Combination Annuity and Long Term Care Insurance with Inflation Protection – Long Term Care University – 06/15/14

Long Term Care University – Question of the Month – 06/15/14

Research

By Aaron Skloff, AIF, CFA, MBA

Q: We read your first Long Term Care University article on Combination (or Hybrid) Annuity and Long Term Care insurance policies and decided to purchase a Combination policy. Can we purchase inflation protection on Combination (or Hybrid) Annuity and Long Term Care (LTC) insurance policies?

The Problem – Determining Whether or Not to Purchase Inflation Protection

Most insurance policies offer you the option to remove the inflation protection option from your policy when applying. Unfortunately, many consumers shortchange themselves when they either forgo the purchase of inflation protection or they purchase an inadequate level of inflation protection. A policy with adequate coverage today, with inadequate or no inflation protection, cannot keep pace with the 4%-5% compound price increases long term care service providers have been implementing.

The Solution – Purchasing Adequate Inflation Protection

Purchasing a LTC insurance policy with inflation protection increases the policy’s benefits each year and reduces the risk that an adequate level of coverage today will become inadequate in the future. Most insurance companies offer the option of 5% compound inflation protection of monthly and total benefits.

Numbers Speak Louder than Words. Let’s look at a husband and wife that are each 60 years old and are comparing a Combination Annuity and Long Term Care policy without inflation protection to one with 5% compound inflation protection.

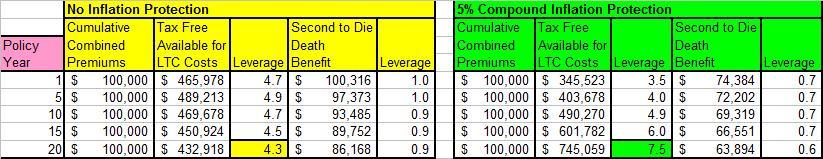

No Inflation Protection. As seen below, following a combined one time payment of $100,000 their Combination policy without inflation protection will immediately provide a combined $465,978 tax free pool of money available for LTC costs and a $100,316 second to die death benefit. That gives them 4.7 and 1.0 times leverage, respectively. In 20 years, when they are likely to need long term care, they will have a combined $432,918 tax free pool of money available for LTC costs and a $86,168 second to die death benefit. That gives them 4.3 and 0.9 times leverage, respectively.

5% Compound Inflation Protection. As seen below, following a combined one time payment of $100,000 their Combination policy with 5% compound inflation protection will immediately provide a combined $345,523 tax free pool of money available for LTC costs and a $74,384 second to die death benefit. That gives them 3.5 and 0.7 times leverage, respectively. In 20 years, when they are likely to need long term care, they will have a combined $745,059 tax free pool of money available for LTC costs and a $63,894 second to die death benefit. That gives them 7.5 and 0.6 times leverage, respectively.

Click to Enlarge

Clearly, the 5% compound inflation protection option provides a larger future amount available for long term care costs than the no inflation protection option. The higher set of long term care benefits comes at the cost of a lower second to die death benefit.

Action Step – Always Compare Benefits With and Without Inflation Protection Before Purchasing a Policy

Since it is unlikely that you will need long term care in the earlier years of your policy, it critically important to understand what future benefits will be with and without inflation protection.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.