Is Another Crash Coming on the 90th Anniversary of the 1929 Stock Market Crash?

Money Matters – Skloff Financial Group Question of the Month – October 27, 2019

By Aaron Skloff, AIF, CFA, MBA

Q: This week is the 90th anniversary of the Stock Market Crash of 1929. Is another crash coming? Should we liquidate all our stocks?

The Problem – Fear of the 90th Anniversary of the Stock Market Crash of 1929 Dictating Another Stock Market Crash

Almost every day marks the anniversary of some event. Whether it’s a pleasant anniversary like winning the lottery or an unpleasant anniversary like the Stock Market Crash of 1929, it’s easy to assume an anniversary dictates the same outcome as the original event.

The Solution – The Only Thing We Have to Fear is Fear Itself

President Franklin D. Roosevelt said, “The only thing we have to fear is fear itself.” Stock market volatility is a function fear and greed that can quickly whipsaw the market up or down, creating fear along the way. That fear can turn investors into traders. While long term investors have made money over time, an estimated 90% of traders have lost money.

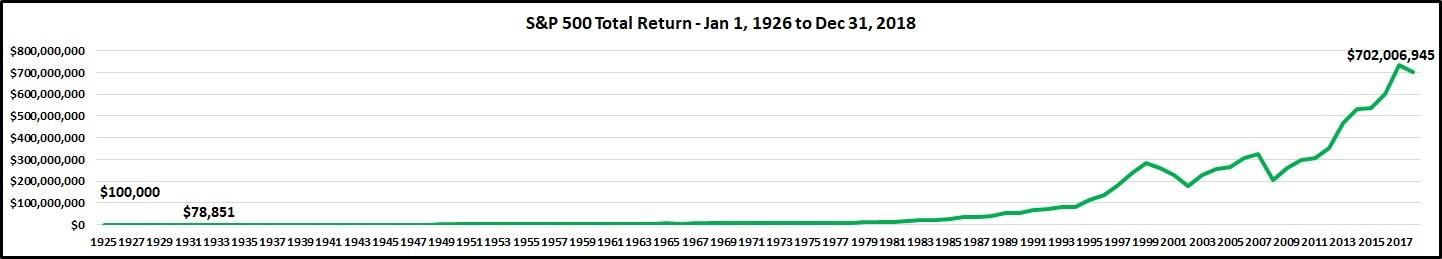

A Historical View of the Stock Market 1926-2018

The chart below shows how $100,000 invested in (a vehicle that replicated the performance of) the S&P 500 (index, with dividends reinvested) from Jan. 1, 1926 to Dec. 31, 2018 grew to $702,006,945. This period included the: Stock Market Crash of 1929, Great Depression, World War II, Korean War, Vietnam War, and Great Recession.

Click to Enlarge

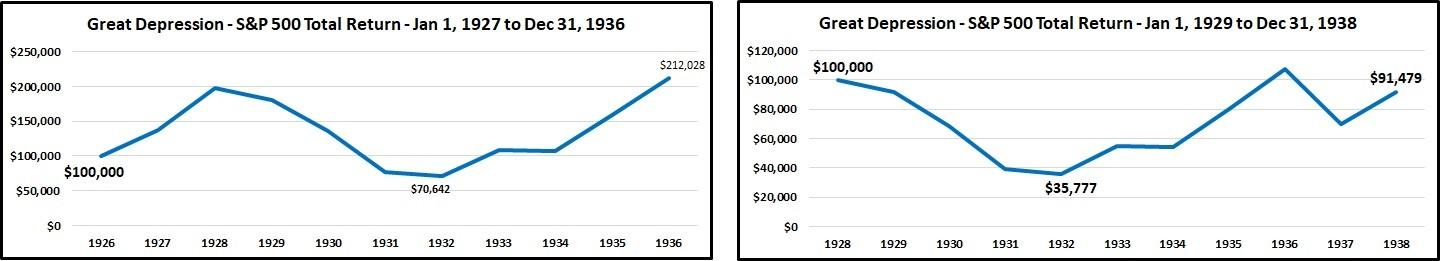

A Historical View of the Stock Market 1927-1936 and 1929-1938

The chart below shows how $100,000 invested in the S&P 500 from Jan. 1, 1927 to Dec. 31, 1936 grew to $212,028. It also shows how $100,000 invested in the S&P 500 from Jan. 1, 1929 to Dec. 31, 1938 shrunk to $91,479. Even investing at the beginning of the worst possible series of years, starting in 1929, the investment declined by 8.5%. These periods included unprecedented performance of the S&P 500: 1929 was -8.4%, 1930 was -24.9% 1931 was -43.3% and 1932 was -8.2%. This drove a $100,000 investment at the beginning of 1929 to $35,777 at the end of 1932, before roaring up to $91,479 at the end of 1938.

Click to Enlarge

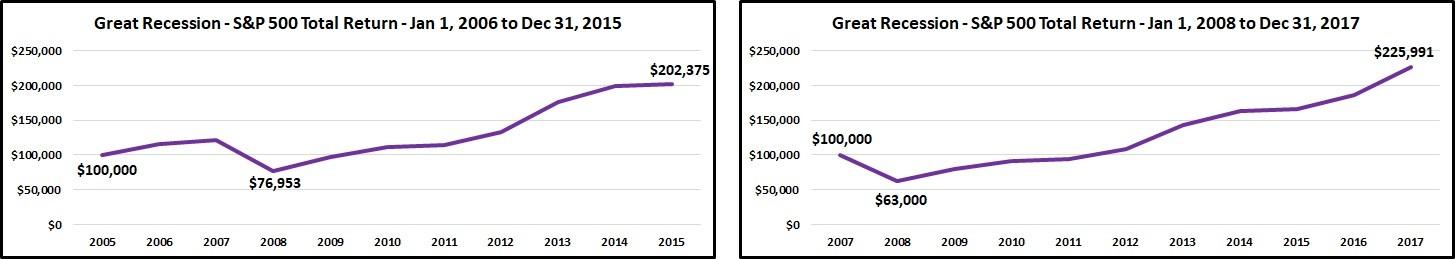

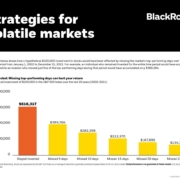

A Historical View of the Stock Market 2006-2015 and 2008-2017

The chart below shows how $100,000 invested in the S&P 500 from Jan. 1, 2006 to Dec. 31, 2015 grew to $202,375. It also shows how $100,000 invested the S&P 500 from Jan. 1, 2008 to Dec. 31, 2017 grew to $225,991. Even investing at the beginning of a terrible year, 2008, the investment grew by about 126%. These periods included the worst annual performance of the S&P 500, -37% in 2008, since 1931. This drove a $100,000 investment at the beginning of 2008 to $63,000 at the end of 2008, before roaring to $225,991 at the end of 2017.

Click to Enlarge

Action Steps – Be Patient – The Only Thing We Have to Fear is Fear Itself – Almost Every Day Marks the Anniversary of Some Event

Anniversaries do not dictate the same outcome as the original event. Be patient, as timing the market is a fool’s game. Work closely with a Registered Investment Adviser (RIA) to build and manage a portfolio that meets your long term return objectives and your tolerance for risk.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.