Combination Life and Long Term Care Insurance Benefits and Premiums – Long Term Care University

Long Term Care University – Question of the Month – 12/15/12

By Aaron Skloff, AIF, CFA, MBA

Q: We read the November 15, 2012 Long Term Care University article that compares Combination Life/Long Term Care insurance policies to Traditional Long Term Care (LTC) insurance policies and decided to purchase a Combination policy. Are the premiums the same for all Combination (Hybrid) Life/Long Term Care insurance policies if we select the same benefits?

The Problem – Vastly Different Premiums for the Same Benefits

If you have decided to purchase a Combination policy instead of a Traditional Long Term Care (LTC) policy you have solved one dilemma – now you are now presented with another dilemma. The new dilemma is selecting the best value among the vastly different premiums the various LTC insurance companies charge for Combination policies with the same benefits.

Insurance companies invest (primarily in fixed income investments) the premiums you pay them, which contributes to their profits. The stubbornly low interest rate environment has presented great challenges to the insurance companies. Faced with lower interest rates and the risk of smaller profits, some companies are taking advantage of consumers too lazy or busy to either conduct their own due diligence or to seek the expertise of an experienced professional. The companies are protecting their profits by increasing premiums for new applicants, reducing benefits for new applicants or both. Note, pricing and benefits for existing policyholders are guaranteed by the insurance companies.

Click Here for Your Long Term Care Insurance Quotes

The Solution – Conduct Your Own Due Diligence or Seek the Expertise of an Experienced Professional

Before purchasing a Combination policy, compare at least two companies. Ideally, use the same set of benefits so you can make an apple to apple comparison.

Numbers Speak Louder than Words. Let’s look at a husband and wife that are each 55 years of age and are comparing Combination Life/LTC policies from Company 1 and Company 2. They each select coverage of $200 per day; 66 months (5.5 years) of LTC per person and 5% compound inflation protection.

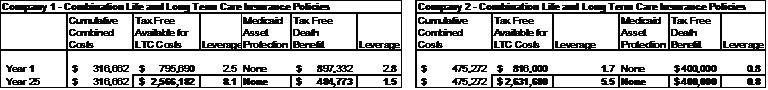

With Company 1, they make a combined one time payment of $316,662 and immediately gain a combined $795,690 (tax free) pool of money available for LTC costs and a combined $897,332 (tax free) death benefit. That gives them 2.5 and 2.8 times leverage, respectively, on the premiums they paid. In 25 years when they are likely to need LTC, they will have a combined $2.6 million (tax free) pool of money available for LTC costs and a combined $484,773 (tax free) death benefit. That gives them 8.1 and 1.5 times leverage, respectively.

With Company 2, they make a combined one time payment of $475,272 and at the end of the first year gain a combined $816,000 (tax free) pool of money available for LTC costs and a combined $400,000 (tax free) death benefit. That gives them 1.7 and 0.8 times leverage, respectively, on the premiums they paid. In 25 years when they are likely to need LTC, they will have a combined $2.6 million (tax free) pool of money available for LTC costs and a combined $400,000 (tax free) death benefit. That gives them 5.5 and 0.8 times leverage, respectively.

Click to Enlarge

Clearly, Company 1 provides much better value in the form of a lower premium, greater initial benefits and greater future benefits.

Action Step – Always Compare Multiple Quotations to Verify You Are Getting the Best Value

While getting a second quotation before making a purchase is always a good idea, it is imperative when insurance companies are reducing benefits, increasing premiums or both.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a NJ based Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Click Here for Your Long Term Care Insurance Quotes