AARP Long Term Care Insurance – Long Term Care University – 09/15/16

Long Term Care University – Question of the Month – 09/15/16

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We are looking into a Long Term Care Insurance policy offered by AARP. Do they offer a competitively priced policy? Is it worth shopping around?

The Problem – Relying on an Exclusive Provider

AARP is a nonprofit, nonpartisan, social welfare organization with nearly 38 million members. AARP has been advocating Long Term Care Insurance (LTCI) over the last two decades. In 2016, they introduced an exclusive agreement with an outside insurance company to offer LTCI. In the same year they published an article titled, “Understanding Long-Term Care Insurance”. The article recommends readers to “Shop around. Premiums can vary a lot, even for similar coverage, so if you’re looking for an individual policy for yourself or for you and your spouse (buying together can reduce premiums), compare information and estimates from at least three carriers.”

The Solution – Shop Around and Compare Estimates From at Least Three Carriers

While the exclusive insurance company AARP has an agreement with may be the best solution based on your needs and health, one of the best ways to know for sure is to shop around and compare estimates from at least three carriers. An independent agent that offers multiple insurance carriers can compare each company’s price, strengths and unique underwriting guidelines.

Each Insurance company Has Its Own Underwriting Guidelines. Although your LTCI application may be denied at one company, it may be approved at another company. Each company has unique underwriting guidelines. While some insurance companies will outright deny every applicant with Type 1 diabetes, other companies will approve the same applicant. While some insurance companies will deny an applicant in good health with a large body build, other insurance companies will approve the same applicant.

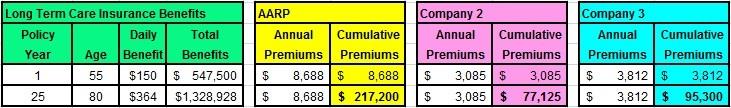

Numbers Speak Louder than Words. Let’s look at a husband and wife that are each 55 years of age and are likely to need care in 25 years at the age of 80. They are comparing the AARP policy to policies from two other carriers. Each policy pays $150 per pay for long term care services, for a minimum of five years, with 3% compound inflation protection. The chart below summarizes their combined benefits and combined premiums now and in 25 years. Clearly, AARP’s offering is priced significantly higher than either Company 2 or Company 3.

Click to Enlarge

Action Step – Shop Around and Compare Estimates From at Least Three Carriers

Taking AARP’s own advice turned out to be very valuable. Policies from two other companies were priced significantly lower than the carrier AARP exclusively recommends. It sure pays to shop around and compare. Contact an experienced independent agent that can offer multiple companies and find the best companies based on your needs and health.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.