Should I Stay or Should I Go? – Market Timing

Money Matters – Skloff Financial Group Question of the Month – September 1, 2020

By Aaron Skloff, AIF, CFA, MBA

Q: The stock market has increased so much in the last five years that I was thinking about selling all my stocks and mutual funds. What are they key considerations of such a change?

The Problem – Market Timing

The year was 1982. Tensions between the world’s nuclear powers, the Unites States of America (USA) and the Union of Soviet Socialist Republics (USSR), were escalating. There was a serious threat of a World War III. The S&P 500 Index (an index that represents the U.S. stock market) declined by 9.7% (negative 4.9% total return with dividends reinvested). And radio stations around the world were playing one of the greatest songs from one of the greatest rock bands, ‘Should I Stay or Should I Go’ by The Clash. Looking at the stock market, many investors were asking themselves if they should stay or go. They were thinking about timing the market. Today, investors are asking themselves the same question.

Are You Interested in Learning More?

The Solution — Slow and Steady Wins the Race

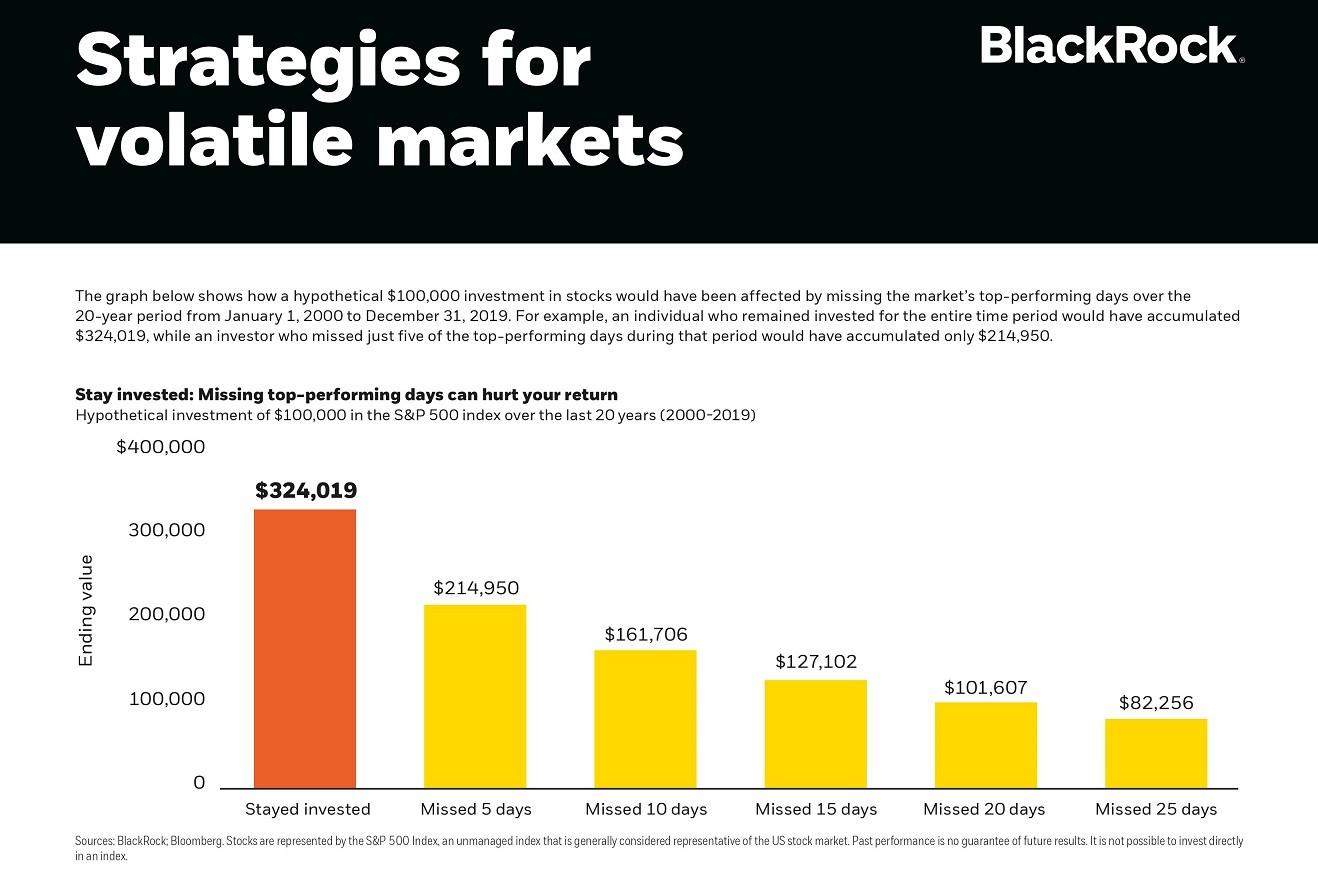

Remember the story of the tortoise that finished first in a race against the hare? Investing in the stock market can be very advantageous for the slow and steady investor and very disadvantageous for the erratic investor. Let’s look at an example of two investors, Logan and Madison. At the beginning of 2000, Logan invested $100,000 in a fund that replicated the S&P 500 Index and maintained his investment until the end of 2019. He maintained his investment even though the S&P 500 Index delivered three sequential years of negative returns during the first three years of his investment period: -9.1% in 2000, -11.9% in 2001 and -22.1% in 2002. Over those 20 years, Logan’s $100,000 generated a compound annual return of 6.1% – leaving him with $324,019. Although Madison invested the same amount at the same time in the same fund, she moved money in and out of the market as she became fearful during periods of market volatility. By missing the best 25 days, Madison’s $100,000 generated a compound annual return of-1.0% – leaving her with only $82,256. Simply remaining invested for the best 25 days left Logan four times wealthier than Madison.

If you can only remember one thing from this article, here it is: Timing the stock market over the long term is a fool’s game.

Click to Enlarge

