The Alabama Long-Term Care Insurance Partnership Program – Long Term Care University – 06/15/22

Long Term Care University – Question of the Month – 06/15/22

Research

By Aaron Skloff, AIF, CFA, MBA

Q: Some insurance companies offer Partnership Qualified long term care insurance policies. Can you explain what that means, what advantages it may provide and details on the Alabama Long-Term Care Insurance Partnership Program?

The Problem – Limited Long Term Care Insurance Benefits, Limited Medicaid Benefits and Limited Medicare Benefits

Most long term care (LTC) insurance policies provide a limited amount of benefits. Even lifetime benefit policies generally have a daily, monthly or annual limit. The cost of long term care after a policy has been exhausted can be financially devastating for you and your family. To compound the problem, assistance in the form of Medicare is limited to those who have been hospitalized and only then will Medicare pay for care in full for up to 20 days. To further compound the problem, assistance in the form of Medicaid is generally limited to the impoverished.

Click Here for Your Long Term Care Insurance Quotes

The Solution – Partnership Qualified Long Term Care Insurance Policies

The Partnership Program is based on the Robert Wood Johnson Foundation program called the Program to Promote Long Term Care Insurance for the Elderly, initiated in 1987. Today, a Partnership Program is a “partnership” between a state, an insurance company and state residents who buy long term care Partnership policies. With a Partnership Qualified policy, you can apply for Medicaid with ‘asset disregard’. This allows you to keep assets that would otherwise be disallowed. In almost all states that have Partnership Programs, the amount of assets Medicaid will disregard is equal to the amount of the benefits you actually receive under your LTC Partnership Qualified policy. This type of disregard is often referred to as Dollar for Dollar. So, you can qualify for Medicaid without being impoverished. Almost all states (including Alabama) participate in the National Reciprocity Compact for the granting of Medicaid Asset Protection for states with Partnership for Long Term Care programs.

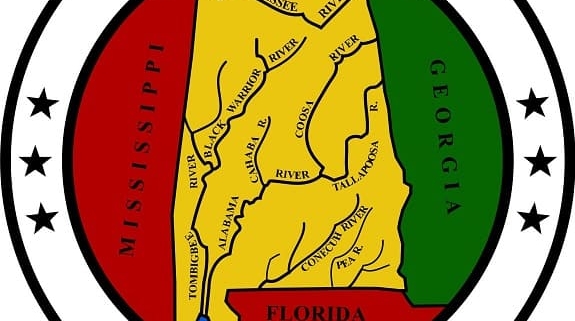

The Alabama Long Term Care Insurance Partnership Program

Let’s say you are a 50 year old Alabama (AL) resident who purchases $252,936 (the average rate of a private nursing room for an average three year stay in AL in 2020) of insurance coverage through a AL Long Term Care Partnership Program Qualified policy. When you need care at age 80 the policy actually pays for $613,944 of tax free care (due to 3% compound inflation protection). Regardless of the premiums you paid, under the Alabama Long Term Care Partnership Program you would then have $613,944 (plus an additional $2,000 that is provided to all AL residents) of assets protected from Alabama Medicaid and states that participate in the National Reciprocity Compact. Thus, the Alabama Long Term Care Partnership Program for provides Dollar for Dollar asset protection. With this example, you could qualify for Medicaid without being impoverished and keep $615,944 of your assets. However, your income is considered in determining your eligibility for Medicaid.

Long term care costs in AL have been increasing at an average annual rate of 2% to 4% for the last 15 years. Long term care costs across the U.S. have been increasing at an average annual rate of 2% to 4% for the last 15 years. The AL Long Term Care Insurance Partnership Program has inflation protection requirements, designed in part to protect the policyholder and in part to protect the state’s Medicaid program. Lest we not forget, this is a Partnership Program. Those requirements are as follows:

- If you are younger than 61, your plan must include compound inflation protection.

- If you are age 61 to 75, your plan must include some level of inflation protection.

- If you are 76 or older, your plan does not need to include inflation protection. However, you can select an inflation protection option and still qualify.

Action Step – Purchase an Alabama Long Term Care Insurance Partnership Program

When you purchase an Alabama Long Term Care Insurance Partnership Program Qualified policy, you gain the safety of long term care insurance and the peace of mind provided by asset protection.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.