Year End Tax and Financial Planning for 2013 – Independent Press

The Independent Press

Money Matters – Skloff Financial Group Question of the Month – December 4, 2013

By Aaron Skloff, AIF, CFA, MBA

Q: With the end of the year quickly approaching, what are some important tax and financial planning measures we can take to reduce our taxes and improve our financial position?

A: The Problem – Year-End Financial Oversights and Mistakes

With so many gifts to purchase and holiday parties to attend, it is easy to forget important year-end tax and financial planning measures that can save you taxes or provide financial benefits for years to come.

The Solution — Take Action in the Before the End of the Year

Many tax and financial planning deadlines are based on a calendar cycle — complete them after Dec. 31 and lose the benefit for that year. Outlined below are some of the most common oversights and mistakes to avoid before the year comes to a close.

Are You Interested in Learning More?

Not Contributing to Your 401(k) or 403(b) and/or 457(b)

Not only do you build your retirement nest egg, but you also gain a tax break by contributing to your employer’s retirement plan.

Better yet, many employers will match your contributions. Unfortunately, there is a cap on contributions each year. For 2013, it is $17,500 for those under the age of 50 and $23,000 for those age 50 and over. Additional contributions can be made with the “lifetime catch-up” with a 403(b) and a “double-limit catch-up” with a 457(b). Once you maximize your contribution you cannot make additional contributions to make up for under-contributing in previous years.

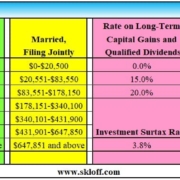

Not Timing Capital Gains and Losses

Capital gains and losses are classified as either short-term (less than one year) or long-term (more than one year). Long-term losses can only offset long-term gains, and vice versa. Selling investments, like stocks, bonds, or mutual funds you have held for more than one year generates a 0%, 15% or 20% capital gains tax rate (based on your income). Realizing a gain on investments held for less than one year could generate a 39.6% tax rate (based on your income). On top of the capital gains tax is a 3.8% investment surtax (based on your income). Review your portfolio to maximize your gains and losses and remember losses can be carried forward to future years. Do not forget your gains are reported on your New Jersey state income tax filing.

Leaving Money in Your Flexible Spending Account

Many employees take advantage of their employer provided Section 125 pre-tax flexible spending account. Unfortunately, many employees leave large balances in their accounts at year-end instead of spending them down. Balances in excess of $500 at the end of the year or balances not used within two and a half months of the next year (“grace period”) will be forfeited. Make sure you pay your child day care bill, your dentist’s root canal bill and your health insurance deductibles before Dec. 31.

Paying the Alternative Minimum Tax

Also known as AMT, the alternative minimum tax is running rampant in New York and New Jersey. Instead of prepaying your state income taxes and real estate taxes pay them when they are due. Instead of exercising your incentive stock options early exercise them when they are closer to their expiration date. Verify your municipal bonds and municipal bond funds holdings are exempt from AMT, as many are not exempt. Each of these measures could eliminate or mitigate your AMT exposure.

Forgetting to Take Your Required Minimum Distribution

Also know as RMD, required minimum distributions are necessary on traditional IRA accounts once you turn 70.5 years old (with certain exceptions) or if you inherit an IRA (with exceptions for spouses). If you have a 401k, 403b or 457b from a former employer and you are at least 70.5 years old, RMD applies as well. Forget to take your RMD and you can be subject to a 50% tax penalty.

Forgetting to Fund Your 529

For 2013, the maximum contribution per person, per beneficiary, to a 529 higher education savings plan is $14,000. There is a special five-year pull-forward rule, allowing you to contribute $70,000 in a single year, per owner, per beneficiary. Like a 401k, 403b or 457b, once you maximize your contribution you cannot make additional contributions to make up for undercontributing in previous years. Plan assets of up to $25,000 in the New Jersey 529 plan won’t be included in determining a beneficiary’s eligibility to receive financial aid awarded by the state of New Jersey. Funding your 529 also provides valuable estate planning benefits.

Action Steps — Reduce Your Taxes and Improve Your Financial Position

Do not leave money on the table, pay more taxes than you need to pay or fail to meet your goals of funding a college education or a comfortable retirement. Avoiding the oversights and mistakes listed above can reap benefits for years to come.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm based in Berkeley Heights. He can be contacted at www.skloff.com or 908-464-3060.