The Protected IRA Plus Plan – Part 1

Money Matters – Skloff Financial Group Question of the Month – June 1, 2020

By Aaron Skloff, AIF, CFA, MBA

Q: We read the articles ‘The SECURE Act Brings the Biggest Changes to IRAs Since Their Inception’ Part 1, Part 2 and Part 3. Can a Protected IRA Plus Plan (PIPP) provide more net income after taxes, protect our assets from financial market losses, gain protection against long term care expenses and return our assets to our beneficiaries on a tax-free basis?

A: The Problem — Optimizing Taxes after the SECURE Act

If you stretch withdrawals too long on large retirement accounts, you could increase your own tax brackets and your beneficiaries’ tax brackets. The higher your income (including withdrawals and Roth IRA conversions), the higher your: income tax bracket, capital gains rates and qualified dividends rates and probability you will be subject to the investment surtax. IRAs inherited after 12/31/19 must be withdrawn within a mere 10 years (spouses have an exception), potentially increasing beneficiaries’ tax brackets. An unexpected death or need for long term care, 7 in 10 people age 65 and older will need long term care, could force large withdrawals at high tax brackets.

The Solution – Implement a Protected IRA Plus Plan (PIPP) with the Goal of Maximizing Roth IRA Values

The Protected IRA Plus Plan (PIPP) can be customized for various goals. If the goal is to maximize Roth IRA values, than you accelerate Traditional IRA withdrawals by taking substantially equal periodic withdrawals before RMDs are required, completing Roth IRA conversions and purchasing life insurance with long term care (LTC) or chronic illness benefits (Hybrid Life and Long Term Care Insurance). If Roth IRA conversions are completed by age 71, RMDs that begin at age 72 can be avoided. Since RMDs cannot be converted to Roth IRAs, they get forced out of future tax free tax sheltering and tax free growth.

The insurance policy leverages premiums paid (ideally, not using IRA withdrawals) into significantly more tax free LTC benefits and/or a tax free death benefit, while protecting the value of the IRA from financial market losses. Since withdrawals from Inherited Roth IRAs are tax free, they can be delayed until the 10th year, maximizing their growth. The PIPP protects your assets from an unexpected death or need for LTC, creates more wealth, reduces (combined) taxes for you and your beneficiaries and maximizes Roth IRA values.

Numbers Speak Louder Than Words.

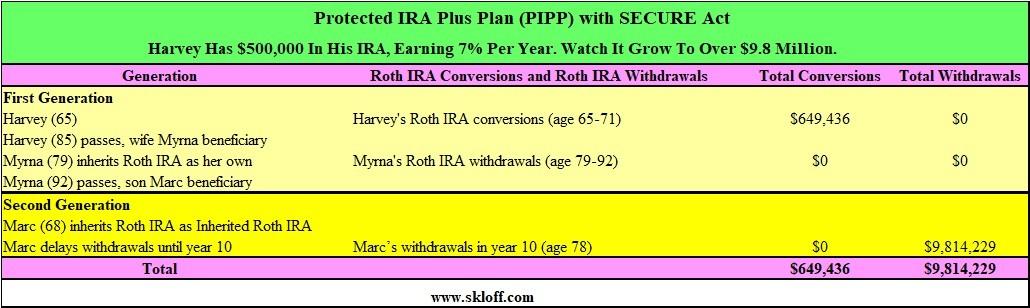

Let us look at an example of a married couple and their son. Harvey (age 65) has a $500,000 Traditional IRA growing at 7% per year and his wife Myrna (59) does not have any IRAs. If Harvey converts his Traditional IRA to a Roth IRA as a joint tax filer, they can: maintain a low income tax bracket of 12% on some income and 22% on some income, a capital gains and qualified dividends rate of 15% and avoid the 3.8% investment surtax. From the age of 65 to 71, Harvey can covert 100% of his Traditional IRA to a Roth IRA through seven Roth IRA conversions at $92,777 per year and pay $20,411 per year in taxes (from income he would have spent). To make the case even stronger, we assume 100% of the conversion is taxed at 22%, instead of a more realistic allocation of 12% for some and 22% for some. Harvey can protect his $500,000 asset from financial market losses, an unexpected death or need for LTC by paying $12,762 per year (from income he would have spent) from age 65 to 85 for a $500,000 Hybrid Life and LTC insurance policy.

When Harvey passes away at 85, Myrna (79) inherits the Roth IRA worth over $2 million as her own Roth IRA to avoid RMDs. When Myrna passes away at 92, her son Marc (68, in a 37% tax bracket) inherits the Roth IRA as an Inherited Roth IRA worth over $4.9 million. By delaying withdrawals until the last day of year 10, Marc can withdrawal over $9.8 million 100% tax free. See table below.

Click to Enlarge

Action Step — Work Closely with a Registered Investment Adviser (RIA) to Review Your Finances

Work closely with an RIA to review your estate, financial and tax plan to determine if you have the best strategies in place to build and protect your wealth. Implement the solutions described above based on your unique circumstances.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.