Safe Harbor 401(k) Plan – Independent Press – 09/02/09

The Independent Press

Money Matters – Skloff Financial Group Question of the Month – September 2, 2009

By Aaron Skloff, AIF, CFA, MBA

Q: My company is considering offering a Safe Harbor 401(k) plan. What is a Safe Harbor 401(k) plan, and how does it differ from a plain 401(k)?

A plain 401(k) will fail its annual compliance testing if officers with incomes of $160,000 or more, and key owners (owing 5% or more) are credited with more than 60% of the assets of the plan. With a Safe Harbor 401(k) plan, all employees can maximize contributions to the plan each year, even if lower paid employees do not contribute or contribute very little.

A Safe Harbor 401(k) requires the employer to match employee contributions in one of three ways:

Option 1: A dollar-for-dollar match on salary deferrals up to 3% of compensation and 50 cents on the dollar for deferrals between 3% and 5%.

Option 2: A dollar-for-dollar match on salary deferrals up to 4% of compensation.

Option 3: A minimum 3% nonelective contribution to all employees eligible to make elective deferrals to the plan.

Beyond the required matching, employers can add a profit sharing component to the plan to allow for additional contributions by the employer. Maximum tax-deductible employer contributions are limited to 25% of compensation on the first $245,000.

An employer offering a Safe Harbor 401(k) plan is providing an incentive for employees to contribute to their own retirement, through the form of a guaranteed match.

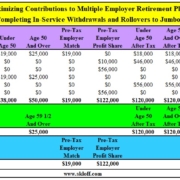

Employee contributions limits are the same in plain and Safe Harbor 401(k)s: $16,500 for those age under the age of 50 and $22,000 for those 50 and older.

Employers with 100 or fewer employees who start a retirement plan may be eligible for a tax credit. The credit equals 50% of the cost to set up and administer the plan and educate employees about the plan, up to a maximum of $500 per year for each of the first three years of the plan.

The deadline to establish a Safe Harbor 401(k) plan for 2009 is Oct. 1.

What action can an employee take? Encourage implementation of a Safe Harbor 401(k) Plan. Your company can reduce its administrative concerns and simultaneously provide a powerful benefit to all eligible employees.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.