Insure or Self-Insure for Long Term Care – Long Term Care University – 08/15/15

Long Term Care University – Question of the Month – 08/15/15

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We are concerned about the exorbitant costs for long term care. Should we insure or self-insure our long term care costs?

The Problem – Paying for Long Term Care

According to the U.S. Department of Health and Human Services, 7 in 10 people over the age of 65 will require long term care. This compares to a 1 in 340 chance of a major auto accident and a 1 in 1,200 chance of a total loss from a fire. About half the people reaching the age of 65 are expected to enter a nursing home at least once in their lifetime.

Click Here for Your Long Term Care Insurance Quotes

The cost of long term care is expensive. The median cost of a private room in a nursing facility is $7,500 per month, an assisted living facility $3,600 per month and home care $3,800 per month. If you are 55-years-old expect to pay almost three times those amounts when you are likely to need care 25 years from now at the age of 80. Based on the average nursing home stay, total costs are expected to reach approximately $720,000 per person — easily wiping out a lifetime of savings for many families.

The Solution – Insure or Self Insure for Your Future Long Term Care Costs

When preparing for your long term care (LTC) costs, you should understand the advantages and disadvantages of insuring versus self-insuring (investing) for your long term care costs. Let’s compare two 55-year-old couples: the Millers choose to self-insure (invest) for their long term care costs, while the Smiths choose to insure. Unfortunately, each couple will likely need long term care for 5 years in a combination of locations; including a nursing home, an assisted living facility and their own home. The only saving grace is that their costs may only run at $300 per day or $9,000 per month per person.

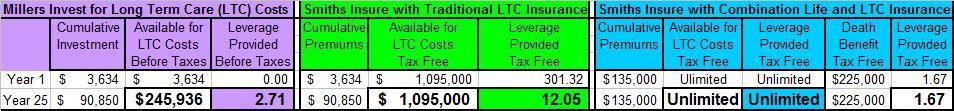

Self-Insure (Invest) for Your Long Term Care Costs. If the Millers each invest $1,817 ($3,634 combined) for one year and earn 7% (before taxes), they will immediately have a combined $3,634 available for LTC costs. If they invest a combined $90,850 ($3,634 X 25) over 25 years and earn 7% per year (before taxes), they will have a combined $245,936 available for LTC costs. Unfortunately, self-insuring (investing) provides a fraction of the leverage insurance provides. See the chart below.

Insure for Your Long Term Care Costs with Traditional Long Term Care Insurance. The Smiths can purchase a Traditional Long Term Care Insurance policy with a $300 per day benefit and a five year benefit multiplier (minimum years of care). After the Smiths each pay $1,817 ($3,634 combined) for one year, they will have a combined $1,095,000 (tax free) available for LTC costs. If they pay a combined $90,850 ($3,634 X 25) over 25 years, they will have a combined tax free $1,095,000 available for long term care costs. Fortunately, insurance provides a multiple of the leverage self-insuring (investing) provides. See the chart below.

Insure for Your Long Term Care Costs with Combination Life and Long Term Care Insurance. The Smiths can purchase a Combination Life and Long Term Care Insurance policy with a $300 per day or $9,000 per month benefit and a Lifetime of care. After the Smiths pay a combined $135,000 ($67,500 each), they will have a combined tax free Lifetime (Unlimited) amount available for LTC costs. They also gain a $225,000 tax free death benefit when the second person dies, assuming the policy’s LTC benefits are unused. Fortunately, insurance provides a multiple of the leverage self-insuring (investing) provides. See the chart below.

Click to Enlarge

Action Step – Insure Instead of Self-Insure (Invest) for Your Long Term Care Costs

Like automobile insurance or homeowners insurance (which most people would never even consider going without), long term care insurance provides significantly more benefits for the same dollars when compared to self-insuring with an investment portfolio. Use the leverage of insurance. Purchase a long term care insurance policy and protect your assets and your estate.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.