Global Atlantic Forethought ForeCare – Hybrid Annuity and Long Term Care

Slideshow Below

Click Here for Your Long Term Care Insurance Quotes

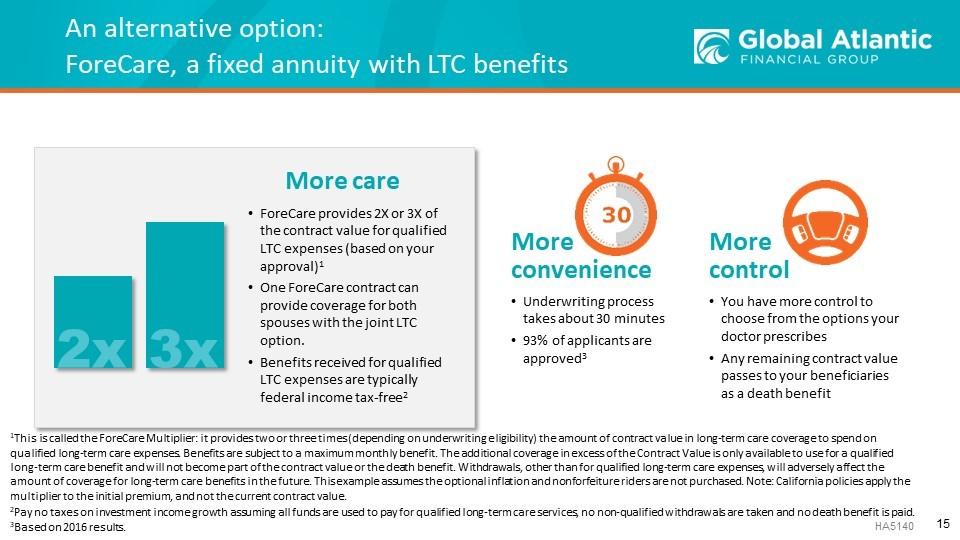

ForeCare is a fixed annuity with LTC benefits that offers you more care, more convenience and more control.

Let’s use a hypothetical example to compare two of these options: self-funding as option one and purchasing ForeCare as option two.

To do that, I’d like to introduce to you our fictitious couple named Clara and Wade. These two are both 70 years old and after 45 years of marriage, they still take their vow to honor each other in sickness and in health very seriously. But they wondered, if something happened to Wade, could Clara physically support her husband (or vice versa)? For example, let’s say that:

Wade has a stroke.

After his hospitalization, he’s unable to perform at least two ADLs such as eating and bathing.

He needs a home health aide and homemaker services.

After that, Wade needs additional care in a nursing home.

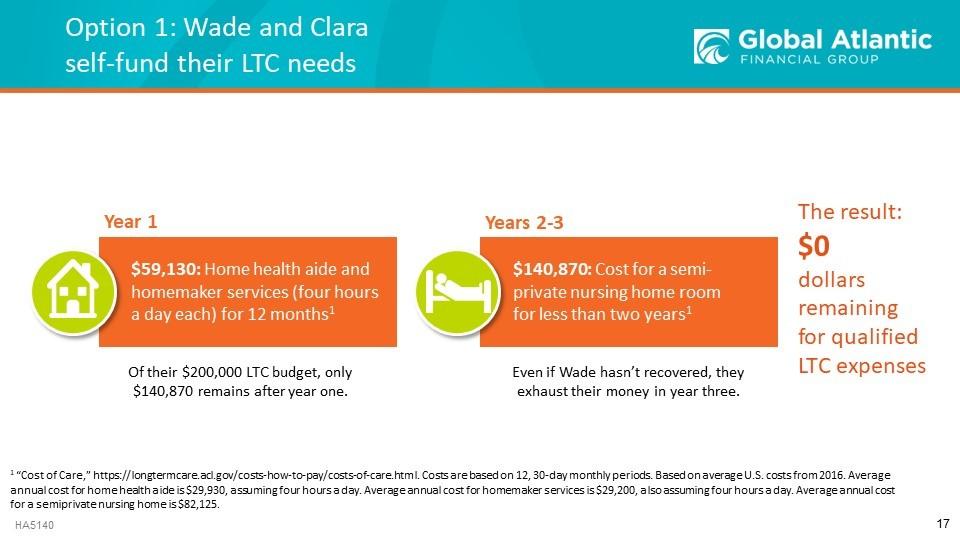

Let’s see what their costs are for the LTC services they need and look at how the self-funding option helps them cover their expenses.

