Understanding Insured Asset Conversion Trusts – 11/01/19

Money Matters – Skloff Financial Group Question of the Month – November 1, 2019

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Understanding Annuities article and the Understanding Single Premium Immediate Annuities (SPIAs) articles. Can we increase our after-tax return on our safe money, guarantee that income for our lifetimes, gain coverage for a chronic illness or long term care, then transfer the safe money completely tax-free to our heirs?

The Problem – Increasing After-tax Returns with Guaranteed Lifetime Cash Flows, While Keeping the Asset for Heirs

There is a scarcity of guaranteed high interest rate vehicles. SPIAs offer high cash flows, but do not return the full principal to heirs.

The Solution – Insured Asset Conversion Trusts (IACTs)

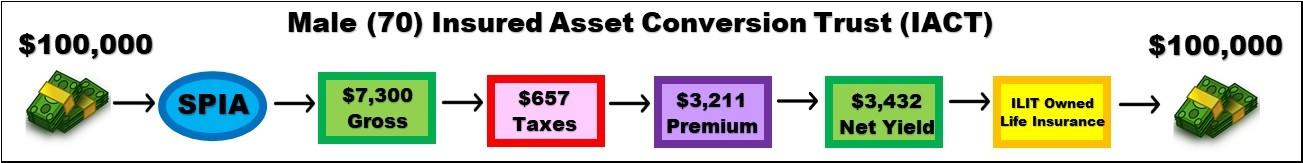

The Insured Asset Conversion Trust (IACT) is a combination of a single premium immediate annuity (SPIA) and a life insurance policy.

After the SPIA is funded, it provides a cash flow composed of principal and interest. The percentage of cash flow that is principal is called the exclusion ratio, and is paid on a tax-free basis. The higher your age, the higher the exclusion ratio. A portion of the after-tax cash flow then funds a life insurance policy. The life insurance benefit can equal the value of the SPIA (or can be even be higher) and can include a chronic illness or long term care benefit. Although the federal estate tax exemption is historically high, it is scheduled to drop after 2025 and have a 40% rate on nonexempt assets. To protect the life insurance benefits from estate taxes, the life insurance policy can be owned by an irrevocable life insurance trust (ILIT), exempting the benefits from estate taxes. The IACT has four effects: 1) increased after-tax yields on safe money, 2) guaranteed lifetime cash flows, 3) coverage for a chronic illness or long term care and 4) transferring assets tax-free to heirs.

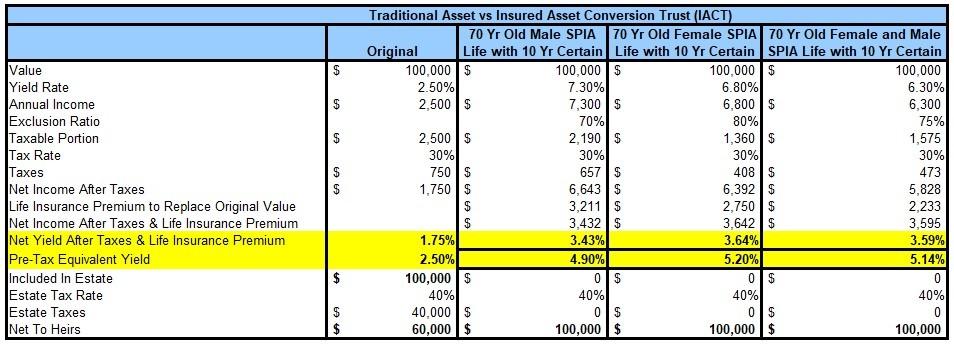

Numbers Speak Louder Than Words. Let’s look at four scenarios for Bill (70) and Sue (70), who are in the 30% tax bracket and are evaluating where to place $100,000 of their safe money. In scenario one, they could pay $100,000 for a vehicle yielding 2.50% before taxes and 1.75% after taxes, or $1,750 per year. When they die, the $100,000 could be subject to a 40% estate tax, leaving $60,000 for their heirs. In scenarios two, three and four, the life insurance is owned by an ILIT. In scenario two, Bill (70) could pay $100,000 for a SPIA life with 10 year certain, yielding 7.30% before taxes and 3.43% after taxes and life insurance premiums (4.90% pre-tax equivalent yield), or $3,432 per year. In scenario three, Sue (70) could pay $100,000 for a SPIA life with 10 year certain, yielding 6.80% before taxes and 3.64% after taxes and life insurance premiums (5.20% pre-tax equivalent yield), or $3,642 per year. In scenario three, Sue (70) and Bill (70) could pay a combined $100,000 for a SPIA life with 10 year certain, yielding 6.30% before taxes and 3.59% after taxes and life insurance premiums (5.14% pre-tax equivalent yield), or $3,595 per year. See the image and chart below.

Click to Enlarge

Click to Enlarge

Action Steps –Implement an IACT and Increase After-tax Returns with Guaranteed Lifetime Cash Flows and Keep Assets for Heirs

Increase your after-tax return on your safe money with a guaranteed lifetime cash flow, then a return of principal in the form of a tax-free life insurance benefit, using an IACT. Work closely with an experienced financial professional to understand and implement an IACT.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.