Combination Life and Long Term Care Insurance With and Without Inflation Protection Part 2 – Long Term Care University

Long Term Care University – Question of the Month – 11/15/16

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Long Term Care University article that compares Traditional to Combination Life and Long Term Care Insurance and the article that compares Combination Life and Long Term Care Insurance With and Without Inflation Protection, and prefer the Combination policy (or Hybrid). What are the pros and cons of purchasing a Combination policy with Lifetime benefits with or without inflation protection?

The Problem – The Cost of an Extended Period of Long Term Care

According to the U.S. Department of Health and Human Services, 7 in 10 people over the age 65 will require long term care. Although the average length of long term care is approximately three years, 20% will need care for longer than five years. One of the largest long term care insurance companies reported that 50% of all claims dollars it has paid are due to dementia, including Alzheimer’s disease. According to the Alzheimer’s Association, 1 in 9 people age 65 and older and about 1 in 3 people age 85 and older have Alzheimer’s disease. The duration of Alzheimer’s disease is generally four to eight years after a diagnosis, but can last as long as 20 years. Applying the historical 4% compound growth rate of long term care services, the cost of care will double every 18 years.

Click Here for Your Long Term Care Insurance Quotes

The Solution – Combination Life and Long Term Care Insurance With or Without Inflation Protection

When evaluating Combination policies, it is important to understand what your monthly and total long term care (LTC) benefits are when you purchase the policy, and what they will be when you are likely to need care. It also important to understand your life insurance benefits.

Numbers Speak Louder than Words

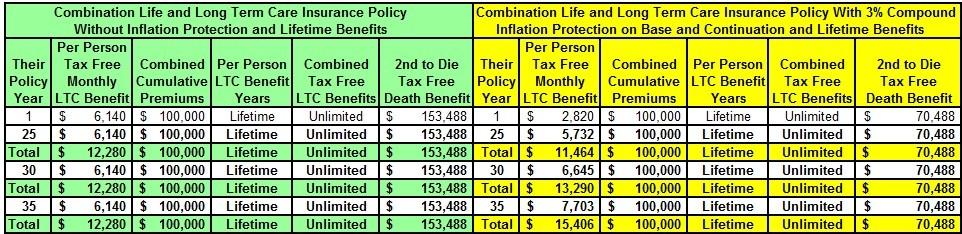

Let’s look at a husband and wife that are each 55 years of age. They are comparing Combination policies with lifetime benefits. The first policy has no inflation protection, while the second policy has 3% compound inflation protection.

Combination Policy Without Inflation Protection

If they make a combined one-time premium payment of $100,000 they immediately gain a combined tax free $12,280 per month LTC benefit ($6,140 per month per person) available for an unlimited number of months for LTC costs; literally a lifetime worth of LTC. They also gain a combined tax free $153,488 death benefit when the second person dies, if the policy’s LTC benefits are unused. The LTC and death benefit will be the same at any age. Please see the chart below. The pros of this policy are a high initial monthly LTC benefit and a lifetime of total LTC benefits that can never run out; along with a fixed death benefit. The cons are the monthly LTC benefit does not grow and the death benefit is only paid when the second person passes away.

Combination Policy With 3% Compound Inflation Protection

If they make a combined one-time premium payment of $100,000 they immediately gain a combined tax free $5,640 per month LTC benefit ($2,820 per month per person) available for an unlimited number of months for LTC costs; literally a lifetime worth of LTC. They also gain a combined tax free $70,488 death benefit when the second person dies, if the policy’s LTC benefits are unused. Please see the chart below.

With 3% compound inflation protection, their base and continuation LTC benefits will grow every year. In 25 years when they are likely to need LTC at the age of 80, they will have a tax free $11,464 per month LTC benefit ($5,732 per month per person) available for an unlimited number of months for LTC costs; literally a lifetime worth of LTC. In 30 years, their monthly benefits would be $13,290. The pros of these policies are a lower initial monthly LTC benefit with an unlimited amount of growth, which would be valuable if care is not needed until later in life (e.g.: policy year 30). The cons are a lower monthly benefit if care is needed in earlier years and a lower death benefit.

Click to Enlarge

Action Step – Purchase a Combination Life and Long Term Care Policy that Best Suits Your Needs

As prices vary between companies, review multiple quotes before purchasing a policy that best suits your needs.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.