Traditional Versus Hybrid Life and Long Term Care Insurance – Long Term Care University

Long Term Care University – Question of the Month – 06/15/23

By Aaron Skloff, AIF, CFA, MBA

Q: What are the advantages of a Hybrid Life and Long Term Care insurance policy versus a Traditional Long Term Care insurance policy, and vice versa?

The Problem – Comparing Apples and Oranges

What happens to all those premiums you pay for a Long Term Care (LTC) Insurance policy if you pass away and never use the policy? The same thing that happens to all those premiums you pay for a homeowners or major medical health insurance policy if you pass away and never use the policy – the insurance company keeps them, and you are happy you never had a claim. But, simply having peace of mind over the life of your policy may not be good enough for some consumers. You may feel like you are getting a better value if you definitely get something back from the insurance company. Fortunately, insurance companies give you two types of policies to choose between.

Click Here for Your Long Term Care Insurance Quotes

With a Traditional LTC Insurance policy, you pay each year until you receive care; at which point your premiums are waived. Just like a homeowners insurance policy, you may never have a claim and never receive anything back from the insurance company. With a Hybrid Life and LTC Insurance policy, you make a one-time payment or over a limited number of years. Hybrid policies provide long term care benefits if you need long term care, a death benefit if you die without needing LTC, or both if you need a limited amount of LTC. Due to their unique advantages, comparing the two types of policies is like comparing apples and oranges – as seen below.

The Solution – Understanding the Advantages of a Traditional Versus a Hybrid Life and Long Term Care Insurance Policy

Click to Enlarge

Numbers Speak Louder than Words. Let’s look at a husband and wife of average health that are each 55 years of age. They are comparing Hybrid and Traditional policies. Their goal is $11,000 per month, per person for LTC in 25 years at the age of 80. They can purchase 7 years of per person or Lifetime LTC per person on a Hybrid policy or 5 years of LTC per person on a Traditional policy.

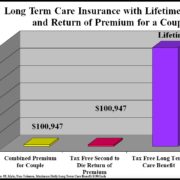

Hybrid Policy. Following a combined one-time premium payment of $171,580 they will have a combined $2,086,149 tax free available for LTC costs in 25 years at the age of 80. They also gain a combined $205,719 tax free death benefit. For each $1 of LTC benefits the policy pays the death benefit is reduced by $1. Or, following a combined one-time premium payment of $222,024 they will have a combined Lifetime, Unlimited tax free amount available for LTC costs in 25 years. They also gain a $366,667 tax free death benefit when the second person dies. For each $1 of LTC benefits the policy pays the death benefit is reduced by $1. See the chart below.

Traditional Policy. Following a combined annual premium payment of $7,700 they will have a combined $1,400,770 tax free available for LTC costs in 25 years at the age of 80. If their premiums never increase, they will have paid a combined $192,500 over the course of 25 years. There is no death benefit. See the chart below.

Click to Enlarge

Action Step – Compare and Contrast Before Purchasing Traditional or Hybrid Life and Long Term Care Insurance

Since Traditional and Hybrid Life and LTC Insurance policies pay for your LTC and protect your assets, purchase a policy that provides you the greatest advantages. Since premiums vary greatly based on age, health and marital status, request individualized quotes.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.