Are Indexed Universal Life (IUL) Insurance Policies as Good as They Sound? – Part 3

Money Matters – Skloff Financial Group Question of the Month – August 1, 2020

By Aaron Skloff, AIF, CFA, MBA

Q: We read the articles ‘Are Indexed Universal Life Insurance Policies as Good as They Sound?’ Part 1 and Part 2. Can Indexed Universal Life (IUL) Insurance Policies be designed to maximize tax-free disbursements?

The Problem – Maximizing the Tax-Free Disbursements on Indexed Universal Life (IUL) Insurance Policies

Indexed Universal Life (IUL) insurance policies must be customized to maximize tax-free disbursements.

Click Here for Your Life Insurance Quotes

The Solution – Customizing Indexed Universal Life (IUL) Insurance Policies to Maximize Tax-Free Disbursements

IUL insurance policies can be customized for various goals. If the goal is to maximize tax-free disbursements, you can contribute to the policy beyond the premium for the tax-free death benefit. Those additional contributions are added to the cash value of the policy. The cash value increases with the indexed interest rate (credit rate), net of costs and charges, and can cover premiums and charges. You can then receive tax-free disbursements from the cash value of a policy through policy loans. While loans and interest on loans do not have to be paid back, they are deducted from the tax-free death benefit paid to beneficiaries. Many call the process of borrowing against your own policy’s cash value, which is really a loan from the insurance company, “Bank on Yourself”.

Positive or Negative Arbitrage on Loans. The interest rate (credit) you earn on a loan and the interest rate you pay on a loan can have a large impact on the cash value of your policy. If you earn an interest rate that is higher than the loan rate, you realize positive arbitrage. If you earn an interest rate that is lower than the loan rate, you realize negative arbitrage.

Types of Loans. The type of loan your policy offers and the type you select can have a large impact on the cash value of your policy. With a fixed loan, the insurance company transfers the loan amount into a collateral account that earns a fixed interest rate that is usually equal to or less than the loan rate – creating zero or negative arbitrage. With an indexed loan, you pay more than a fixed loan, but you earn interest based on the indexed account or indexed loan account – creating the opportunity for positive arbitrage. With a variable loan, you pay more than a fixed loan, but you earn interest based on the indexed account – creating the opportunity for positive arbitrage. The variable interest rate you pay is often based on an interest rate index (e.g.: Moody’s Corporate Bond Yield) and is considered a higher risk and higher reward loan than other types of loans. Participating loans (vs. fixed loans) do not affect the performance of the indexed account because the insurance company does not require any segments that secure the loan to be transferred to the fixed account to collateralize the loan.

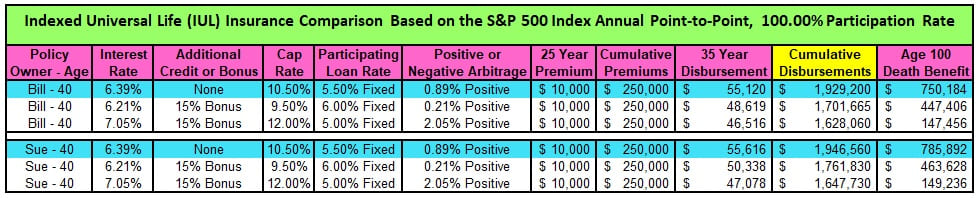

Numbers Speak Louder Than Words. Let’s look at a husband and wife, Bill and Sue, who are each 40 years old. They each pay $10,000 per year for 25 years for IUL insurance policies. Their goal is to maximize their tax-free distributions through age 99, while completing their premiums payments at age 64. The IUL policy they purchase is based on the annual point-to-point price increase in the S&P 500 Index, with a 6.39% interest rate, 100.00% participation rate, 10.50% cap and a 5.50% fixed participating loan rate – providing 0.89% positive arbitrage.

Bill will have $1,929,200 of cumulative tax-free distributions from age 65 to age 99 and a $750,184 tax-free death benefit at age 100, despite paying $250,000 in cumulative premiums (highlighted in blue in the chart below). Had Bill paid the same premiums for one of the other two IULs seen below he would have had $1,701,665 or $1,628,060, respectively – even though another IUL had higher positive arbitrage.

Sue will have $1,946,560 of cumulative tax-free distributions from age 65 to age 99 and a $785,892 tax-free death benefit at age100, despite paying $250,000 in cumulative premiums (highlighted in blue in the chart below). Had Sue paid the same premiums for one of the other two IULs seen below she would have had $1,761,830 or $1,647,730, respectively – even though another IUL had higher positive arbitrage.

Click to Enlarge

Action Steps – Customize Your Indexed Universal Life (IUL) Insurance Policy for Your Goals

Before purchasing an IUL insurance policy evaluate its: death benefit, underlying index, cap rate, participation rate, spread rate, bonuses, cost of insurance, charges, and cash flow capabilities in the form of policy withdrawals and loans. Work closely with an experienced financial professional to customize your IUL insurance policy for your goals.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm specializing in financial planning, investment management and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.