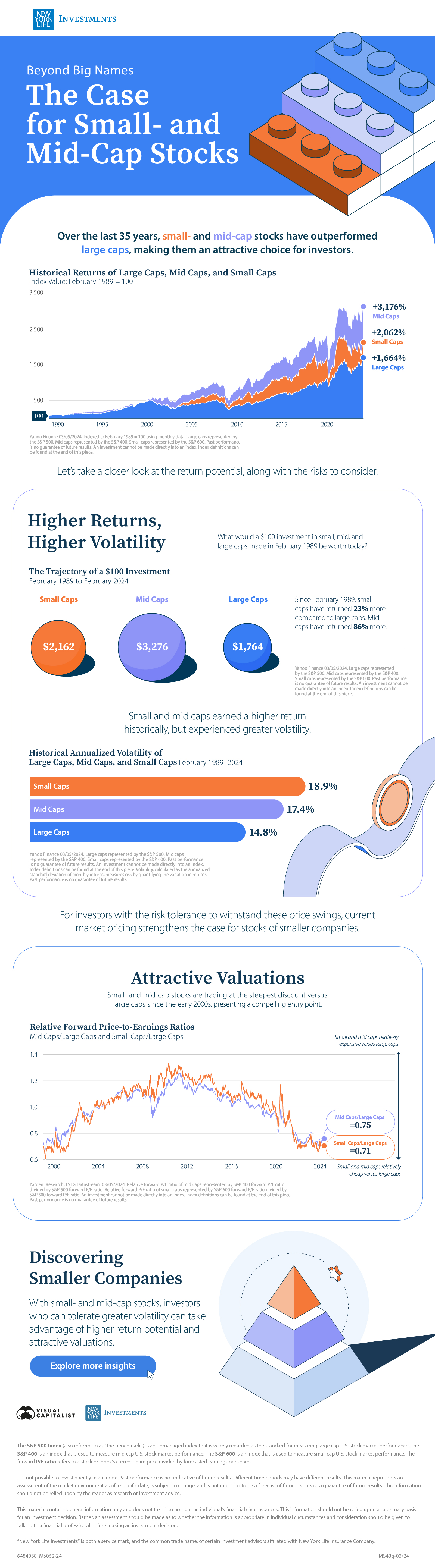

Beyond Big Names: The Case for Small and Mid-Cap Stocks: 1989-2024

Click to Enlarge

Past performance is no guarantee of future results. Assumes reinvestment of income and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index.

Investing involves risk, including the possible loss of principal and fluctuation of value. Equity and fixed income securities are subject to various risks including, but not limited to, market risk, credit risk and interest rate risk.

Higher Historical Returns

If you made a $100 investment in baskets of small-, mid-, and large-cap stocks in February 1989, what would each grouping be worth today?

| Small Caps | Mid Caps | Large Caps | |

|---|---|---|---|

| Starting value (February 1989) | $100 | $100 | $100 |

| Ending value (February 2024) | $2,162 | $3,276 | $1,764 |

Source: Yahoo Finance (2024). Small caps, mid caps, and large caps are represented by the S&P 600, S&P 400, and S&P 500 respectively.

Higher Volatility

However, higher historical returns of small- and mid-cap stocks came with increased risk. They both endured greater volatility than large caps.

| Small Caps | Mid Caps | Large Caps | |

|---|---|---|---|

| Total Volatility | 18.9% | 17.4% | 14.8% |

Source: Yahoo Finance (2024). Small caps, mid caps, and large caps are represented by the S&P 600, S&P 400, and S&P 500 respectively.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

The example provided is hypothetical and used for illustration purposes only. It does not represent the returns of any particular investment.