Are All Roth IRA Withdrawals Tax Free? – Part 3

Money Matters – Skloff Financial Group Question of the Month – November 1, 2023

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘Are All Roth IRA Withdrawals Tax Free?’ Part 1 and Part 2. Can you give additional examples and the tax implications of Roth IRA withdrawals?

The Problem – Knowing When Roth IRA Withdrawals Are or Are Not Tax Free

Generally, withdrawals from Roth IRAs are tax free. According to the IRS, “If you satisfy the requirements, qualified distributions are tax-free”. It seems the IRS always has an ‘if”, ‘but’ or ‘subject to’ up its sleeve that can trip you up. And those trip ups can be costly. Non-qualified distributions are subject to income taxes and a 10% penalty. Withdrawals are evaluated in order of contributions, conversions, then gains. After the age 59 ½ there are no penalties, but the 5-year rule still applies to gains.

The Solution – A Side by Side Comparison of Roth IRA Withdrawals

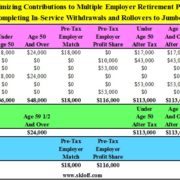

By examining scenarios on a side by side basis, we can see which withdrawals are tax free and which are not. The examples and chart below are based on a 30% income tax rate. We highlight some exceptions to the 59 ½ rule and/or 5-year rule.

Are You Interested in Learning More?

Contributing at Age 30 and Withdrawing Contribution and Gain at Age 35 Due to a Disability. You contribute $5,000 at age 30. Your investment grows to $7,500 at age 35 and you withdraw your $5,000 contribution and $2,500 gain due to a disability. There are no tax implications on your contributions, as contributions can always be withdrawn tax free. Due to your disability, the 59 ½ rule on your gain is waived. Since the 5-year rule is met and you have a disability, the gain is income taxs and penalty free. According to the IRS, a physician must determine that your condition can be expected to result in death or to be of long, continued, and indefinite duration.

Contributing at Age 30 and Withdrawing Contribution and Gain at Age 50 to Pay for Qualified Education Expenses. You contribute $5,000 at age 30. Your investment grows to $20,000 at age 50 and you withdraw your $5,000 contribution and $15,000 gain to pay qualified education expenses. There are no tax implications on your contributions, as contributions can always be withdrawn tax free. Although the 5-year rule is met, the gains are subject to income taxes. Since you are using your gain to pay for qualified education expenses, the 59 ½ rule on your gain is waived. Since the gain is used for qualified education expenses, the gain is not subject to a 10% penalty. According to the IRS, qualified expenses are amounts paid for tuition, fees and other related expenses at an eligible educational institution. According to the IRS, the following expenses are not qualified education expenses: room and board, insurance, medical expenses (including student health fees), transportation, similar personal, living or family expenses.

Contributing at Age 30 and Withdrawing Contribution and Gain at Age 32 for a Qualified First-Time Home Purchase. You contribute $5,000 at age 30. Your investment grows to $6,000 at age 32 and you withdraw your $5,000 contribution and $1,000 gain to pay for a qualified first-time home purchase. There are no tax implications on your contributions, as contributions can always be withdrawn tax free. Since you are using your gain to pay for a qualified first-time home purchase, the 59 ½ rule on your gain is waived. Since the gain is used for a qualified first-time home purchase, the gain is not subject to a 10% penalty. Since you did not meet the 5-year rule, the gain is subject to income taxes. The income tax and/or penalty exceptions are subject to a $10,000 lifetime cap for a first-time home purchase.

Inheriting a Roth IRA from a Non-Spouse at Age 30 and Withdrawing Inherited Amount and Gain at Age 41. You inherit a $500,000 Roth IRA from your mother, father, sibling friend or even a stranger [all examples of non-spouses, as spouses have exceptions] at age 30. Your Inherited Roth IRA grows to $1,100,000 at age 41 and you withdraw your $500,000 inheritance and $600,000 gain. The 59 ½ rule on your gain is waived on Inherited Roth IRAs. Since the 5-year rule is met, the inheritance is income tax and penalty free. Had the original Roth IRA not met the 5-year rule, the gain would be subject to income taxes. Consistent with the SECURE Act , non-spouse Inherited Roth IRAs inherited after 2019 must be fully withdrawn by the tenth year after the year the account holder died, with few exceptions.

Click to Enlarge

Action Steps

Defer Roth IRA withdrawals as long as possible. Roth IRAs are one of a few estate planning and retirement planning vehicles that provide tax free growth and tax free withdrawals. Avoid unnecessary taxes by staying within the IRS guidelines. Work closely with your Registered Investment Adviser (RIA) to reduce your taxes, and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.