What Is the Best Age to Claim Survivor Social Security Benefits? – Part 2 – 10/01/22

Money Matters – Skloff Financial Group Question of the Month – October 1, 2022

By Aaron Skloff, AIF, CFA, MBA

Q: I read the article ‘What Is the Best Age to Claim Social Security Benefits?’ Part 1, Part 2 and ‘What Is the Best Age to Claim Spousal Social Security Benefits?’ and ‘What Is the Best Age to Claim Survivor Social Security Benefits?’ Part 1. Can you provide examples of what my survivor benefits would be under various scenarios?

The Problem – Determining When to Claim Survivor Social Security Benefits Versus Your Own Benefits

If you are a widow or widower (surviving spouse), you can claim your own benefits or survivor benefits. You can also claim your survivor benefits, then switch to your own benefit. Without examples, it is difficult to visualize the outcomes.

The Solution – The Best Age to Claim Survivor Social Security Benefits

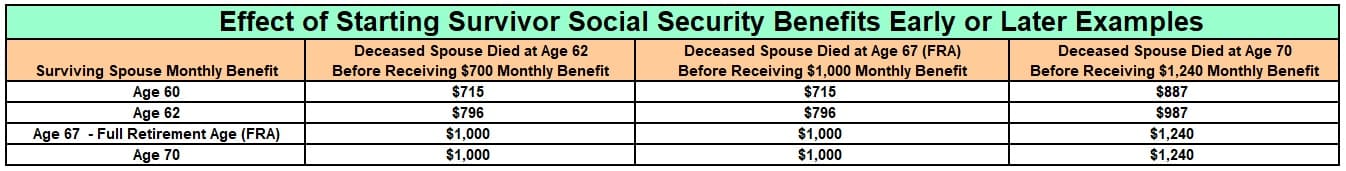

Let’s look at claiming survivor benefits for common scenarios. For simplicity, we apply full retirement age (FRA) of 67 for both spouses and set the deceased spouse’s FRA benefit at $1,000 per month, excluding cost-of-living adjustment (COLA). The first set of examples and table are scenarios where the deceased spouse claimed and received their own benefit before dying. The second set of examples and table are scenarios where the deceased spouse did not claim or receive their own benefit before dying.

Age 62 Survivor and Age 62 Deceased Spouse Who Claimed Benefits at Age 62. Your survivor benefit would be 79.6% of your deceased spouse’s FRA benefit, or $796 per month.

Age 67 Survivor and Age 62 Deceased Spouse Who Claimed Benefits at Age 62. Your survivor benefit would be the greater of your deceased spouse’s benefit or 82.5%, or $825 per month, of the deceased spouse’s FRA benefit; due to the Widow’s Limit or Retirement Insurance Benefit Limit (RIB-LIM).

Age 60 Survivor and Age 70 Deceased Spouse Who Claimed Benefits at Age 70. Your survivor benefit would be 71.5% of your deceased spouse’s benefit, equal to 124% of their FRA benefit, or $887 per month (124% X $1,000 = $1,240 X 71.5% = $887).

Click to Enlarge

Age 60 Survivor and Age 62 Deceased Spouse Who Did Not Claim Benefits. Your survivor benefit would be 71.5% of your deceased spouse’s FRA benefit, or $715 per month.

Age 67 Survivor and Age 67 Deceased Spouse Who Did Not Claim Benefits. Your survivor benefit would be 100% of your deceased spouse’s FRA benefit, or $1,000 per month.

Age 67 Survivor and Age 70 Deceased Spouse Who Did Not Claim Benefits. Your survivor benefit would be 100% of your deceased spouse’s benefit, equal to 124% of their FRA benefit, or $1,240 per month.

Click to Enlarge

Strategies. If you have your own high earnings history, start survivor benefits and delay your own benefits to age 70. Then, claim your own higher benefit. Your own benefits increase 8% per year each year you delay from 67 to 70. If your deceased spouse claimed benefits before their FRA, surviving spouse benefits are the greater of the deceased spouse’s benefit at death or 82.5% of the deceased spouse’s FRA benefit. In that scenario, if born after 1960, you maximize survivor benefits at age 62 years and 8 months.

Action Steps – Determine the Best Age to Claim Social Security Benefits Based on Your Wants and Needs

Work closely with your Registered Investment Adviser (RIA) to determine the best age to claim survivor Social Security benefits.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.