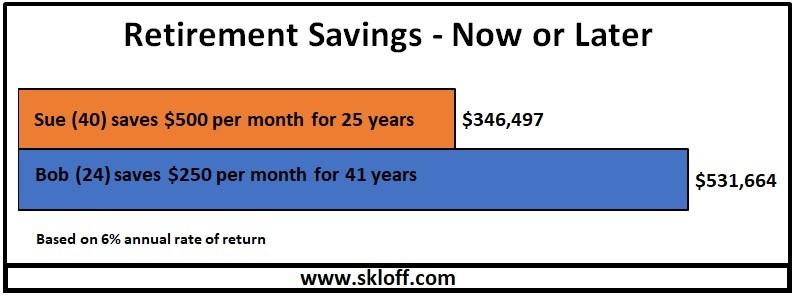

Retirement Savings – Now or Later

Click to Enlarge

Let’s look at an example of two retirement savers. Bob is 24 years old and chooses to invest $250 per month until he retires at the age of 65. At the age of 24, Sue decides to delay saving until she was 40 and would save $500 per month until she retired at the age of 65. Through the power of diligent savings and earning a 6% annual rate of return on a compound basis, both build respectable retirement savings accounts.

Despite Sue savings twice as much as Bob, Bob wins the retirement savings race with a $531,664 ending balance. Sue’s ending balance is $346,497. Bob gained the benefit of a slow and steady savings approach along with the power of his earnings compounded upon themselves for a longer period of time than Sue. He amassed over 53% greater savings than Sue when they each retired at 65.

Have Your 401(k), 403(b), 457(b) Account Professionally Managed