For the self-funding option, Clara and Wade have $200,000 set aside for LTC.

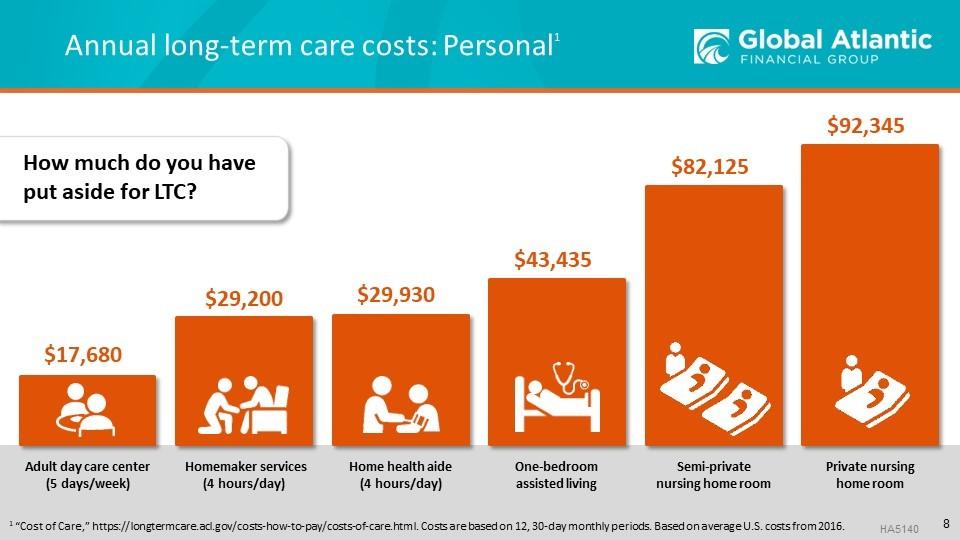

In the first year, they pay $59,130 for a home health aid and homemaker services, each helping them for four hours a day. That leaves them with $140,870 by the end of year one. For years two and three, Wade needs help in a nursing home. In less than three years, even if Wade hasn’t recovered, they spent all of their original $200,000 LTC budget.

As you can see, they will completely exhaust their assets in year three just for paying for a home health aide and homemaker services in year one and a semi-private nursing home room in years two and three.

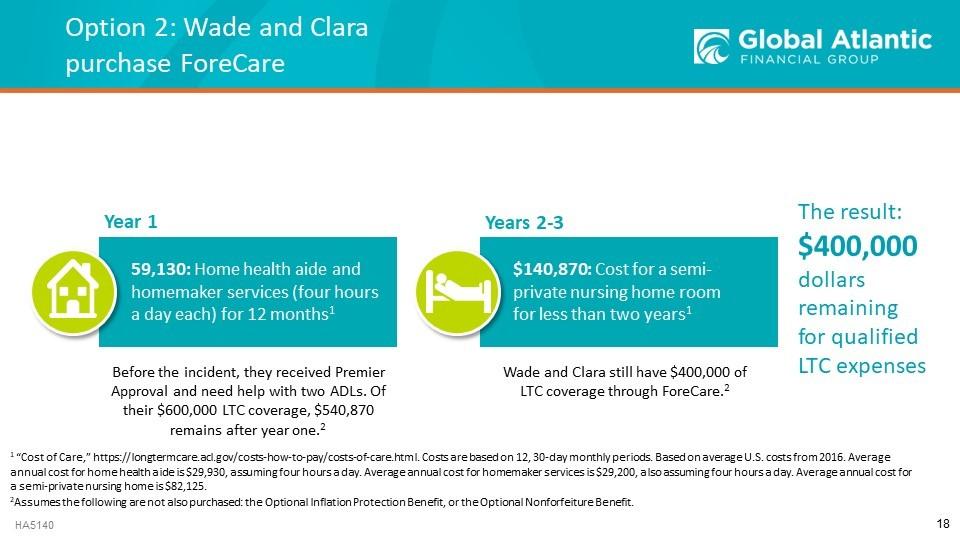

However, if they used that same $200,000 to purchase ForeCare and received Premier Approval, the story changes.

