Pre-tax Versus Roth Employer Contributions to Retirement Accounts – Which Is Better? – Part 2

Money Matters – Skloff Financial Group Question of the Month – August 1, 2023

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘Pre-tax Versus Roth Employer Contributions to Retirement Accounts – Which Is Better?’ Part 1. Can you give us examples of contributions today versus withdrawals in the future?

The Problem – Tax-free Roth Employer Withdrawals Always Sound Better Than Taxable Withdrawals on the Surface

Even if you receive a tax benefit today through pre-tax employer contributions, you are simply creating an even larger future tax upon withdrawal – right? Tax-free employer withdrawals just inherently seem better on the surface. Like an audience member at a magic show, don’t let the magician trick you into seeing what you want to believe versus reality.

The Solution – A Side by Side Comparison of Employer Contributions Today and Withdrawals in the Future

Accounting for taxes today and in the future reveals how a future tax obligation may be more than offset by a tax benefit today.

Have Your 401(k), 403(b), 457(b) Account Professionally Managed

Current Income Tax Bracket of 30% and Future Income Tax Bracket of 20% Example

Pre-Tax Employer Contributions: All of Your Employer Contributions are Invested. Pre-tax employer contributions defer federal and state income taxes. For example: If you are in the 30% combined federal and state marginal income tax brackets, every $1.00 of pre-tax contributions defers $0.30 of taxes, or 30%.

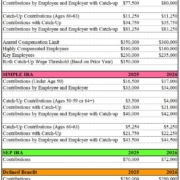

If your employer contributes $10,000 to your 401(k), 403(b) or 457(b) plan, the full $10,000 is contributed because the taxes are deferred. If your employer’s contribution is invested and grows at 7% per year, after 40 years it will be worth $149,745. If you will be in the 20% combined federal and state marginal income tax brackets when you take employer withdrawals in retirement, every $1.00 of pre-tax withdrawals will be only be subject to $0.20 of taxes, or 20%. After taxes, your net withdrawal is $119,796. See below.

Roth Employer Contributions: Only Your Employer Net of Tax Contributions are Invested. Roth employer contributions are subject to federal and state income taxes. For example: If you are in the 30% combined federal and state marginal income tax brackets, every $1.00 of gross employer contributions is subject to $0.30 of taxes, or 30%. If your employer gross contributes $10,000 to your 401(k), 403(b) or 457(b) plan, only $7,000 is contributed because you pay taxes today. If your employer’s net contribution is invested and grows at 7% per year, after 40 years it will be worth $104,821. Since Roth employer withdrawals are tax free, your net withdrawal is $104,821. See below.

Current Income Tax Bracket of 20% and Future Income Tax Bracket of 30% Example

Pre-Tax Employer Contributions: All of Your Employer Contributions are Invested. Pre-tax employer contributions defer federal and state income taxes. For example: If you are in the 20% combined federal and state marginal income tax brackets, every $1.00 of pre-tax contributions defers $0.20 of taxes, or 20%. If your employer contributes $10,000 to your 401(k), 403(b) or 457(b) plan, the full $10,000 is contributed because the taxes are deferred. If your employer’s contribution is invested and grows at 7% per year, after 40 years it will be worth $149,745. If you will be in the 30% combined federal and state marginal income tax brackets when you take withdrawals in retirement, every $1.00 of pre-tax withdrawals will be subject to $0.30 of taxes, or 30%. After taxes, your net withdrawal is $104,821. See below.

Roth Employer Contributions: Only Your Employer Net of Tax Contributions are Invested. Roth employer contributions are subject to federal and state income taxes. For example: If you are in the 20% combined federal and state marginal income tax brackets, every $1.00 of gross employer contributions is subject to $0.20 of taxes, or 20%. If your employer gross contributes $10,000 to your 401(k), 403(b) or 457(b) plan, only $8,000 is contributed because you pay taxes today. If your employer’s net contribution is invested and grows at 7% per year, after 40 years it will be worth $119,796. Since Roth employer withdrawals are tax free, your net withdrawal is $119,796. See below.

Click to Enlarge

Action Steps

Defer taxes with pre-tax employer contributions if your current income tax rate is higher than your future income tax rate. Pay taxes today with Roth employer contributions if your future income tax rate is higher than your current income tax rate. Work closely with your Registered Investment Adviser (RIA) to reduce your taxes, and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Have Your 401(k), 403(b), 457(b) Account Professionally Managed