Understanding Hybrid Annuities with Long Term Care – 11/01/19

Money Matters – Skloff Financial Group Question of the Month – November 1, 2019

By Aaron Skloff, AIF, CFA, MBA

Q: We read the Understanding Annuities article and the 1035 Tax-Free Exchange article. Can you please explain Hybrid Annuities with Long Term Care (LTC)?

The Problem – Paying for a Long Term Care with a Traditional Annuity Can be Taxing

According to the U.S. Department of Health and Human Services, 7 in 10 people over the age of 65 will require long term care (LTC). According to a Gallop survey, 73% of annuity owners intend to use their annuity as an emergency fund for a catastrophic illness or nursing home care. But, withdrawals of gains from traditional annuities are taxed as income. Based on a 25% income tax rate, withdrawing $100,000 of gains would leave only $75,000 to pay for LTC.

The Solution – Hybrid Annuities with Long Term Care that Pay Tax-Free Long Term Care Benefits

Many consumers purchase an annuity based on their existing and future needs. As those needs change, they realize their existing annuity is inadequate. With the exchange of an old traditional annuity to a new Hybrid Annuity and LTC, you can gain double, triple, quintuple or even unlimited the value of the original annuity for LTC costs. The Pension Protection Act (PPA) of 2006 added additional flexibility to the tax-free 1035 exchange of old annuities to new annuities. If the new annuity is a Hybrid Annuity with LTC policy and withdrawals are for LTC costs, all the gains from the original policy and the doubling, tripling, etc. of value are tax-free.

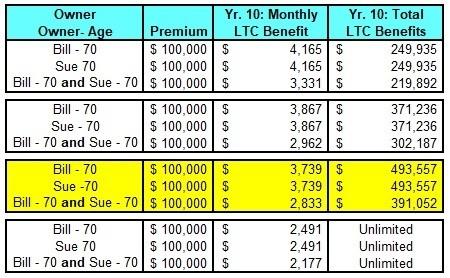

Numbers Speak Louder Than Words. Let’s look at examples for Bill (70) and Sue (70). Bill has his own annuity. Sue has her own annuity. They also own a joint annuity. While they paid $40,000 for each, the annuities have $60,000 of taxable gain and are each now valued at $100,000. They want to exchange the old annuities into new Hybrid Annuity with LTC policies that pay tax-free LTC benefits. They expect to need LTC in 10 years at the age of 80. See the image and chart below.

Bill and Sue can exchange each of their $100,000 individually owned traditional annuities to a new Hybrid Annuity with LTC paying monthly and total LTC benefits of: $4,165 and $249,935 or $3,867 and $371,236 or $3,739 and $493,557 or $2,491 and unlimited benefits. They choose $3,739 monthly and $493,557 total LTC benefits because it provides a strong combination of a highly monthly and total LTC benefits. The full $493,557 is tax free, providing almost five times the value of the original exchange.

Bill and Sue can exchange their $100,000 jointly owned traditional annuity to a new Hybrid Annuity with LTC paying monthly and total LTC benefits of: $3,331 and $219,892 or $2,962 and $302,187 or $2,833 and $391,052 or $2,177 and unlimited benefits. They choose $2,833 monthly and $391,052 total LTC benefits because it provides a strong combination of a highly monthly and total LTC benefits. The full $391,052 is tax free, providing almost four times the value of the original exchange.

Action Steps–Exchange Your Tradition Annuities to Hybrid LTC Annuities and Gain 5X Their Value in Tax-Free LTC Benefits

Complete tax-free exchanges of your taxable traditional taxable annuities into a Hybrid Annuities with LTC benefits and gain 5 X their value in tax-free LTC benefits. Work closely with an experienced financial professional to understand all the capabilities and limitations of Hybrid Annuities with Long Term Care benefits.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.