The amount available for LTC coverage would be $600,000 immediately after issue. That means that even after experiencing the exact same expenses as in option 1, they’re still left with $400,000 – that’s twice the amount of their original LTC budget.

Now that we’ve shown you that hypothetical case study, let’s look at some trending strategies to see how people are choosing to prepare for long-term care.

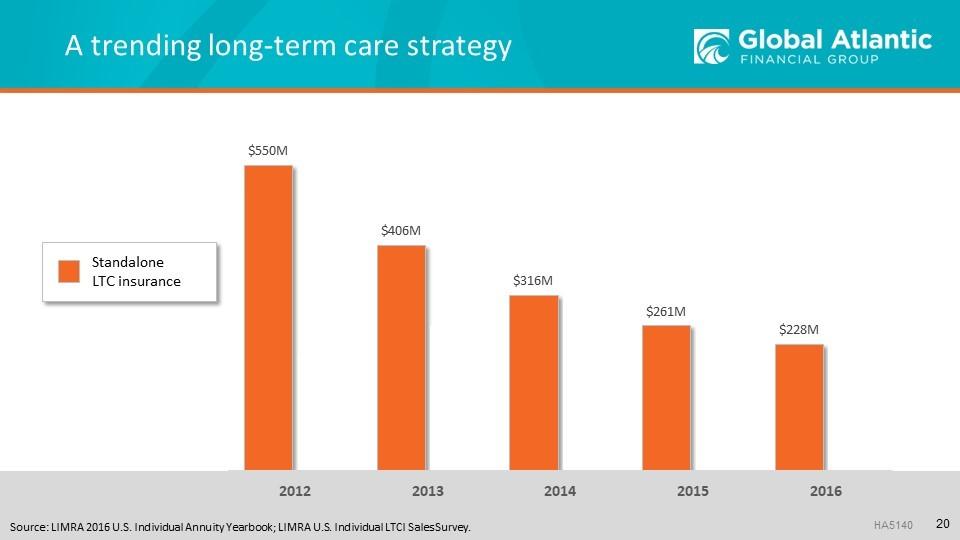

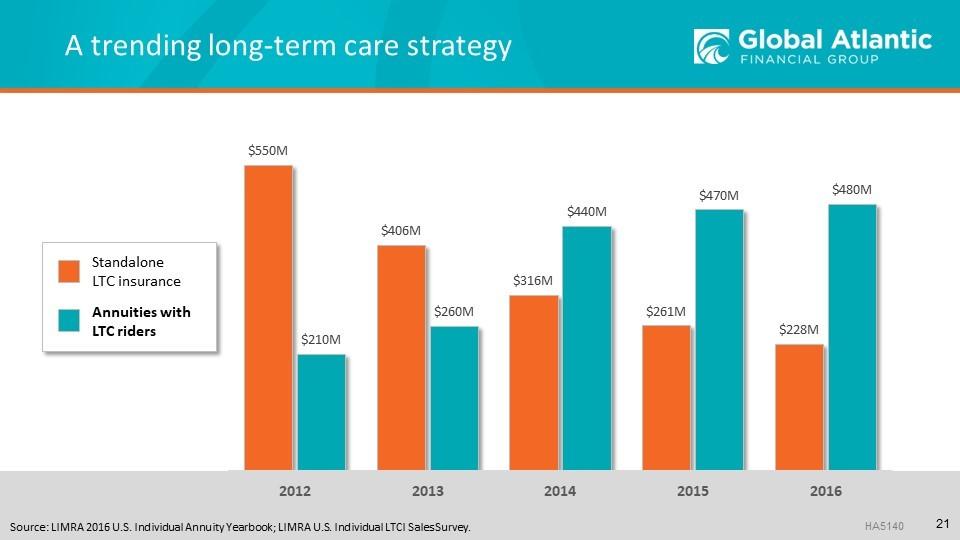

Let’s first look at buying standalone LTC insurance. Since 2012, the collective premiums of everyone choosing to purchase standalone LTC insurance has steadily declined.

