Pre-tax Versus Roth Employer Contributions to Retirement Accounts – Which Is Better? – Part 1

Money Matters – Skloff Financial Group Question of the Month – July 1, 2023

By Aaron Skloff, AIF, CFA, MBA

Q: We are evaluating whether to take pre-tax employer contributions or Roth employer contributions to our retirement accounts, including 401(k)s, 403(b)s, 457(b)s and IRAs. Which is a better choice for contributions and withdrawals?

The Problem – Determining if Pre-tax Employer Contributions or Roth Employer Contributions Are Better

Withdrawals of pre-tax retirement account employer contributions are subject to income taxes. Withdrawals of Roth employer retirement account contributions are tax free. Since tax free withdrawals are better than taxable withdrawals, Roth contributions must be the simple answer to the question – right? Not so fast.

Have Your 401(k), 403(b), 457(b) Account Professionally Managed

The Solution – Understanding the Advantages and Disadvantages of Pre-tax and Roth Employer Contributions and Withdrawals

Effective December 29, 2022, Section 604 of SECURE Act 2.0 allows employers to offer employees the option to receive employer contributions in the form of Roth contributions – including matching or profit sharing. Roth employer contributions are 100% vested by the employee upon contribution. Let’s examine the advantages and disadvantages of both types of contributions and withdrawals.

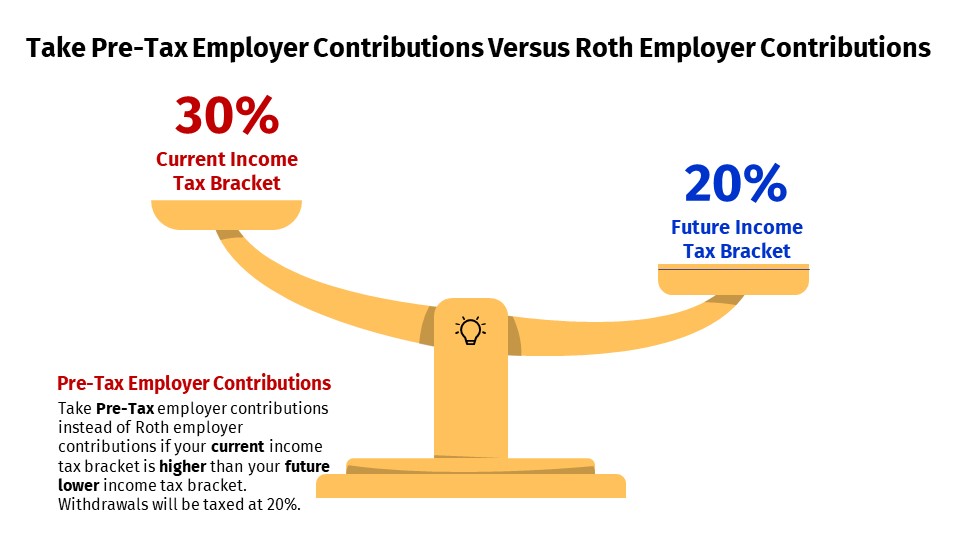

Pre-Tax Employer Contributions

Advantages. Pre-tax employer contributions defer federal and state income taxes. For example: If you are in the 24% federal and 6% state marginal income tax brackets (MITB), every $1.00 of pre-tax contributions defers $0.30 of taxes, or 30%. Pre-tax contributions can reduce your taxable income and MITB. With a lower income you can qualify for a Roth IRA, realize capital gains at a 0% or 15% capital gains rate, etc.

Disadvantages. Pre-tax employer withdrawals are taxed at your marginal federal and state income tax brackets. A disadvantageous example: If you will be in the 32% federal and 8% state MITB when you take withdrawals in retirement, every $1.00 of pre-tax withdrawals will be subject to $0.40 of taxes, or 40%. A common example: If you will be in the 12% federal and 8% state MITB when you take withdrawals in retirement, every $1.00 of pre-tax withdrawals will be only be subject to $0.20 of taxes, or 20%.

Strategy. Take pre-tax employer contributions instead of Roth employer contributions if your current income tax bracket is higher than your future income tax bracket. Taking employer contributions at a 30% pre-tax rate and withdrawing at a 20% rate creates a 10% tax arbitrage.

Click to Enlarge

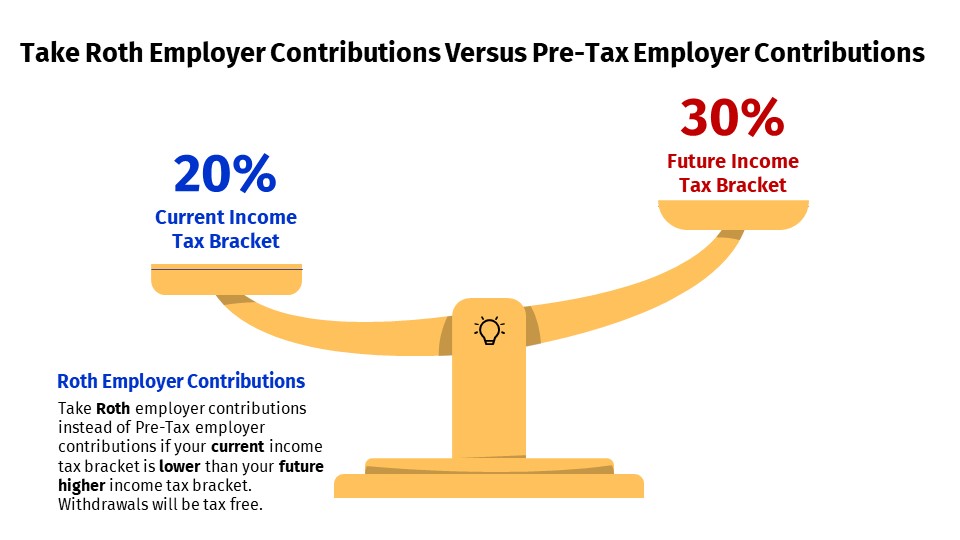

Roth Employer Contributions

Advantages. Roth employer contributions are subject to federal and state income taxes. For example: If you are in the 12% federal and 8% state MITB, every $1.00 of Roth contributions is subject to $0.20 of taxes, or 20%. Lower income earners, such as younger employees, can utilize their full ‘low’ MITB as an arbitrage to a higher income tax bracket on withdrawals in retirement.

Disadvantages. Roth employer withdrawals are tax free. A disadvantageous example: If you will be in the 10% federal and 5% state MITB when you take withdrawals in retirement, every $1.00 of Roth withdrawals will only avoid only $0.15 of taxes, or 15%. A common example: If you will be in the 22% federal and 8% state MITB when you take withdrawals in retirement, every $1.00 of Roth withdrawals will avoid $0.30 of taxes, or 30%. Unlike Roth IRAs, RMDs from an employer retirement plan are required for Roth accounts until tax year 2024.

Strategy. Take Roth employer contributions instead of pre-tax employer contributions if your current income tax bracket is lower than your future income bracket. Taking contributions at a 20% after tax rate and withdrawing, while avoiding a 30% rate creates a 10% tax arbitrage.

Click to Enlarge

Action Steps

Realize tax arbitrage by deferring taxes with pre-tax contributions if your current income tax rate is higher than your future income tax rate.

Realize tax arbitrage by paying taxes today with Roth contributions if your future income tax rate is higher than your current income tax rate.

Work closely with your Registered Investment Adviser (RIA) to reduce your taxes, and grow and preserve your wealth.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.

Have Your 401(k), 403(b), 457(b) Account Professionally Managed