Are Dividends as Good as They Sound? – Part 1 – 05/01/21

Money Matters – Skloff Financial Group Question of the Month – May 1, 2021

By Aaron Skloff, AIF, CFA, MBA

Q: Do some companies really pay their stockholders dividends for simply owning their stock? Are dividends as good as they sound?

The Problem – Understanding Dividends and Their Pros and Cons

Many investors do not understand what a dividend really is. They can see the pros of dividends but cannot see the cons of dividends. Like many financial topics, there is more to the story than meets the eye. Sometimes, what you cannot see is more important than what you can see.

The Solution – Understanding Dividends and Identifying Their Pros and Cons

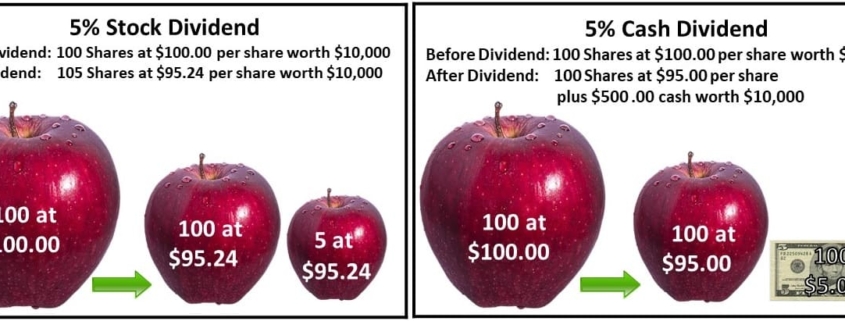

A company can distribute a stock dividend or a cash dividend. When a company distributes a stock dividend, stockholders receive additional shares. While the value of the company is unchanged, the value per share declines. For example, a 5% stock dividend for a company valued at $10 million with 100,000 shares would increase the number of shares to 105,000 and reduce the $100 per share price to $95.24. When a company distributes a cash dividend, stockholders receive cash. The value of the company and the value per share both decline. For example, a 5% cash dividend for a company valued at $10 million with 100,000 shares would reduce the value of the company to $9.5 million and the price per share to $95. See the infographic below for examples of a stock dividend and cash dividend.

Click to Enlarge

Let’s examine the pros of cash dividends:

- They create a nonguaranteed passive stream of income that can complement or replace other sources of income.

- Companies often increase dividends annually. Some companies have increased their dividends in the face of wars, and recessions.

- Dividends are taxed on a tax preferred basis. Based on your income level, dividends can even be tax-free.

- Dividends can be reinvested in the same stock, compounding your return.

- Companies that pay dividends are often more mature and stable than companies that do not pay dividends.

Let’s examine the cons of cash dividends:

- Companies have reduced or eliminated their dividends in the past and can do so in the future.

- Companies that pay the highest dividend rates may pay more in dividends than they earn in profits, which is unsustainable.

- Most companies pay taxes on their profits. If they pay a dividend from profits, most stockholders pay taxes. That is double taxation.

- Dividends deplete the capital companies can use to buy back their shares, which can increase profits per share on a tax-free basis.

- Dividends deplete the capital companies can use to invest in existing and new products and services to grow their profits.

Creating Your Own Dividend. As seen above, cash dividends do not add value. In fact, they destroy value in the form of taxes paid by many dividend recipients. Stockholders can create their own dividend rate (e.g.: 1%, 5%, 10%, etc.) and frequency (e.g.: monthly, quarterly, annually, etc.) by simply selling a portion of their shares. Selling shares held for over one year (long term) receive the same tax preferred treatment as dividends.

Action Steps – Understand the Pros and Cons of Dividends Before Buying or Selling a Stock

Some investors view dividends as ‘found money’, while others view dividends as a ‘waste of capital’. Before buying or selling a stock understand the pros and cons of dividends. Work closely a Registered Investment Adviser (RIA) to make the best investment decisions.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.