Investment Options

The Meta 401(k) offers a traditional mutual fund lineup and Fidelity BrokerageLink. Fidelity BrokerageLink provides thousands of investment options, allowing you to have your Meta 401(k) account professionally managed.

Professionally managed accounts can generate 3% to 4% higher returns per year.

Have Your Meta 401(k) Account Professionally Managed

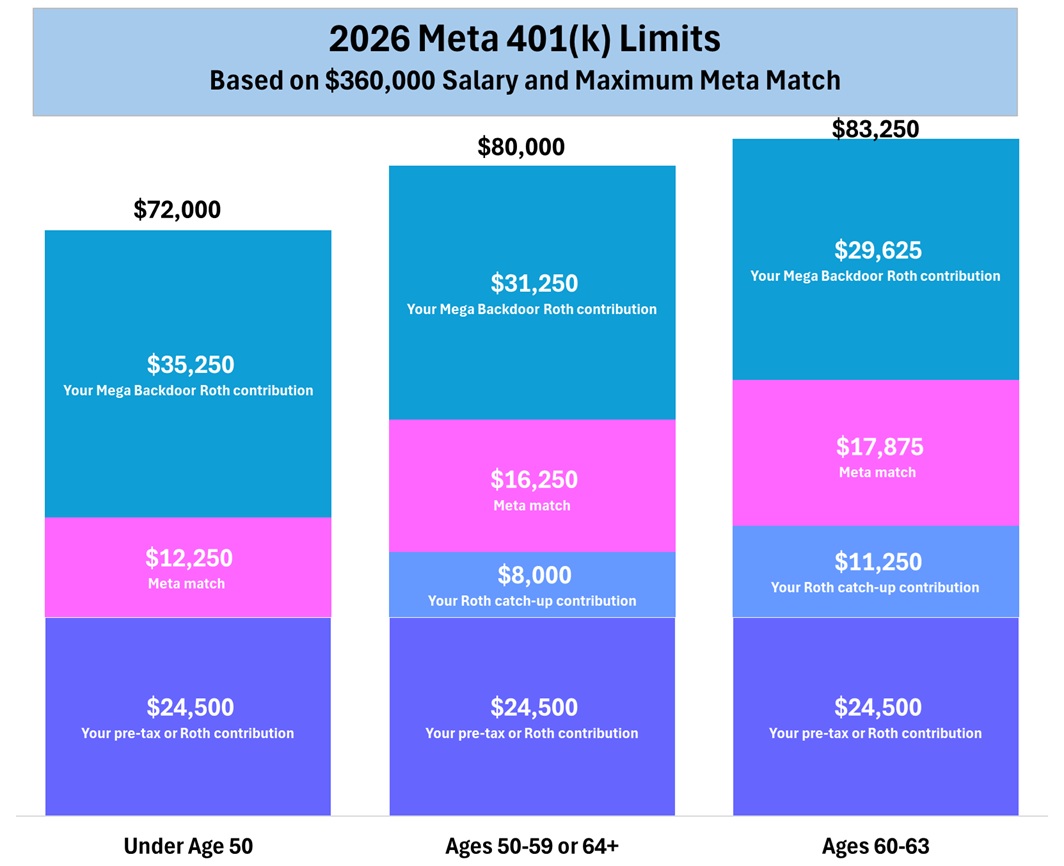

2026 Contribution Limits

| Under age 50 | $24,500 |

| Ages 50-59 or 64+ | $32,500 [$24,500 + $8,000 catch-up] |

| Ages 60-63 | $35,750 [$24,500 + $11,250 catch-up] |

Pre-tax Contributions and Pre-Tax Catch-up Contributions

With pre-tax contributions and pre-tax catch-up contributions, you defer income taxes until you withdraw the assets.

Roth Contributions and Roth Catch-up Contributions

With Roth contributions and Roth catch-up contributions, you pay taxes on the contributions but withdrawals are tax-free.

Meta Match

Meta matches 50% on your contributions up to $24,500 of contributions in 2026 for ages under 50, resulting in a maximum match of $12,250 in 2026. Meta matches 50% on your contributions up to $32,500 of contributions in 2026 for ages 50-59 or 64+, resulting in a maximum match of $16,250 in 2026. Meta matches 50% on your contributions up to $35,750 of contributions in 2026 for ages 60-63, resulting in a maximum match of $17,875 in 2026. Meta matches catch-up contributions.

You must contribute $24,500 to receive your full match for ages under 50. You must contribute $32,500 to receive your full match for ages 50-59 or 64+. You must contribute $35,750 to receive your full match for ages 60-63.

Meta matches vest immediately.

Meta Match Examples

Employee Contributes $10,000

Based on a $360,000 salary, you contribute $10,000. Meta will match your contribution by 50% or $5,000.

Employee Contributes 6% of Salary

Based on a $360,000 salary, you contribute $21,600. Meta will match your contribution by 50% or $10,800.

Mega Backdoor Roth

In addition to your pre-tax and Roth contributions and the Meta match, you can utilize a Mega Backdoor Roth. You can contribute after-tax to your 401(k) up to the limit of all employee and employer contributions, then convert those after-tax contributions to a Roth IRA or Roth 401(k).

2026 Contribution Limits for All Employee and Employer Contributions

| Under age 50 | $72,000 |

| Ages 50-59 or 64+ | $80,000 |

| Ages 60-63 | $83,250 |

Mega Backdoor Roth Examples

Employee Under the Age of 50

Based on a $360,000 salary, you can generate $70,000 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your Meta match, you can contribute $35,250 after taxes.

| Your pre-tax or Roth contributions | $24,500 |

| Meta match | $12,250 |

| Your Mega Backdoor Roth contributions | $35,250 |

| Total | $72,000 |

Employee Age 50-59 or 64+

Based on a $360,000 salary, you can generate $80,000 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your Meta match, you can contribute $31,250 after taxes.

Starting in 2026, if your wages from the preceding year (2025) exceeded $145,000 (indexed to $150,000–$160,000 depending on final IRS inflation adjustments, though $145,000 is the base threshold), any catch-up contributions must be made on a Roth basis.

| Your pre-tax or Roth contributions | $24,500 |

| Your Roth catch-up contributions | $8,000 |

| Meta match | $16,250 |

| Your Mega Backdoor Roth contributions | $31,250 |

| Total | $80,000 |

Employee Age 60-63

Based on a $360,000 salary, you can generate $83,250 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your Meta match, you can contribute $29,625 after taxes.

Starting in 2026, if your wages from the preceding year (2025) exceeded $145,000 (indexed to $150,000–$160,000 depending on final IRS inflation adjustments, though $145,000 is the base threshold), any catch-up contributions must be made on a Roth basis.

| Your pre-tax or Roth contributions | $24,500 |

| Your Roth catch-up contributions | $11,250 |

| Meta match | $17,875 |

| Your Mega Backdoor Roth contributions | $29,625 |

| Total | $83,250 |