Tag Archive for: Tax Planning

Does Your State Tax Pre-Tax Contributions to Retirement Accounts? – Part 1

Money Matters - Skloff Financial Group Question of the Month…

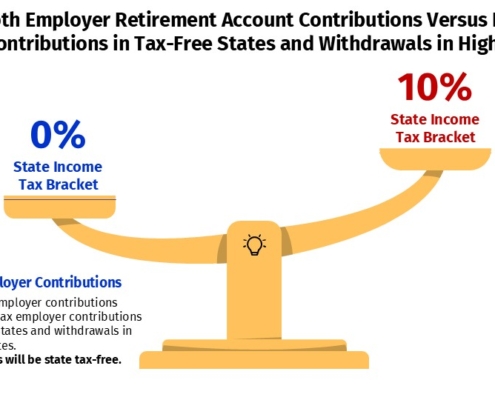

Take Roth Employer Retirement Account Contributions Versus Pre-Tax Employer Contributions in Tax-Free States and Withdrawals in High Tax States

Click to Enlarge

Take Roth Employer Retirement Account Contributions…

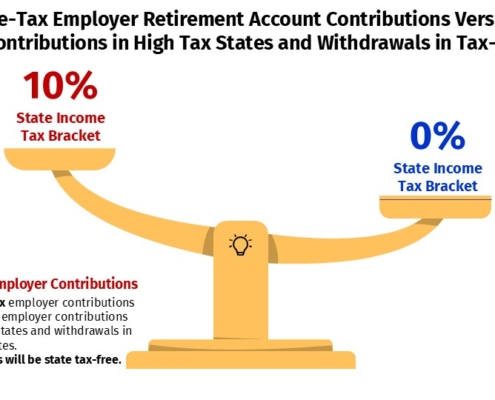

Take Pre-Tax Employer Retirement Account Contributions Versus Roth Employer Contributions in High Tax States and Withdrawals in Tax-Free States

Click to Enlarge

Take Pre-Tax Employer Retirement Account…

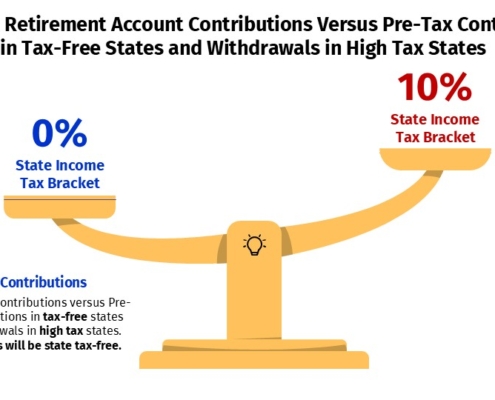

Make Roth Retirement Account Contributions Versus Pre-Tax Contributions in Tax-Free States and Withdrawals in High Tax States

Click to Enlarge

Make Roth Retirement Account Contributions…

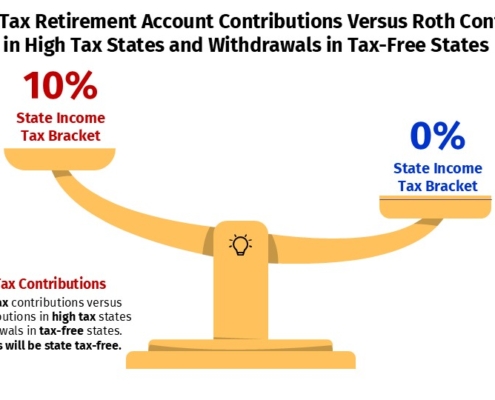

Make Pre-Tax Retirement Account Contributions Versus Roth Contributions in High Tax States and Withdrawals in Tax-Free States

Click to Enlarge

Make Pre-Tax Retirement Account Contributions…

Ed Slott: The Case for Roth IRA Contributions – Morningstar

Ed Slott: The Case for Roth IRA Contributions

The tax and…

Ed Slott: Confronting RMD Confusion for Inherited IRAs – Morningstar

Ed Slott: Confronting RMD Confusion for Inherited IRAs

The…

Income Tax and Capital Gains Rates 2025 – Part 2

Money Matters - Skloff Financial Group Question of the Month…

Income Tax and Capital Gains Rates 2025 – Part 1

Money Matters - Skloff Financial Group Question of the Month…