However, during this same time period, annuities with LTC benefits (like ForeCare) have become increasingly popular.

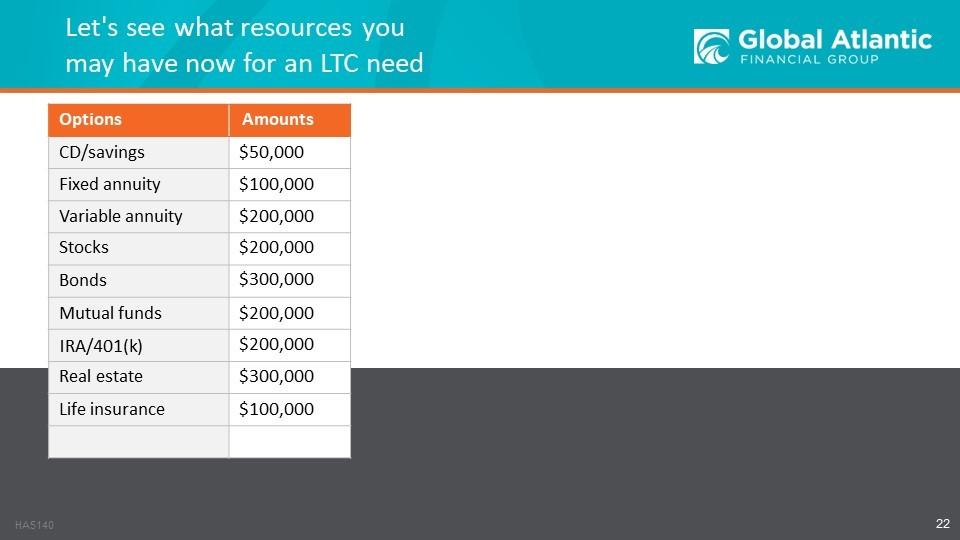

Hypothetically, let’s say that you are now considering purchasing ForeCare for your own personal LTC needs. How might you begin the process?

The first thing you might want to do is look across all of your assets to see what you could possibly repurpose to purchase a ForeCare fixed annuity with long-term care benefits.

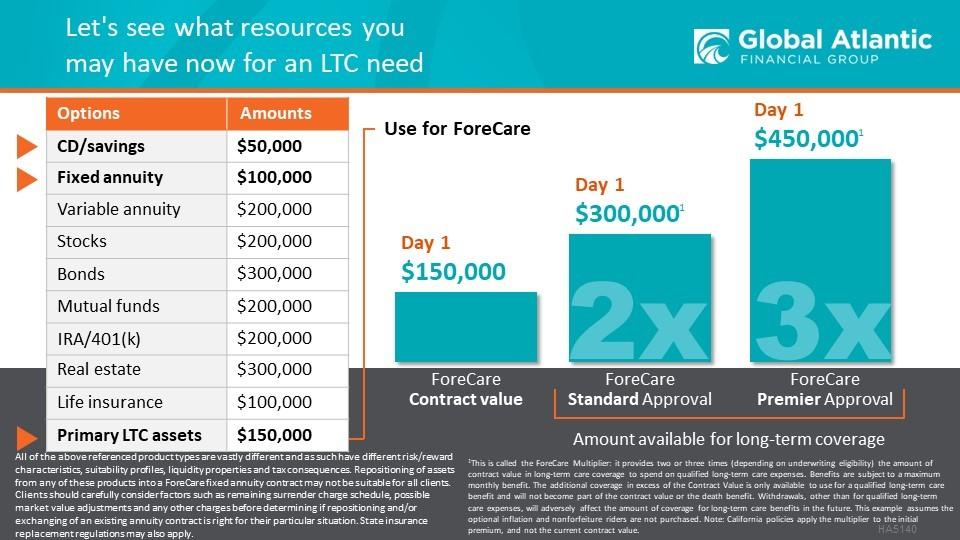

Once you’ve listed all of your assets, you’ve decided that you may be able to use the money you have in CDs/savings combined with the contract value of your fixed annuity to purchase ForeCare – together, these assets equal $150,000.

Using that amount to purchase ForeCare:

- If you receive Standard Approval, you’ll get $300,000 on day one for qualifying LTC expenses.

