How the CARES Act Affects Retirement Accounts – Part 2 – 04/01/20

Money Matters – Skloff Financial Group Question of the Month – April 1, 2020

By Aaron Skloff, AIF, CFA, MBA

Q: We read the article How the CARES Act Affect Retirement Accounts – Part 1. Since we are concerned about financial market volatility, should we take withdrawals from our retirement accounts, then redeposit them in the future?

A: The Problem – Withdrawals from Retirement Accounts During Financial Market Volatility

Although the CARES Act allows withdrawals from retirement accounts without penalty and allows up to three years to redeposit the money, exercising that allowance can be devastating to your wealth. Over the last 100 years the world has faced famine, wars, economic depression and health catastrophes. All these events created financial market volatility. When faced with market volatility, investors must make the choice physiologist Walter Cannon called ‘fight or flight’. When applied to the financial markets, investors can fight by staying invested in the market or flight by exiting the market. Time and time again, investors that stayed invested in the markets reaped the rewards, while those that timed the markets were punished. Timing the market is a fool’s game.

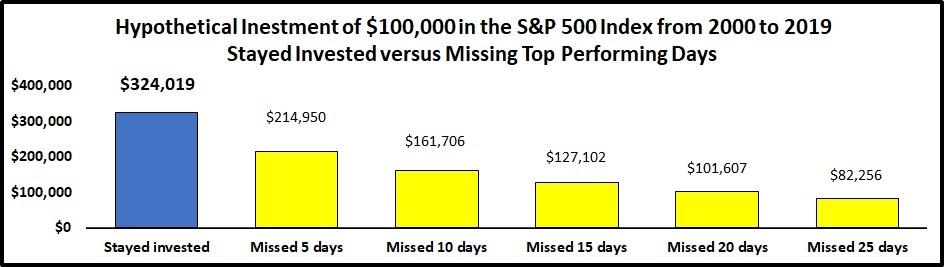

Numbers Speak Louder than Words. Although past financial market performance does not necessarily predict future results, financial markets often reflect human psychology; dipping when people are fearful and soaring when they are confident. The most successful investors avoid market timing. Let’s look at an example of investors who invested $100,000 in stocks that replicated the S&P 500 index during the 20-year period from January 1, 2000 to December 31, 2019. We’ll call the first investor ‘Stayed invested’ and compare that investor to five other investors, who’s names reflect the number of top performing days they missed by market timing during the same period: ‘Missed 5 days’, ‘Missed 10 days’, ‘Missed 15 days’, Missed 20 days’ and ‘Missed 25 days’. The investor named ‘Stay invested’ had an ending value of $324,019, which was over 50% more than the investor “Missed 5 days’. The investor ‘Missed 25 days’ was not only punished with abysmal performance but lost almost 18% of his $100,000 principal. See the chart below.

Click to Enlarge

The Solution – ‘Fight’ the Market by Staying Invested and Reap the Rewards

Staying invested through health catastrophes and other periods of market volatility allows your portfolio to sustain declines, regain from those declines and flourish during recoveries. Turn financial market pain into your gain with these two strategies.

Tax Loss Harvesting. Turn unrealized tax losses into realized tax losses in taxable accounts. For example, if your investment has an unrealized loss you can sell it and immediately buy a similar investment. As long as the new investment is not substantially equivalent to the old investment (e.g.: selling Vanguard’s S&P 500 fund to buy Fidelity’s S&P 500 fund), you maintain the tax loss. You can then sell the new investment and replace it with the old investment after 30 days, avoiding the wash sale rule (that eliminates the tax benefits).

In-Kind Roth IRA Conversions. Through in-kind Roth IRA conversions, you convert the same temporarily depressed investments in pre-tax Traditional IRAs to Roth IRAs. You pay less taxes than you would have before the depression in values, while keeping the same investments (in-kind). Roth IRA conversions reduce the size of pre-tax Traditional IRAs, which reduce the size of future RMDs and the tax obligations for owners, spousal beneficiaries and particularly Inherited IRA owners (due to the SECURE Act).

Action Step — Work Closely with a Registered Investment Adviser (RIA) to Best Utilize the CARES Act

Work closely with an RIA to utilize the estate, financial, retirement and tax benefits provided by the CARES Act.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.