Not All Hybrid-Combination Life And Long Term Care Insurance Policies Are The Same Part 2 – Long Term Care University – 05/15/19

Long Term Care University – Question of the Month – 05/15/19

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Long Term Care University article that compares Traditional to Combination Life and Long Term Care (LTC) Insurance and Not All Hybrid Combination Life And Long Term Care Insurance Policies Are The Same, and prefer the Hybrid-Combination LTC policy. If we paid for policies over 10 years instead of a single upfront payment, what benefits would we receive?

Overview. Hybrid-Combination LTC policies provide guaranteed benefits and guaranteed premiums. The insurance company either: 1) pays you if you need LTC, 2) pays your heirs if you do not need LTC, 3) pays you and your heirs if you need a modest amount of LTC or 4) pays you a refund if you cancel the policy.

Click Here for Your Long Term Care Insurance Quotes

The Problem – Not All Hybrid-Combination Life and Long Term Care Insurance Policies are the Same

There are a range of Hybrid-Combination LTC policies. With some policies your premiums are primarily paying for long term care benefits. With others you are primarily paying for life insurance. You can determine which type of policy you are purchasing based on the ratio of LTC to Life (long term care benefits divided by life insurance benefits). The higher the ratio, the more LTC benefits versus life insurance the policy provides. It is important to understand what your primary goal is, so you purchase the correct policy design.

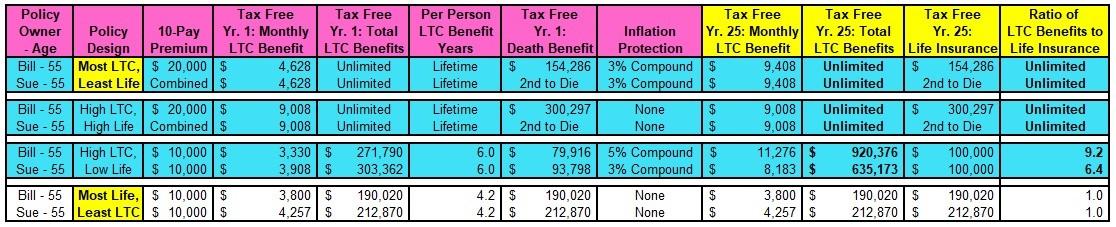

Let’s look at a husband and wife, Bill and Sue, who are each 55 years old and reside in New Jersey. They each pay $10,000 per year for 10 years (or $20,000 combined) and are expected to need LTC in 25 years at the age of 80. Their primary goal is to purchase a Hybrid-Combination LTC policy with very strong LTC benefits and secondarily a life insurance benefit if they do not need care. We review numerous designs based on age 80. The designs focused on LTC benefits are highlighted in blue in the chart below.

Most LTC, Least Life. Bill and Sue will each have $9,408 monthly and unlimited total LTC benefits or a $154,286 2nd to die life insurance benefit. As indicated by the unlimited ratio of LTC to life insurance, this design is primarily focused on LTC benefits.

High LTC, High Life. Bill and Sue will each have $9,008 monthly and unlimited total LTC benefits or a $300,297 2nd to die life insurance benefit. As indicated by the unlimited ratio of LTC to life insurance, this design is primarily focused on LTC benefits.

High LTC, Low Life. Bill will have $11,276 monthly and $920,376 total LTC benefits or a $100,00 life insurance benefit. Sue will have $8,183 monthly and $635,173 total LTC benefits or a $100,000 life insurance benefit. As indicated by Bill’s 9.2 and Sue’s 6.4 ratio of LTC to life insurance, this design is primarily focused on LTC benefits.

Most Life, Least LTC. Bill will have $3,800 monthly and $190,020 total LTC benefits or a $190,020 life insurance benefit. Sue will have $4,257 monthly and $212,870 total LTC benefits or a $212,870 life insurance benefit. As indicated by Bill’s 1.0 and Sue’s 1.0 ratio of LTC to life insurance, this design is primarily focused on life insurance benefits.

Click to Enlarge

The Solution – Purchase a Hybrid-Combination Life and Long Term Care Insurance Policy That Meets Your Primary Goal

As highlighted in blue above, Bill and Sue have three solutions that meet their primary goal of very strong LTC benefits and a life insurance benefit if they do not need care. The ratio of LTC benefits to life insurance benefits provides you a clear indication of what you are purchasing and what value are receiving. Thus, allowing you to purchase a policy that meets your primary goal.

Action Steps. Not all Hybrid-Combination LTC policies are the same. Some are focused on LTC, some are focused on life and some are more balanced between both. Since premiums vary greatly based on age, health and marital status, request individualized quotes.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.