Investment Options

The NVIDIA 401(k) offers a traditional mutual fund lineup and Fidelity BrokerageLink. Fidelity BrokerageLink provides thousands of investment options, allowing you to have your NVIDIA 401(k) account professionally managed.

Professionally managed accounts can generate 3% to 4% higher returns per year.

Have Your NVIDIA 401(k) Account Professionally Managed

2025 Contribution Limits

| Under age 50 | $23,500 |

| Ages 50-59 or 64+ | $31,000 [$23,500 + $7,500 catch-up] |

| Ages 60-63 | $34,750 [$23,500 + $11,250 catch-up] |

Pre-tax Contributions and Pre-Tax Catch-up Contributions

With pre-tax contributions and pre-tax catch-up contributions, you defer income taxes until you withdraw the assets.

Roth Contributions and Roth Catch-up Contributions

With Roth contributions and Roth catch-up contributions, you pay taxes on the contributions but withdrawals are tax-free.

NVIDIA Match

NVIDIA matches 100% on your first $6,000 of contributions in 2025. Then, NVIDIA matches 50% on your next $11,000 of contributions in 2025. The maximum match is $11,500 in 2025. You must contribute $17,000 to receive your full match.

NVIDIA matches vest immediately.

NVIDIA Match Examples

Employee Contributes 2% of Salary

Based on a $350,000 salary, you contribute 2% of your salary or $7,000. NVIDIA will match your first $6,000 of contributions with $6,000 and your next $1,000 of contributions with $500, for a total of $6,500.

Employee Contributes 6% of Salary

Based on a $350,000 salary, you contribute 6% of your salary or $21,000. NVIDIA will match your first $6,000 of contributions with $6,000 and your next $15,000 of contributions with $5,500, for a total of $11,500, subject to the $11,500 maximum match.

Mega Backdoor Roth

In addition to your pre-tax and Roth contributions and the NVIDIA match, you can utilize a Mega Backdoor Roth. You can contribute after-tax to your 401(k) up to the limit of all employee and employer contributions, then convert those after-tax contributions to a Roth IRA or Roth 401(k).

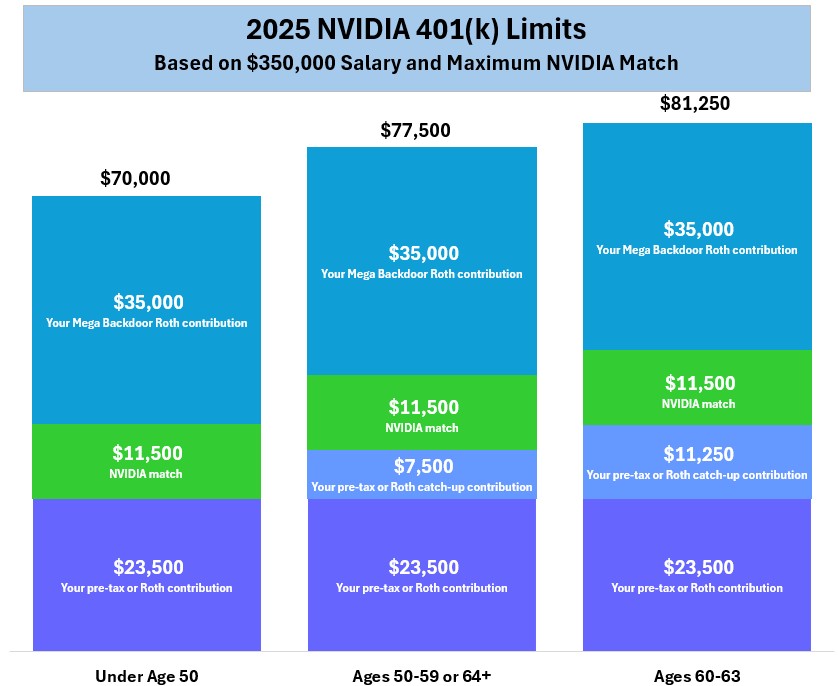

2025 Contribution Limits for All Employee and Employer Contributions

| Under age 50 | $70,000 |

| Ages 50-59 or 64+ | $77,500 |

| Ages 60-63 | $81,250 |

Mega Backdoor Roth Examples

Employee Under the Age of 50

Based on a $350,000 salary, you can generate $70,000 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your NVIDIA match, you can contribute $35,000 after taxes.

| Your pre-tax or Roth contributions | $23,500 |

| NVIDIA match | $11,500 |

| Your Mega Backdoor Roth contributions | $35,000 |

| Total | $70,000 |

Employee Age 50-59 or 64+

Based on a $350,000 salary, you can generate $77,500 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your NVIDIA match, you can contribute $35,000 after taxes.

| Your pre-tax or Roth contributions | $23,500 |

| Your pre-tax or Roth catch-up contributions | $7,500 |

| NVIDIA match | $11,500 |

| Your Mega Backdoor Roth contributions | $35,000 |

| Total | $77,500 |

Employee Age 60-63

Based on a $350,000 salary, you can generate $81,250 in 401(k) contributions. In addition to your pre-tax or Roth contributions and your NVIDIA match, you can contribute $35,000 after taxes.

| Your pre-tax or Roth contributions | $23,500 |

| Your pre-tax or Roth catch-up contributions | $11,250 |

| NVIDIA match | $11,500 |

| Your Mega Backdoor Roth contributions | $35,000 |

| Total | $81,250 |