Top 3 Most Most Frequently Asked Questions (FAQs) on Benefits and Denials – Long Term Care University – 01/15/12

Long Term Care University – Question of the Month – 01/15/12

Research

By Aaron Skloff, AIF, CFA, MBA

Q: How much long term care am I going to need? How many years of long term care insurance coverage do most people buy? When is the best time to apply for long term care insurance?

The Problem – Learning the Basics About Length of Care, Years of Coverage and When to Buy Long Term Care Insurance

According to the U.S. Department of Health and Human Services, almost seven out of ten people turning age 65 today will need long term care. The problem with researching long term care is learning the right questions to ask. With so many statistics to cipher through, it is easy to overlook some of the most important criteria.

The Solution – Learning the Answers to the Top 3 Questions About Length of Care, Years of Coverage and Application Denials

Click to Enlarge

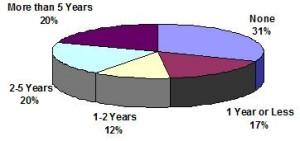

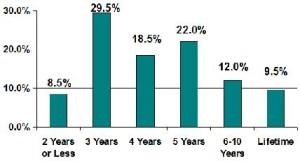

| Question 1. What is the estimated number of years needed for long term care services after the age of 65? Answer 1. According to the American Association for Long-Term Care Insurance, 69% of people will need long term care after the age of 65. The following chart provides an estimate of the number of years of long term care services needed after the age of 65. |

Click to Enlarge

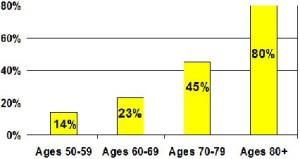

Click to Enlarge

Action Step – Utilize the Information Above When Designing Your Long Term Care Insurance Policy

Utilize the key statistics above when designing your long term care insurance policy and you will reduce the likelihood of under-insuring or over-insuring for your long term care needs.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a NJ based Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.