Long Term Care Insurance Tax Free with Health Savings Account (HSA) – Long Term Care University

Long Term Care University – Question of the Month – 02/15/25

By Aaron Skloff, AIF, CFA, MBA

Q: Can we pay for our long term care insurance policies on a tax-free basis?

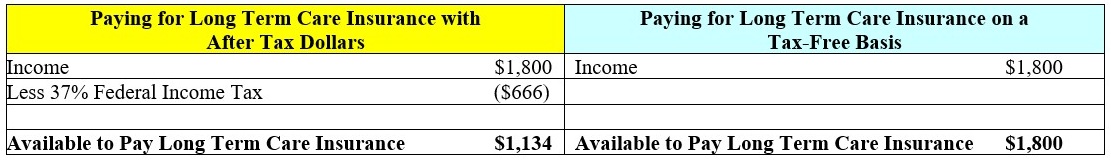

The Problem – Paying for Long Term Care Insurance with After Tax Dollars

The Internal Revenue Code is loaded with tax benefits to encourage you to save for retirement through vehicles like 401(k) plans and Individual Retirement Accounts (IRAs). Unfortunately, paying for long term care insurance on a tax-free basis is much less understood.

Click Here for Your Long Term Care Insurance Quotes

The Solution – Paying for Long Term Care Insurance on a Tax-Free Basis

While companies have many ways to pay for long term care insurance on a tax free basis, individuals have fewer choices. Let’s look at the tax implications of paying on an after tax versus tax-free basis, then two solutions to pay on a tax free basis.

Click to Enlarge

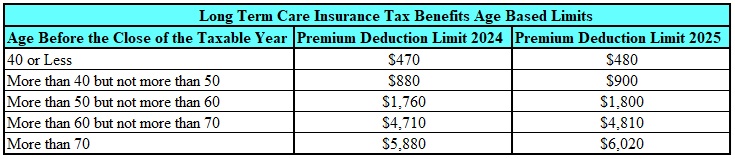

Health Savings Account (HSA) Allows You to Pay Your Long Term Care Insurance on a Tax-Free Basis

An HSA is a tax-advantaged savings account tied to a high deductible health insurance plan that is increasingly becoming more common with employers. Contributions to your HSA are made on a pre-tax basis, while withdrawals for qualified medical expenses are made tax free. Just as importantly, any growth (interest, dividends, capital gains, etc.) inside an HSA is tax-free if withdrawals are used for qualified medical expenses. Tax-qualified long term care insurance premiums are a qualified medical expense. [See IRS Notice 2004-50] The maximum amount of premium you can pay on a tax-free basis is indicated in the table below.

| Long Term Care Insurance Tax Benefits Age Based Limits | ||

| Age Before the Close of the Taxable Year | Premium Deduction Limit 2024 | Premium Deduction Limit 2025 |

| 40 or Less | $470 | $480 |

| More than 40 but not more than 50 | $880 | $900 |

| More than 50 but not more than 60 | $1,760 | $1,800 |

| More than 60 but not more than 70 | $4,710 | $4,810 |

| More than 70 | $5,880 | $6,020 |

Click to Enlarge

Certain Withdrawals from Retirement Plans Allow You to Pay Your Long Term Care Insurance on a Tax-Free Basis

With the introduction of the Healthcare Enhancement for Local Public Safety Officers (HELPS) Act, qualified retired public safety employees can make tax-free distributions of up to $3,000 per year from qualified retirement plans to help pay for long term care insurance. A qualified public safety employee is an employee of a State or political subdivision of a State if the employee provides police protection, firefighting services, or emergency medical services. An eligible retirement plan includes a governmental qualified retirement or annuity plan, 403(b) annuity, or 457(b) plan.

Section 328 of the SECURE Act 2.0 now allows retirees to make these distributions directly to their insurance provider, so they do not have to rely on retirement plan administrators to make the distribution. This change is effective for distributions made after December 29, 2022.

Action Step – Pay for Your Long Term Care Insurance Policies on a Tax-Free Basis

Instead of the government taking advantage of you, take advantage of the government. Follow the guidelines above and force the government to effectively pay up to 37% of your long term care insurance policy.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.