Savings After 25 Years

Money Matters – Skloff Financial Group Question of the Month – February 1, 2017

By Aaron Skloff, AIF, CFA, MBA

Q: Due to a modest salary, I do not have any savings and cannot save a large amount of money. Is it possible for my savings to grow to $1 million?

The Problem – $1 Million Savings Goal on a Modest Salary and No Existing Savings

Many savers aspire to have $1 million in savings. Aside from a big inheritance or investing in the early stages of the next Apple Computer, most savers will not achieve their aspirations without a steady savings plan.

The Solution – Steady Savings Plan with Compound Interest

There’s an old joke: How do you eat an elephant? One bite at a time of course! Applying the joke to your savings, can leave you laughing all the way to the bank, with $1 million or more.

Saving Steadily. One of the best ways to build savings ‘one bite at a time’ and save steadily is through automatic payroll deductions into your employer sponsored retirement plan (e.g.: 401(k) or 403(b)) or automatic electronic drafting from your checking account into your investment account; or both. Starting with even a small amount of savings reduces the amount of future savings needed to achieve the same goal. If you were to start out with no savings, but save $1,250 per month (or about $312 per week) over the course of 25 years, you would have $375,000 in savings. But, $375,000 is far less than $1 million. So, please read on.

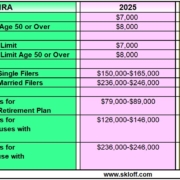

Compound Interest. Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t…pays it.” Compounding allows an investor to earn interest on interest. Applying compound interest (average annual return) to the same savings approach described above yields vastly superior results. Generally, you must accept a higher level of risk to earn a higher return. If you were to save $1,250 per month over the course of 25 years and earn an average annual 7% per year (a good balance of risk and return for many savers) on your investments, you would have over $1 million in savings. Please see the table below for this example and other combinations of monthly savings and average annual returns.

Click to Enlarge

Action Steps

Save steadily through an automated savings plan. Invest your savings in investments that are consistent with your risk tolerance level. Allow your interest and earnings to compound on themselves and reap the benefits of your money working for you.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.