Cost of a College Education 2017-2018

Money Matters – Skloff Financial Group Question of the Month – November 1, 2017

Cost of a College Education 2017-2018

By Aaron Skloff, AIF, CFA, MBA

Q: We are concerned about college tuition costs, but know there are additional costs. What are the costs of a college education?

The Problem – Underestimating the Costs of a College Education

Whether you are saving for a newborn’s undergraduate college education or about to write a check for a young adult’s first semester, the cost of a college education can be startling. For the 2017-2018 academic year, the cost of a college education rose faster than the rate of inflation and the median increase in household incomes. The year over year increase of the average published charges (tuition and fees, and room and board) were: public two-year in-district commuter student 2.8%, public four-year in-state on-campus student 3.1%, public four-year out-of-state on-campus student 3.2% and private nonprofit four-year on-campus student 3.5%.

Are You Interested in Learning More?

The Solution – Understanding the Cost of a College Education

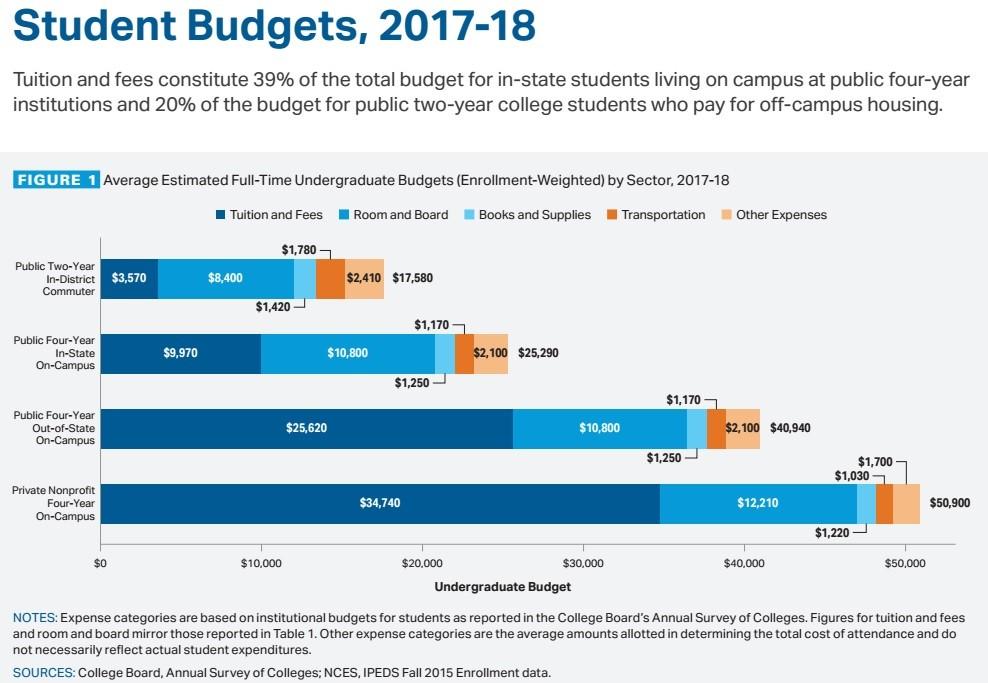

The cost of a college education varies greatly by the type of education. The five largest categories of expenses include: tuition and fees, room and board, books and supplies, transportation and other expenses. The cost for a public two-year in-district commuter student is $17,580. The cost for a public four-year in-state on-campus student is $25,290. The cost for a public four-year out-of-state on-campus student is $40,940. The cost for a private nonprofit four-year on-campus student is $50,900. We examine the five components of undergraduate college expenses in the chart below.

Click to Enlarge

Action Steps

Contact the colleges you are interested in attending and ask about scholarships, grants and financial aid. If costs increase at 4% per year, a newborn will pay more than twice as much a 2017-2018 freshman. Save aggressively through a 529 savings plan. A 529 savings plan offers tax free growth when the savings are used for higher education expenses and is an excellent estate planning tool.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.