IRAs: Avoid Double Taxation on Withdrawals

Money Matters – Skloff Financial Group Question of the Month – August 1, 2016

By Aaron Skloff, AIF, CFA, MBA

Q: I have a number of Roth IRAs and Traditional IRAs. Are all my withdrawals subject to income taxes?

The Problem – Double Taxation on IRA Withdrawals

With a number of different Individual Retirement Accounts (IRAs), you may wind up paying the IRS taxes twice. All too often lax recordkeeping results in tax filing errors and unnecessary tax payments.

The Solution – Avoid Double Taxation on IRAs with Good Recordkeeping

Fortunately, the IRS makes avoiding double taxation on IRA withdrawals easy with IRS Form 8606. This form is your ‘secret weapon’ to track how much of your retirement assets the IRS cannot tax. It tracks your after tax contributions (cost basis) to your Traditional IRAs, so you and the IRS know these withdrawals are tax free – avoiding double taxation.

Are You Interested in Learning More?

Roth IRAs. As long as you are 59 ½ years of age or older and your first Roth IRA contribution was at least five years ago, withdrawals of both your principal and earnings are tax free.

Traditional IRAs with Pre-Tax Contributions. Some Traditional IRA owners have only pre-tax contributions in their IRAs due to 401(k) rollover, pre-tax contributions or both. As long as you are 59 ½ years of age or older, withdrawals of both your principal and earnings are subject to income taxes.

Traditional IRAs with After Tax Contributions without Earnings. Other Traditional IRA owners have only after tax contributions in their IRAs, due to income limits that prevent them from making pre-tax contributions or Roth IRA contributions. As long as you are 59 ½ years of age or older, withdrawals of your principal (as long as there are no earnings) are tax free.

Traditional IRAs with After Tax Contributions with Earnings. More practically, the after tax contributions would have generated earnings over time. To guarantee you don’t wind up paying taxes on both your principal and your earnings, keep track of your after tax contributions (principal) with IRS Form 8606.

Upon withdrawal the after tax contributions (cost basis) will be excluded from income taxes, while the earnings will be subject to income taxes. Thus, a pro-rata taxation on withdrawals. Let’s look at an example based on a $100,000 Traditional IRA, made up of $40,000 of after tax contributions and $60,000 of earnings. If you withdrawal the entire $100,000, $40,000 would be excluded from income taxes and $60,000 would be subject to income taxes. If you take a $5,000 partial withdrawal, such as a Required Minimum Distribution (RMD), $2,000 would be excluded from income taxes and $3,000 would be subject to income taxes.

Traditional IRAs with Pre-tax and After Tax Contributions. Upon withdrawal the after tax contributions (cost basis) will be excluded from income taxes, while the pre-tax contributions (and earnings) will be subject to income taxes. Thus, a pro-rata taxation on withdrawals. You cannot withdrawal only pre-tax or only after tax dollars – each withdrawal will be accounted as a combination of both.

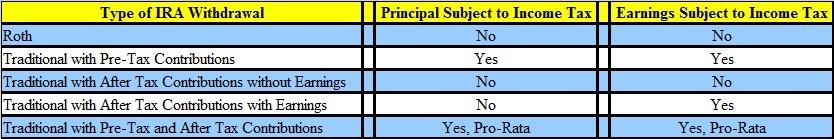

The following chart summarizes the four types of withdrawals and their tax implications.

Click to Enlarge

Action Steps – Avoid Double Taxation on IRAs with Good Recordkeeping

Maintain good records, using IRS Form 8606, to avoid double taxation (taxes on your costs basis) on IRA withdrawals.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Are You Interested in Learning More?