What about the Average Investor? According to the 2020 DALBAR Quantitative Analysis of Investor Behavior, the average equity fund investor generated a compound annual return of 4.3% versus 6.1% for the S&P 500 Index, for the 20-year period ending 2019. The gap between the S&P 500 Index’s 31.5% return and the average equity fund investor’s return of 26.1% in 2019 is even more startling. The average fixed income fund investor also underperformed the Bloomberg Barclays Aggregate Bond Index (an index that represents the U.S. bond market). The average fixed income fund investor generated a compound annual return of 0.5% versus 5.0% for the Bloomberg Barclays Aggregate Bond Index. The gap between the Bloomberg Barclays Aggregate Bond Index’s 8.7% return and the average fixed income fund investor’s return of 4.6% in 2019 is even more startling. Investors tend to sell after experiencing a paper loss and start investing only after the markets have recovered their value.

A Historical Perspective. During the world’s most devastating events the stock market, as measured by the S&P 500 Index, declined meaningfully. More importantly, it has always rebounded. For example, a $1,000 investment in the S&P 500 Index during the Great Depression would have been worth $2,000 10 years later. For another example, a $1,000 investment in the same index on the day of the 1987 stock market crash would have been worth over $5,600 10 years later. Astute investors see times of turmoil as opportunities.

The Rollercoaster Effect. One of the biggest mistakes you can make is letting your emotions impact your investment decisions. It is just too easy to get caught up in the euphoria when everything is going up and everyone seems to be getting rich. But, buying at the top of the market when stocks are selling at premium valuations or selling after prices have already discounted weak results is a recipe for disaster. For many investors, investing in the stock market feels like a rollercoaster ride. When the rollercoaster (stock market) is climbing they feel confident. Right at the peak of the incline, before they can see the decline, they feel euphoric. This is the time when many investors are drawn into the market, only to be disappointed. As the decline begins investors become nervous, then desperate. Right at the trough, before they can see the next incline, they feel defeated and bail out of the market. Of course, they mis the next incline.

Action Steps – Stay Invested

Timing the entries and exits of the stock market is a fool’s game. Maintaining a long term investment horizon and slow and steady investment approach is a recipe for success. Stay invested and reap the rewards.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.