Top 10 Tax Tips Created by the New Tax Law – Part 1

Money Matters – Skloff Financial Group Question of the Month – September 1, 2025

By Aaron Skloff, AIF, CFA, MBA

Q: With the One Big Beautiful Bill (OBBB) signed into law, what are the top 10 tax tips created by the new law?

The Problem – Extracting Valuable Benefits from the New Tax Law

Extracting valuable tax planning benefits from 870 pages of a new tax law can seem like an insurmountable task.

The Solution – The Top 10 Tax Tips Created by the New Tax Law

Below are the top 10 financial and tax planning tips that can provide you with financial benefits and tax savings for years to come.

Are You Interested in Learning More?

1. Itemize State and Local taxes (SALT)

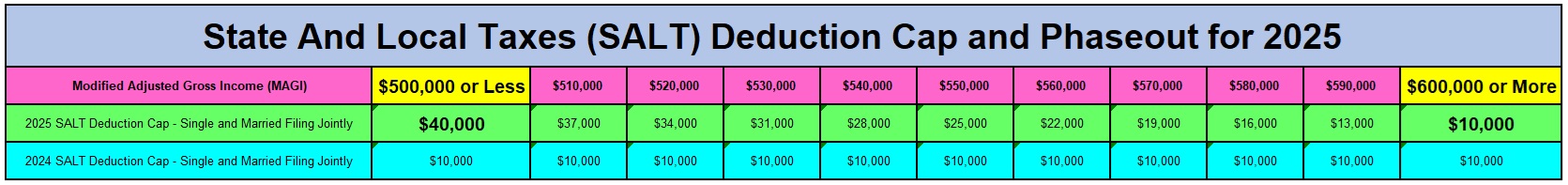

Prior to the new law, the itemized deduction cap on state and local taxes (SALT) was $10,000. The new law brings the cap to $40,000 for those filing their taxes as single or married filing jointly. However, the cap is slashed as your modified adjusted gross income (MAGI) exceeds $500,000, a process known as an income based phaseout. With a 30% phaseout rate, each $10,000 of income over $500,000 reduces your deduction by $3,000. When your MAGI reaches $600,000, the cap is slashed to the previous $10,000 cap. See the table below.

Click to Enlarge

The new SALT deduction applies to 2025-2029 and includes a 1% increase each year. Beginning in 2030, the SALT cap will be slashed to $10,000. See the table below.

Click to Enlarge

Strategy. Instead of opting for the standard deduction, assess whether itemizing with the new SALT deduction will reduce your taxes. Aggregating other itemized deductions and prepaying assessed taxes, such as property taxes, can maximize your tax savings.

2. Optimize Income Tax Brackets

Prior to the new tax law, the income tax brackets were scheduled to increase in 2026, with a top bracket of 39.6%. The new tax law makes the current 10%, 12%, 22%, 24%, 32%, 35%, and 37% tax brackets permanent.

Strategy. Instead of accelerating income into 2025 to avoid higher tax brackets formerly anticipated in 2026, smooth out your income to optimize your tax brackets.

3. Earn More Overtime Income

Prior to the new law, overtime income did not have its own deduction. The new law creates a deduction for qualified overtime of up to $12,500 for single filers and up to $25,000 for those married and filing jointly. Overtime is the portion of income that is above your normal wage. For example: if your normal hourly wage is $30 and your hourly overtime wage is $45, only the incremental $15 is qualified overtime income. The deduction begins phasing out as your MAGI exceeds $150,000 for single filers and $300,000 for those married filing jointly, and is phased out at $275,000 and $550,000, respectively. Each $1,000 above $150,000 or $300,000, respectively, reduces your deduction by $100. The new overtime deduction applies to 2025-2028.

Strategy. Instead of using all of your overtime in one year and losing some or all of your deduction, spread out your overtime over two years to gain more or all of your deduction.

Action Steps

Work closely with your Registered Investment Adviser (RIA) to reduce your taxes and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.