- If you receive Premier Approval, it’s $450,000.

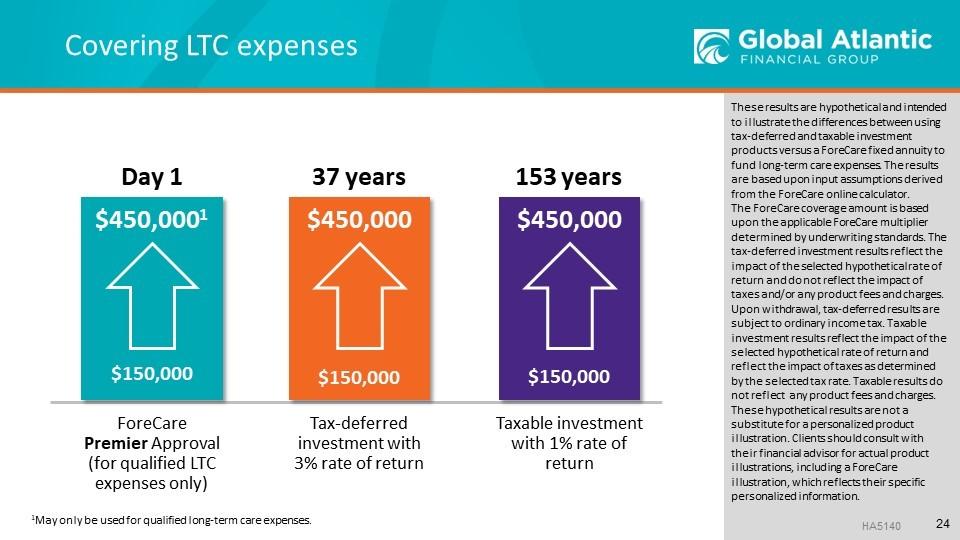

If you were to pursue other options to grow your money for qualified LTC expenses to equal that same Premier Approval amount of $450,000, it might take you some time.

For example, let’s say you invested in a tax-deferred account with a 3% compound annual growth rate of about 3% – it’d take you 37 years to get $450,000.

If you invested in a taxable investment with a 1% taxable rate, it would take you about 150 years.

As you can see, ForeCare may enable you to maximize your LTC dollars much more efficiently.

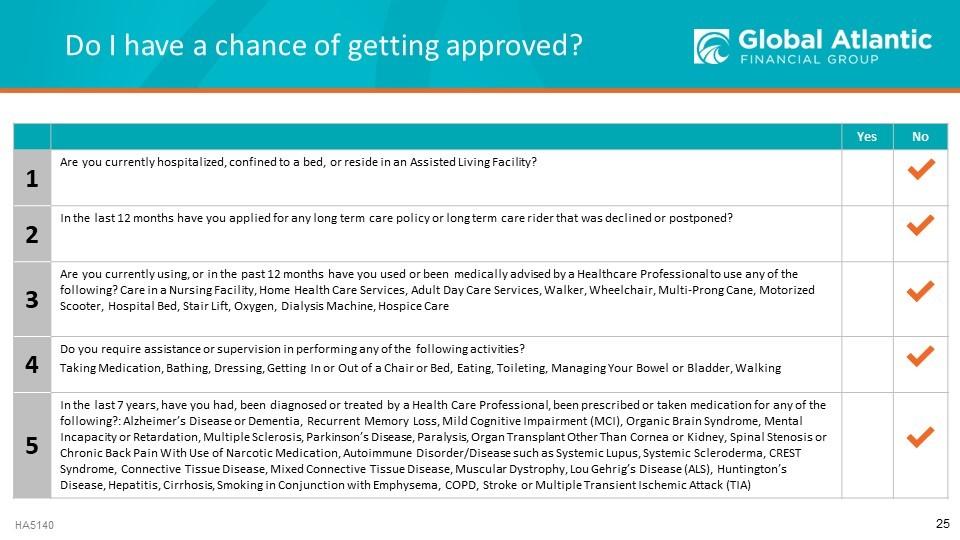

Let’s talk about the ForeCare approval process. It starts with just five questions.

The Premier Approval process includes five additional questions.