Traditional Versus Combination Life and Long Term Care Insurance – Independent Press

The Independent Press

Money Matters – Skloff Financial Group Question of the Month – June 5, 2013

By Aaron Skloff, AIF, CFA, MBA

Q: What are the advantages of a Combination Life and Long Term Care insurance policy versus a Traditional Long Term Care insurance policy, and vice versa?

A: The Problem – Comparing Apples and Oranges

What happens to all those premiums you pay for a Traditional Long Term Care (LTC) insurance policy if you pass away and never use the policy? The same thing that happens to all those premiums you pay for a homeowners insurance policy if you pass away and never use the policy – the insurance company keeps them and you are happy you never had a claim. But, simply having peace of mind over the life of your policy may not be good enough. You may feel like you are getting a better value if you definitively get something back for the premiums you paid the insurance company. Insurance companies have two solutions to meet your needs.

The first is a Traditional LTC insurance policy with a Return of Premium (ROP) Rider. The ROP rider returns all the premiums you paid if you pass away and never use the LTC benefits. The second is a Combination (or Hybrid) Life and LTC insurance policy. A Combination policy pays either a LTC benefit, a death benefit or both if you only use a portion of the LTC benefit. Due to their unique advantages, comparing the two is like comparing apples and oranges.

The Solution — Understanding the Advantages of Traditional LTC and Combination Life and LTC Insurance

Insurance companies price policies based on their risk. There is a 7 in 10 risk you will need LTC if you live past the age of 65. There is a 10 in 10 risk you will die. Insurance companies charge more for Combination policies than Traditional polices because they are taking on more risk. Traditional and Combination policies have unique advantages compared to one another, as seen below.

Traditional Long Term Care Insurance Advantages: 1) Highest benefits for the lowest price, 2) Options: waiver of premium when you go on claim, restoration of benefits when you recover, refund of premium at death, shared benefits for partners and spouses, waiver of premium when your spouse or partner goes on claim and 3) Partnership Program Medicaid Asset Protection.

Combination Life and Long Term Care Insurance Advantages: 1) Large one time premium payment, 2) You get your money back in a the form of a long term care benefit, a death benefit or both and 3) Policy can be canceled with a refund of premium at any time.

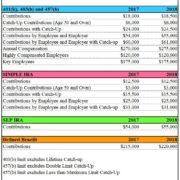

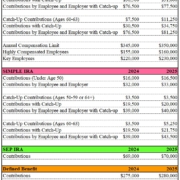

Numbers Speak Louder than Words. Let’s look at a husband and wife that are each 55 years of age and are comparing Traditional and Combination policies. They select coverage of $200 per day, five years of LTC per person and 5% compound inflation protection.

Traditional LTC Insurance. After they pay a combined $4,549 they will immediately have a combined $730,000 (tax free) pool of money available for long term care costs and Medicaid Asset Protection (note: New York and Indiana offer unlimited Medicaid Asset Protection Partnership Policies) on the Traditional policies. That gives them 160.5 times leverage on their investment. In 25 years, when they are 80 years of age and likely to need LTC they will have a combined $2.3 million or 20.7 times leverage on their investment.

Combination Life and LTC Insurance. Following a combined one time payment of $316,662 their Combination policies will immediately provide a combined $795,690 (tax free) pool of money available for LTC costs and a combined $897,332 (tax free) death benefit. That gives them 2.5 and 2.8 times leverage, respectively. In 25 years, they will have a combined $2.6 million and $484,773 or 8.1 and 1.5 times leverage, respectively.

Action Step: Purchase an Insurance Policy that Meets Your Needs. Since there is no free lunch in they eyes of the insurance companies, determine if you want LTC coverage or Life and LTC coverage before purchasing a Traditional or Combination Life and Long Term Care insurance policy.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm based in Berkeley Heights. He can be contacted at www.skloff.com or 908-464-3060.