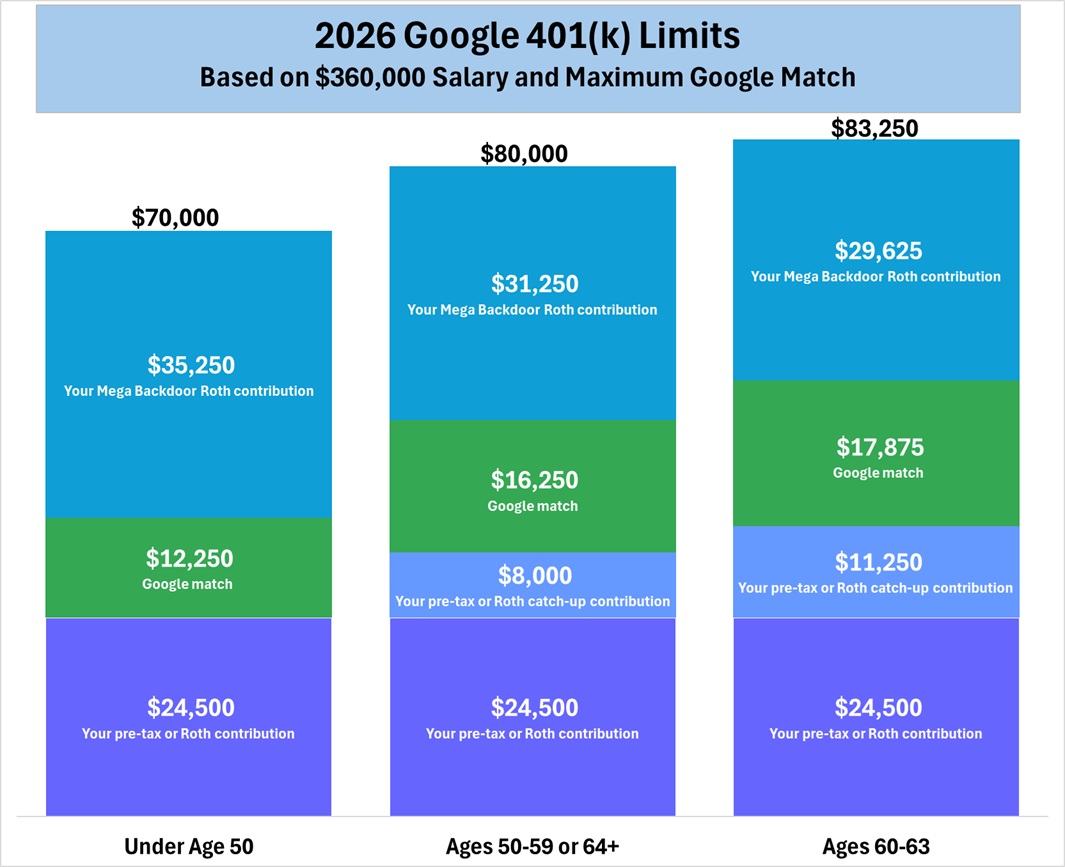

2026 Contribution Limits

| Under age 50 | $24,500 |

| Ages 50-59 or 64+ | $32,500 [$24,500 + $8,000 catch-up] |

| Ages 60-63 | $35,750 [$24,500 + $11,250 catch-up] |

Pre-tax Contributions and Pre-Tax Catch-up Contributions

With pre-tax contributions and pre-tax catch-up contributions, you defer income taxes until you withdraw the assets.

Roth Contributions and Roth Catch-up Contributions

With Roth contributions and Roth catch-up contributions, you pay taxes on the contributions but withdrawals are tax-free.

Google Match

Google matches the greater of: a) 100% of your contribution up to $3,000 or b) 50% on your contributions up to $24,500 of contributions in 2026 for ages under 50, resulting in a maximum match of $12,250 in 2025. Google matches 50% on your contributions up to $32,500 of contributions in 2026 for ages 50-59 or 64+, resulting in a maximum match of $16,250 in 2026. Google matches 50% on your contributions up to $35,750 of contributions in 2026 for ages 60-63, resulting in a maximum match of $17,875 in 2025. Google matches catch-up contributions.

You must contribute $24,500 to receive your full match for ages under 50. You must contribute $32,500 to receive your full match for ages 50-59 or 64+. You must contribute $35,750 to receive your full match for ages 60-63.

Google matches vest immediately.

Google Match Examples

Employee Contributes $10,000

Based on a $360,000 salary, you contribute $10,000. Google will match your contribution by 50% or $5,000.

Employee Contributes 6% of Salary

Based on a $360,000 salary, you contribute $21,600. Google will match your contribution by 50% or $10,800.

Mega Backdoor Roth

In addition to your pre-tax and Roth contributions and the Google match, you can utilize a Mega Backdoor Roth. You can contribute after-tax to your 401(k) up to the limit of all employee and employer contributions, then convert those after-tax contributions to a Roth IRA or Roth 401(k).

2026 Contribution Limits for All Employee and Employer Contributions

| Under age 50 | $72,000 |

| Ages 50-59 or 64+ | $80,000 |

| Ages 60-63 | $83,250 |

Mega Backdoor Roth Examples

Employee Under the Age of 50

Based on a $360,000 salary, you can generate $72,000 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your Google match, you can contribute $35,250 after taxes.

| Your pre-tax or Roth contributions | $24,500 |

| Google match | $12,250 |

| Your Mega Backdoor Roth contributions | $35,250 |

| Total | $72,000 |

Employee Age 50-59 or 64+

Based on a $360,000 salary, you can generate $80,000 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your Google match, you can contribute $31,250 after taxes.

| Your pre-tax or Roth contributions | $24,5000 |

| Your pre-tax or Roth catch-up contributions | $8,000 |

| Google match | $16,250 |

| Your Mega Backdoor Roth contributions | $31,250 |

| Total | $80,000 |

Employee Age 60-63

Based on a $360,000 salary, you can generate $83,250 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your Google match, you can contribute $29,625 after taxes.

| Your pre-tax or Roth contributions | $24,500 |

| Your pre-tax or Roth catch-up contributions | $11,250 |

| Google match | $17,875 |

| Your Mega Backdoor Roth contributions | $29,625 |

| Total | $83,250 |