Tax Benefits of Hybrid Life and Long Term Care Insurance Versus Hybrid Life Insurance with Care Riders 2024 – Part 4 – Long Term Care University

Long Term Care University – Question of the Month – 06/15/24

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read ‘Tax Benefits of Hybrid Life and Long Term Care Insurance Versus Hybrid Life Insurance with Care Riders 2024’ Part 1, and Part 2 and Part 3. Can you give examples of the tax benefits for employers, employees and individuals for policies with ongoing premiums?

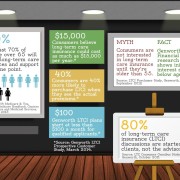

The Problem – Maze of Tax Benefits on Hybrid Life and Long Term Care Insurance Policies

Offering an attractive benefits package can be a key element in attracting and retaining the highest quality employees. While a single premium may be the best premium method in some circumstances, it may not be ideal in other circumstances.

The Solution – A Side by Side Comparison of Hybrid Life and Long Term Care Insurance Policies Tax Benefits

By examining policies on a side-by-side basis, we can see how the type of business, type of business owner, type of employee or paying as an individual can impact tax benefits of various policies. The table below examines Hybrid Life and Long Term Care Insurance (HLTC) policies with a base or acceleration (BoA) and a continuation or extension (CoE) for policies with clearly defined CoE premiums. Hybrid Life Insurance policies with Care Riders (HCR) do not offer tax advantages beyond receiving the benefits on tax free basis. With an ongoing premium (to age 95 or age 100), employers gain golden handcuffs to retain employees and gain ongoing tax benefits, as they pay lower ongoing premiums per year (versus single pay or 10-pay premiums). With ongoing premiums, individuals and owners of businesses that are not C Corporations can gain ongoing tax benefits – oftentimes, without foregoing tax benefits due to age-based limits.

Click Here for Your Long Term Care Insurance Quotes

Tax Benefits for Businesses, Business Owners, Employees and Individuals

Based on $5,000 ongoing annual premiums for Bill and Sue or $10,000 combined for Bill and Sue for shared policies, the CoE portion of the premium can be expensed by businesses, or deducted or paid from an HSA by individuals. See the chart below.

With Nationwide Care Matters II, C corporations can expense $2,033 for Bill and $2,664 for Sue – even if Bill and Sue are owners. Other businesses can expense $1,760 for Bill and $1,760 for Sue if both are owners – for ages 51-60. Other businesses can expense $2,033 for Bill and $2,664 for Sue if both are owners – for ages 61-70 and for ages more than 70. Other businesses can expense $2,033 for Bill and $2,664 for Sue if neither are owners. If Bill and Sue purchased policies on their own, they can each deduct or pay from an HSA $1,760 – for ages 51-60. If Bill purchased a policy on his own, he can deduct or pay from an HSA $2,033 – for ages 51-60 and for ages more than 70. If Sue purchased a policy on her own, she can deduct or pay from an HSA $2,664 – for ages 51-60 and for ages more than 70.

With Nationwide CareMatters Together, C corporations can expense $7,346 combined for Bill and Sue – even if Bill and Sue are owners. Other businesses can expense $1,760 for Bill and $1,760 for Sue if both are owners – for ages 51-60. Other businesses can expense $3,673 for Bill and $3,673 for Sue if both are owners – for ages 61-70 and for ages more than 70. Other businesses can expense $7,346 combined for Bill and Sue if neither are owners. If Bill and Sue purchased a policy on their own, they can each deduct or pay from an HSA $1,760 – for ages 51-60. If Bill and Sue purchased a policy on their own, they can each deduct or pay from an HSA $3,673 – for ages 61-70 and for ages more than 70.

With OneAmerica State Life Asset Care with Inflation Protection, C corporations can expense $8,199 combined for Bill and Sue – even if Bill and Sue are owners. Other businesses can expense $1,760 for Bill and $1,760 for Sue if both are owners – for ages 51-60. Other businesses can expense $4,100 for Bill and 4,100 for Sue if both are owners – for ages 61-70 and for ages more than 70. Other businesses can expense $8,199 combined for Bill and Sue if neither are owners. If Bill and Sue purchased a policy on their own, they can each deduct or pay from an HSA $1,760 – for ages 51-60. If Bill and Sue purchased a policy on their own, they can each deduct or pay from an HSA $4,100 – for ages 61-70 and for ages more than 70.

With OneAmerica State Life Asset Care without Inflation Protection, C corporations can expense $5,803 combined for Bill and Sue – even if Bill and Sue are owners. Other businesses can expense $1,760 for Bill and $1,760 for Sue if both are owners – for ages 51-60. Other businesses can expense $2,902 for Bill and $2,902 for Sue if both are owners – for ages 61-70 and for ages more than 70. Other businesses can expense $5,803 combined for Bill and Sue if neither are owners. If Bill and Sue purchased a policy on their own, they can each deduct or pay from an HSA $1,760 – for ages 51-60. If Bill and Sue purchased a policy on their own, they can each deduct or pay from an HSA $2,902 – for ages 61-70 and for ages more than 70.

Click to Enlarge

Action Step – Offer Long Term Care Insurance as a Company Benefit to Employees and Take Advantage of Tax Benefits

Whether you are a sole proprietor, the benefits director of a mid sized LLC or the CEO of a multi-national corporation, implementing long term care insurance as an employee benefit can have tremendous qualitative and quantitative benefits. Individuals can deduct premiums and pay premiums through an HSA. Request your insurance consultant provide you with quotations from multiple vendors before choosing a plan.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.