Minnesota Life SecureCare Combination Life and Long Term Care Insurance Review – Long Term Care University – 05/15/17

Long Term Care University – Question of the Month – 05/15/17

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Long Term Care University article that compares Traditional to Combination Life and Long Term Care (LTC) Insurance and prefer the Combination policy (or Hybrid). Can you please review the Minnesota Life SecureCare Combination Life and LTC policy?

Overview. Minnesota Life is part of Securian Financial Group, an A.M. Best A+ rated, 136-year-old company. The Minnesota Life SecureCare policy is a Combination Life and Long Term Care Insurance (also called hybrid or asset based) policy. With Traditional LTC policies, premiums can be increased and you may not receive any benefits if you do not need LTC. With Combination LTC policies the benefits and premiums are guaranteed. The insurance company either: 1) pays you if you need LTC, 2) pays your heirs if you do not need LTC, 3) pays you and your heirs if you need a modest amount of LTC or 4) pays you a refund if you cancel the policy.

Minnesota Life SecureCare is Unique Because it is a Traditional Indemnity Policy. There are three benefit payment methods among LTC policies. Reimbursement policies, the most common type of policies, require you to submit documentation of all expenses for reimbursement up to your monthly LTC benefits. Cash Indemnity policies pay up to your monthly LTC benefits if you need LTC. Traditional Indemnity policies pay up to your monthly LTC benefits if you show even $1 worth of LTC expenses, or documentation of informal care.

Click Here for Your Long Term Care Insurance Quotes

Minnesota Life SecureCare is Unique Because It Pays for Formal and Informal Care from Family and Friends. Most LTC polices prohibit informal care, particularly if the care is provided by a family member. The Minnesota Life SecureCare policy allows you to use formal care providers (home care agencies or facilities) and informal care providers, including family and friends. Since informal care providers can be much less costly, you can obtain significantly more care with a lower monthly benefit. This is very valuable for home care.

Minnesota Life SecureCare Policy Options. The policy options include: Benefit periods of 2-7 years; Inflation protection of none, 3% simple, 5% simple and 5% compound; Elimination period of 90 days; Residual life insurance benefit (even if you deplete of your LTC benefits) equal to the lesser of 10% of the face amount of insurance or $10,000 and a Return of premium vesting schedule 80% year 1, 84% year 2, 88% year 3, 92% year 4, 96% year 5, 100% year 6+.

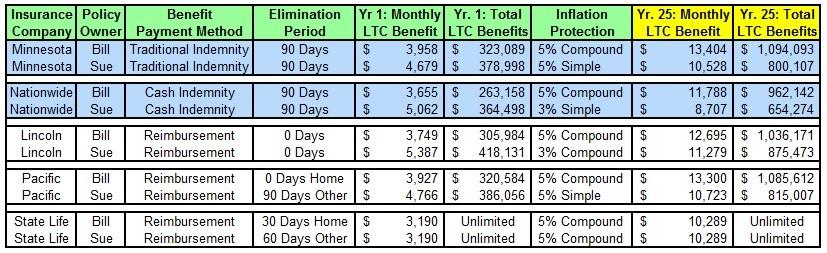

How Minnesota Life SecureCare Compares with Other Combination Life and LTC Policies. Let’s look at a husband and wife, Bill and Sue, who are each 55 years old and reside in New Jersey. They each pay a $100,000 one-time premium ($200,000 combined with State Life) and are expected to need LTC in 25 years at the age of 80. They are comparing Combination policies that offer the largest LTC benefits, with six years of LTC and inflation protection included in the premium. They prefer Indemnity policies (highlighted in blue in the chart below).

Minnesota Life Outperforms Indemnity based, Nationwide YourLife CareMatters – with Higher Monthly and Total LTC Benefits. Bill will have $13,404 monthly and $1,094,093 total LTC benefits, while Sue will have $10,528 and $800,107, respectively. Lincoln MoneyGuard II is a strong alternative due to its 0 day elimination period. Pacific PremierCare Advantage is notable for its 0 day home care elimination period, but still has 90 days for facility care. State Life Asset-Care I is a strong alternative due to its unlimited, lifetime total LTC benefits.

Click to Enlarge

Action Step – Purchase a Combination Life and Long Term Care Policy that Best Suits Your Needs

As prices vary between companies, review multiple quotes before purchasing a policy that best suits your needs.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.